Despite challenging environment, new CoBank report looks at ways for farm supply cooperatives to rethink model and drive value.

Challenging fundamentals and disruptive forces that have been in place prior to COVID-19 are pressuring the business model for farm supply cooperatives. A new report from CoBank said those challenges may be the catalyst for farmer supply cooperatives to rethink their business model and emerge on the other side stronger.

Several agricultural cooperatives have merged or signed joint ventures during 2020. Unfortunately, consolidation alone does not fix difficult industry fundamentals, which include competition with independent agricultural retailers and stress on farmers’ income.

Beyond the market share battle, farm supply co-ops’ margins are being squeezed by customer pressures and macro variables. On the former, low grain prices since 2014 have weakened farmer income and cash flow, which has affected farmer input purchase decisions. On the latter, margins for fertilizer and crop protection chemicals have contracted due to competition, plentiful supplies, generics and alternatives. In the case of fertilizer, lower margins from carry (i.e., buying nutrients when cheap during the summer growing season and reselling product at higher prices during the fall and spring) have largely evaporated.

"The farm supply space remains dynamic, and cooperatives have several tools to strengthen their operating model,” said Kenneth Scott Zuckerberg, lead economist, grain and farm supply, at CoBank. “Beyond pursuing internal operational excellence, co-ops are uniquely positioned to help guide the digital transformation of agriculture.”

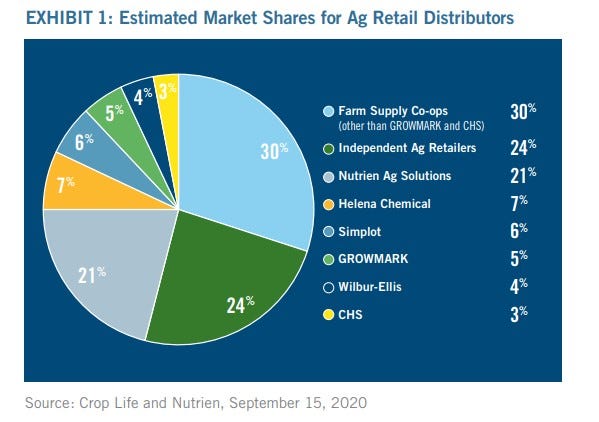

The cumulative effect of industry pressures has been a 24% decline in both the number of U.S. farm supply cooperatives and total U.S. agriculture cooperatives since 2009. Farm supply service cooperatives remain the dominant form of input distribution in North America. However, competition has intensified in recent years with non-cooperative distributors (independents) as well as Nutrien Ag Solutions, a vertically integrated crop input supplier.

Historically, farm supply cooperatives have added value to members and maintained a competitive advantage through local knowledge and expertise, strong multigenerational relationships and an adherence to tradition. However, farmers are more focused on costs after multiple years of margin pressure due to low commodity prices and competition with other growing regions such as Argentina and Brazil. Meanwhile, new and next-generation farmers often don’t feel as tethered to legacy relationships with local cooperatives.

Another threat comes from the input manufacturers that supply products to farm cooperatives for resale. Beyond their ability to limit sales commissions and incentives, manufacturers may eventually sell more products directly to farmers. Additionally, as farming enterprises grow larger and more sophisticated, they are more likely to hire their own crop consultants, agronomic advisors and contract sprayers and are less likely to rely on traditional services from the local cooperative.

Despite these challenges, farm supply cooperatives can create additional value by pursing economies of scale, diversifying product offerings and revenue sources and simplifying operations. One strategic idea boards and management teams may wish to consider is partnering with other grain and farm supply cooperatives -- especially those with transportation, logistics or infrastructure assets, such as fertilizer blending.

As an example, Helena Chemical and Wilbur-Ellis, both part of much larger diversified organizations, have made investments in customer spraying, aerial application services and various “digital farming” solutions to differentiate their customer offering, CoBank noted.

Another more transformational idea is to partner with emerging agricultural technology startup companies that offer farm management software, crop diagnostics, aerial imagery, advanced sensors and even robotics. The end goal of such partnerships is the ability to offer enhanced agronomy and precision field application services.

Finally, the farm operations that grow larger will have more intellectual and financial capital to modernize their operations. For these next-generation growers, cooperatives have the opportunity to offer more technical advice, analytics and insights to guide them in the digital transformation of agricultural production.

“Depending on region, the advice could include and/or incorporate crop diagnostics, soil analysis precision irrigation, integrated pest management and various other field-specific services,” the report noted.

In any business in any industry, “failure is not fatal, but failure to change could be,” Zuckerberg quoted John Wooden as saying in the report. “We believe that if the American farm supply cooperative can build greater product and service capabilities, the farmer will show up to embrace it.”

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)