September ethanol exports drop to lowest monthly volume in a year.

November 6, 2018

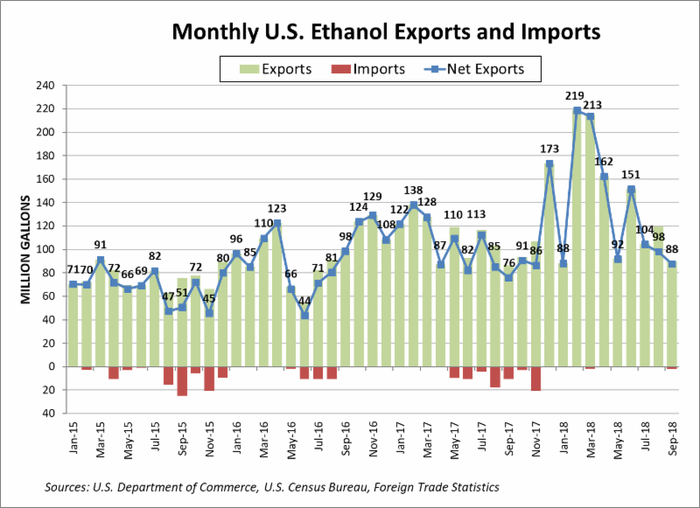

U.S. ethanol exports totaled 89.9 million gal. in September, a 25% drop from August and the lowest monthly volume in a year, according to government data released by the Renewable Fuels Assn. (RFA). Still, by historical standards, September was a relatively strong month for exports, with the brightest spot being a return of meaningful exports to Brazil, RFA noted.

Canada was the top U.S. customer in September for the third straight month, taking in 17% more American ethanol than the previous month, at 35.0 million gal. (representing 39% of U.S. export sales). Malaysia opened its doors to 14% more ethanol over August levels for a record 13.4 million gal. (15% of the market). The Netherlands cut back to a more typical monthly volume of 11.5 million gal. (13% of the market). South Korea (7.5 million gal., up 8%), Colombia (6.0 million gal., up 7%) and Brazil (5.4 million gal., up 6%) all returned to the table after a quiet August. Total U.S. ethanol exports stand at 1.24 billion gal. for the first three quarters of 2018, implying a record annualized total of 1.66 billion gal.

According to RFA, September exports of U.S. undenatured fuel ethanol plummeted 45% to 13.4 million gal., the lowest volume in 52 months (since May 2014). Brazil and South Korea reappeared on the scene after a month’s hiatus to buy 5.3 million gal. and 4.8 million gal., respectively. While smaller than normal, those volumes represented roughly three-fourths of all undenatured ethanol exports. Other markets for undenatured fuel product included the Netherlands, which scaled back imports by 84% to 1.8 million gal., and Mexico, which slimmed down to the lowest volume in eight months at 1.3 million gal., down 36%. RFA said The Philippines and India (which has been running an average monthly total of about 9 million gal. this year) were noticeably absent from the undenatured fuel ethanol export market in September.

American producers shipped 67.1 million gal. of denatured fuel ethanol in September, a 22% decrease following near-record volumes in August. Top customer Canada boosted imports by 18% to 30.4 million gal. for a 45% market share. Malaysia (13.4 million gal., up 14%), the Netherlands (9.7 million gal., up 44%) and Colombia (5.5 million gal.) also increased their imports of denatured fuel product. Peru, Jamaica, South Korea and the Philippines were other significant markets, RFA noted. The United Arab Emirates, on the other hand, was absent for the month following a 15 million gal. draw the prior month.

The report said September sales of ethanol for non-fuel, non-beverage purposes slipped 3% to 9.4 million gal. Saudi Arabia was the lead customer of U.S. exports of undenatured non-fuel product for the third straight month despite a 26% decrease to 1.5 million gal. Japan purchased 1.4 million gal. — the first substantial imports of that product to date. Sales of denatured non-fuel ethanol to Canada maintained impressive growth as September exports of 4.5 million gal. were roughly four times higher than in January. South Korea, at 1.3 million gal., was responsible for much of the remaining volumes shipped in September.

According to RFA, the U.S. imported 2.2 million gal. of undenatured ethanol from Brazil in September. Total year-to-date imports stand at 25.4 million gal., implying an annualized total of 33.8 million gal. However, it is expected that October will show larger import volumes, RFA said.

Exports of U.S. dried distillers grains with solubles (DDGS) were 1.028 million metric tons, RFA reported. While September saw an active market — the U.S. shipped DDGS to 35 countries — exports declined for the first time in five months (down 11%), RFA said.

The largest market was again Mexico, at 149,408 mt, representing 15% of U.S. global sales. This was the second straight month of diminishing volumes heading south of the border following peak sales this year in July, RFA noted.

Vietnam (111,900 mt, up 2% from August), South Korea (105,548 mt, down 17%), Thailand (94,235 mt) and Indonesia (67,461 mt, down 23%) were other prominent markets. Additionally, the U.K. and Ireland have shown notable interest in U.S. DDGS since August. Meanwhile, exports to Turkey have waned significantly since July, declining 78% when it had been the top customer.

RFA said year-to-date DDGS exports are 8.96 million mt, implying an annualized total of 11.95 million mt.

“If realized, this volume of U.S. distillers grains exports would be the second-largest annual volume on record,” the report said.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)