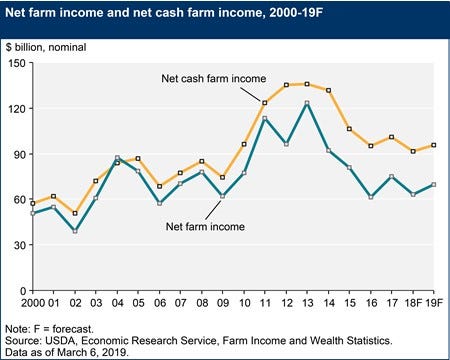

ERS projects 2019 net farm income up 10%, yet still half of what it was in peaks of 2013 and 2014.

Projected 2019 net farm income is forecasted at $69.4 billion, up $6.3 billion, or 10%, from 2018, according to the latest forecast from the U.S. Department of Agriculture’s Economic Research Service (ERS). This is still lower than the 20-year average of $90.0 billion per year, which was driven higher by income spikes in 2013 and 2014, when the peak level hit $136.1 billion in 2013.

The 2019 increase is driven primarily by higher farm cash receipts for both crops and livestock, with crop farm cash receipts increasing $4.6 billion (2.6%) from 2018 levels. However, this is expected to be offset by an increase in production expenses of $2.2 billion (up 0.6%) from 2018. Debt-to-asset ratios continue to increase -- an upward trend that begat in 2012 -- as liquidity measures are weakening.

Direct government farm payments are expected to decrease 17% in 2019 due to lower payments for the Market Facilitation Program and the Agriculture Risk Coverage and Price Loss Coverage programs.

Cash receipts for all commodities are projected to increase $8.6 billion (2.3%) to $381.5 billion in 2019 in nominal terms. Total animal/animal product receipts are expected to increase $4.6 billion (2.6%) following expected increases in milk and cattle/calf receipts, ERS said.

Total animal/animal product cash receipts are anticipated to rise $4.6 billion (2.6%) to $179.9 billion in 2019, reflecting expected increased receipts for milk, cattle and calves and turkeys.

Milk receipts are expected to increase $2.7 billion (7.8%) in 2019 based on increases in both price and quantities of milk sold. Likewise, cash receipts from cattle and calves are expected to increase $2.7 billion (4%) on increases in price and quantities sold. Hog cash receipts are expected to decline $700 million (3.2%) in 2019, reflecting an expected price decline, ERS report.

Broiler receipts are expected to rise slightly by $100 million (0.3%) in 2019 as larger quantities are forecasted to be sold at a marginally lower price. Chicken egg receipts are expected to fall $700 million (7%), reflecting lower prices. Turkey receipts are expected to increase $300 million (7.5%) in 2019 based on expectations for higher prices and quantities sold.

Total production expenses (including operator dwelling expenses) are forecasted to be largely unchanged from 2018 levels, at $372.0 billion in 2019, with increases in spending on hired labor, feed and interest being mostly offset by dropping energy prices. When adjusted for inflation, total production expenses are projected to decrease $4.2 billion (1.1%).

Farm business average net cash farm income is projected to increase $6,400 (9.3%) to $75,000 in 2019. Although this is the first increase since 2014, it is also the third-lowest average income recorded since the series began in 2010. Every resource region of the country is expected to see farm business average net cash farm income increase by 5% or more. All categories of farm businesses except wheat and hog farm businesses are expected to see average net farm income rise in 2019.

Farm sector equity is projected to be up $28.8 billion (1.1%) in nominal terms to $2.65 trillion in 2019. Farm assets are forecasted to increase by $44.6 billion (1.5%) to $3.1 trillion in 2019, reflecting an anticipated 1.8% rise in farm sector real estate value. When adjusted for inflation, farm sector equity and assets are projected to decline $16.3 billion (0.6%) and $7.6 billion (0.2%), respectively.

Farm debt in nominal terms is forecasted to increase by $15.8 billion (3.9%) to $426.7 billion, led by an expected 5.1% rise in real estate debt. The farm sector debt-to-asset ratio is expected to rise from 13.55% in 2018 to 13.86% in 2019. Working capital, which measures the amount of cash that would be available to fund operating expenses after paying off debt due within 12 months, is expected to decline almost 25% versus 2018.

About the Author(s)

You May Also Like