Cash corn prices during the remainder of marketing year unlikely to again reach peak seen in May.

August 23, 2021

September 1 marks the end of the 2020/2021 marketing year for corn and soybeans, and what a wild ride it has been! As if battling COVID-19 was not bad enough, the grain markets had to deal with another drought, strong purchases of both corn and beans from China, and escalating input prices. The market is not likely to get easier anytime soon.

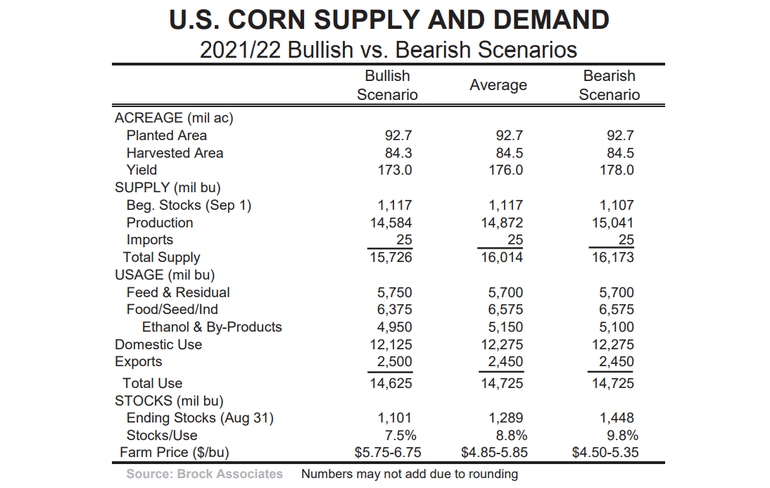

The corn balance sheet scenarios below show a range of expectations for the coming marketing year. In the average column, we are assuming a national average corn yield of 176 bushels per acre. For reference, the August estimate from the USDA was 174.6 bushels. Several private estimates have it as high as 178, which is in the bearish column. In the average column, feed usage and ethanol usage estimates for the 2021/22 marketing year are not significantly changed from 2020/21. Export sales will be down. China will be a long-term buyer but not as much as this past year. That leaves a carryover of 1.29 billion bushels, a stocks-to-usage ratio of 8.8% and expected average price at about $5.25 per bushel (basis Central Illinois).

On the bearish side, which is very possible, carryover jumps to 1.45 billion bushels and the market would struggle to average $5.00/bu. at the farm. What will likely be surprising to many is stronger-than-expected yield due to the drought resistance of today’s hybrids. The seed companies have been genetically modifying corn seed for years to make the crop more drought resistant. Not as much water is needed as would have been needed 15 years ago. The industry has been discovering the results of this for the last several years, and this year it will likely hit home in a big way.

We find a bullish scenario very unlikely. A 173 bushel/acre national average corn yield at this stage can only happen if a major weather disaster such as another windstorm flattens the crop prior to harvest. Even an early frost will have very little impact at this stage. So, we are basically assuming that we will end up with something within the range of an average-to-bearish scenario this year.

Corn prices reach top

Cash corn prices this year peaked in May. The market will not likely even come close to that peak in this marketing year. A few notable fundamental observations. Not as much grain will be sold at harvest as would normally be expected. Producers sold early last year, and they’re not going to do that again. Most of us have short memories when it comes to grain marketing. Thus, basis levels will be tighter than normal during the first few months of the marketing year, and we would not anticipate significant increases in cash movement until January. This is a year that producers should be selling early, but most will not do so.

Another key fundamental to watch will be the availability of inputs and the price of ag chemicals and fertilizer. Both are now sky high—if a producer can even get them. Unless something changes drastically, the market will likely shift a significant number of corn acres to soybeans next spring. Therein lies the sleeping bull, if that occurs.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)