Senate Agriculture Committee renews focus on potential anticompetitive behavior by beef packers.

Last month, price dynamics following a fire at a beef packing plant in western Kansas renewed discussion about packer concentration and potential anticompetitive behavior, according to testimony by Jayson Lusk during a Senate Agriculture Committee hearing on Sept. 25. The cattle price impact of the fire at the Holcomb, Kan., processing plant was an ongoing topic of conversation during the hearing, which featured testimony from livestock producers, including two cattle producers.

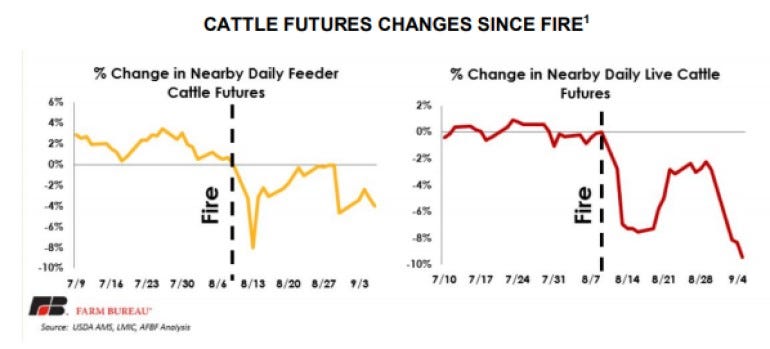

On Aug. 9, 2019, a fire broke out at one of the largest beef packing plants in the U.S.: the Finney County beef plant in Holcomb owned by Tyson Foods, which accounts for nearly 6% of the nation’s slaughter capacity. “In the days following the fire, U.S. cattle producers witnessed extreme volatility in the daily feeder and live cattle futures. Prices have not yet recovered from the impact of the fire, despite a return to business as usual for both processors and retailers,” according to the written testimony from Lindsay, Mont., cattle producer Shane Eaton, on behalf of the U.S. Cattlemen’s Assn.

Eaton’s testimony cited a Sept. 16, 2019, report from Kansas State University that listed projected values for finished steers in Kansas feedyards last month at -$184.992. During that same time period, packer margins spiked significantly to nearly four times their annual average, or approximately $549. Within that same report, Kansas State University predicted that cattle feeders will not see a positive net return on finished steers or heifers until May 2020.

During questioning, Sen. Deb Fischer (R., Neb.), who raises cattle, asked whether fed cattle prices will return to normal when the facility comes back on line and packing capacity is restored.

Eaton noted that when the fire occurred, futures prices went down for 2.5 days. He remains pessimistic that futures will go up for 2.5 days when the plant comes back on line. He acknowledged that packers created additional margin when the cutout went up $22 in the first three days after the fire, before a fat calf was even purchased. However, the fat calf price then dropped $7, while wholesale beef prices maintained the margin, causing “severe frustration” with the packers as they’ve kept wholesale boxed beef prices up.

Lusk responded that the extra margin was the incentive needed to induce more packing capacity availability, such as Saturday runs.

“Concerns about anticompetitive behavior in general must be evaluated on a case-by-case basis, and details about this particular case are still emerging in light of simultaneous market dynamics that were also at play. Available evidence to date suggests the observed reduction in cattle prices and the increase in wholesale beef prices following the fire are not inconsistent with a model of competitive outcomes. An unexpected reduction in processing capacity reduces demand for cattle, thereby depressing cattle prices,” Lusk said in his written testimony.

“The need to bring in additional labor to increase Saturday processing and temporarily repurposing cow plants for steers and heifers involves additional costs that pushed up the price of wholesale beef. These price dynamics are not surprising and are generally what would be expected from the fundamental workings of supply and demand. In general, a lack of availability of labor at processing facilities and in transportation have proved significant hurdles for the sector. When processors are unable to secure sufficient workforce to operate facilities at capacity, there is the potential to reduce demand for livestock and poultry, which has much the same price effects witnessed after the Kansas fire,” Lusk noted.

Jennifer Houston, president of the National Cattlemen’s Beef Assn. (NCBA), said the Holcomb plant closure has hurt feedlots and feeders the most, with some trickle-down effect on cow/calf producers.

“I hope things will stabilize,” Houston said, adding that many cattle producers are already hurting from floods and fires. “This is one extra thing we didn’t need.”

At the end of August, the U.S. Department of Agriculture’s Packers & Stockyards Division launched an investigation into recent beef pricing margins to determine if there is any evidence of price manipulation, collusion, restrictions of competition or other unfair practices. The cattle industry awaits the findings of that investigation.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)