Tyson sees record 2019 second-quarter operating income in Prepared Foods and Beef segments.

May 6, 2019

Tyson Foods Inc. — a leading food and protein company with brands that include Tyson, Jimmy Dean, Hillshire Farm, Ball Park, Wright, Aidells, ibp and State Fair — has reported results for its fiscal 2019 second quarter and first half.

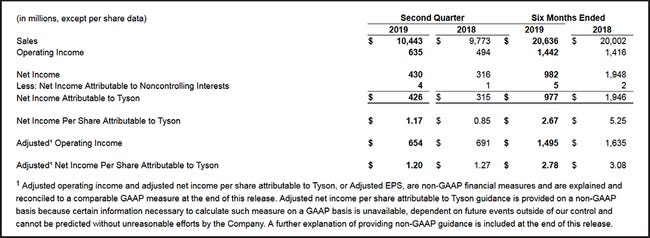

Second-quarter earnings per share (EPS) on a generally accepted accounting principles (GAAP) basis were $1.17, up 38% from the prior year, while adjusted EPS was $1.20, down 6%.

GAAP operating income for the second quarter was $635 million, and adjusted operating income was $654 million.

Tyson reported a total company GAAP operating margin of 6.1% and an adjusted operating margin of 6.3%.

Record second-quarter Prepared Foods GAAP operating margin and income were 12.1% and $245 million, respectively, while adjusted operating margin and income were 12.3% and $249 million. Record second-quarter Beef segment GAAP and adjusted operating income were $156 million.

GAAP operating income was $1.442 billion, and adjusted operating income was $1.495 billion. The total company GAAP operating margin was 7.0%, while the adjusted operating margin was 7.2%.

The Prepared Foods segment saw a record GAAP operating margin of 12.2% and record adjusted operating margin of 12.4% in the first half.

“I'm pleased with our direction as we begin the back half of the year,” Tyson president and chief executive officer Noel White said. “The Prepared Foods segment produced its second consecutive quarter of record return on sales. Both the Beef and Pork segments were solid performers, while the Chicken segment is poised for improvement following what we believe are its margin lows for the year.

“Looking ahead, African swine fever (ASF) has the potential to impact the global protein industry on a level that we have never experienced, and it is an event that will underscore the power of the Tyson business model," White added. "While Tyson's diversity across segments provides stability and puts us in a position to capitalize when opportunities arise, all proteins could see a benefit. A worldwide decrease in the pork supply would offer significant upside to our pork business while also lifting the chicken and beef businesses as substitutes and increasing raw material costs in our prepared foods business.

He noted, however, that the company's fiscal 2019 forecast so far does not include any potential impact from ASF "as we do not have clarity on when the impact might occur or what the magnitude could be. To date, pork pricing hasn't kept pace with increased hog costs, leading us to believe any positive ASF impact would occur in late fiscal 2019 into fiscal 2020 and beyond." White said that is why Tyson will maintain its fiscal 2019 EPS guidance at $5.75-6.10.

Summary of segment results

Beef. Tyson reported that sales volume in the Beef segment increased for the fiscal 2019 second quarter and six months due to improved availability of cattle supply and stronger demand for its beef products, with the average sales price increasing on that stronger demand.

Operating income increased for the six months and second quarter as the company continued to maximize revenues relative to live fed cattle costs, which were partially offset by increased operating and labor costs. Additionally, fiscal 2018 second-quarter operating income was affected of by a one-time cash bonus to frontline employees of $27 million.

Pork. Sales volume for the Pork segment increased for the second quarter due to increased domestic availability of live hogs but decreased for the first half as a result of Tyson balancing supply with customer demand during a period of margin compression in the first quarter of fiscal 2019, partially offset by the increased sales volume in the second quarter.

The average sales price decrease for the six months and second quarter was associated with lower livestock costs.

Second-quarter operating income increased as Tyson maximized revenues relative to the live hog markets due to operational and mix performance. Operating income for the six-month period remained strong but lower than prior-year results due to periods of compressed pork margins caused by excess domestic pork availability in the 2019 first quarter. Additionally, operating income in the 2018 second quarter was affected by a one-time cash bonus to frontline employees of $12 million.

Chicken. Sales volume in the Chicken segment increased for the second quarter and six months primarily due to incremental volume from business acquisitions. The average sales price decreased for both periods due to sales mix primarily associated with Tyson's acquisition of a poultry rendering and blending business in the fourth quarter of fiscal 2018.

Operating income decreased for the second quarter and first half due to increased operating costs, in addition to higher feed ingredient costs and current market conditions. Additionally, operating income in the 2018 second quarter was affected by a one-time cash bonus to frontline employees of $51 million.

Prepared Foods. Sales volume decreased for the second quarter and first six months primarily from business divestitures. The average sales price increased for both periods due to product mix, which was positively affected by business divestitures.

Operating income increased for the second quarter and first half due to strong demand for Tyson's products, improved product mix and lower raw material costs, which were partially offset by increased operating and labor costs. Additionally, operating income in the 2018 second quarter was affected by a one-time cash bonus to frontline employees of $19 million and a $75 million impairment associated with the divestiture of non-protein business.

Outlook

For fiscal 2019, the U.S. Department of Agriculture indicates that domestic protein production (beef, pork, chicken and turkey) should increase approximately 2% from fiscal 2018 levels, but Tyson said it expects export markets to absorb a portion of the increased production.

On Nov. 30, 2018, Tyson completed the acquisition of the foodservice industry supplier Keystone Foods business from Marfrig Global Foods for $2.3 billion in cash. The results from domestic operations of this business are included in the Chicken segment, and results from its international operations are included in Other.

On Feb. 6, 2019, Tyson announced that it had reached a definitive agreement to acquire the Thai and European operations of BRF S.A. for $340 million, including four processing facilities in Thailand and one processing facility each in the U.K. and the Netherlands. The transaction is expected to close during the 2019 fiscal third quarter and is subject to customary closing conditions. Tyson said the impact of this acquisition was excluded from the outlook.

For fiscal 2019, the company expects sales to grow to approximately $43 billion due to volume growth and mix as well as the impact of the Keystone acquisition. Most of the sales growth is expected to occur in the Chicken segment and Other, as well as expected growth in the Prepared Foods segment after excluding the impact of fiscal 2018 business divestitures.

Source: Tyson Foods, which is solely responsible for the information provided and is wholly owned by the source. Informa Business Media and all its subsidiaries are not responsible for any of the content contained in this information asset.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)