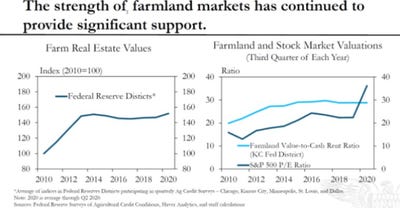

Government payments and improved outlook for commodity prices continue to sustain ag land values.

Despite concerns early in the COVID-19 pandemic in March, April and May that low commodity prices could create a disruption in farmland markets or some form of liquidation, that has not appeared to be the case, according to Nate Kauffman, vice president and Omaha, Neb., branch executive with the Federal Reserve Bank of Kansas City.

“There was a thought, for the past 10 years, land values were a bit too high to justify returns in that market,” Kauffman said during a recent webinar hosted by USAgriculture titled "Six Months In: How Has COVID-19 Affected Farmland & Agricultural Investment Markets."

However, Kauffman noted that outlook expectations for interest rates have changed significantly, especially following the economic fallout from the pandemic, and efforts are expected to continue with a low interest rate environment. Near-zero interest rates are expected to remain over the next three years, he said.

Kauffman said many agricultural markets have seen some normalization, including the ethanol industry recovering much of its lost production, improvement on the trade front and government payments creating a more profitable outlook for agricultural producers. “The market has been more stable from what many would have expected early on,” Kauffman said of the COVID-19 impact.

Jackson Takach, chief economist at FarmerMac, said his previous pessimism on the market may be turning into more optimism.

“I expected farm auctions to slow down in 2020 as people couldn’t go,” Takach said. Instead, he noted that data from one of the largest agricultural real estate outfits -- Farmers National -- has shown that sales in Iowa and Illinois happened at similar levels to 2019. He also reported a small uptick in the average sale.

Although sales did slow in the first half of the year, they picked up in August and September. This is likely due to extra cash availability to do some auctions, albeit with social distancing practices. “That’s going to keep the velocity of auctions moving,” Takach said.

The transaction velocity is one of the indicators he will continue to watch with respect to auction performance.

Bruce Sherrick, agricultural economist at the University of Illinois, said he’s seeing evidence that farmland values are ticking up in the third quarter in major agricultural regions. The “I” states – Illinois, Iowa and Indiana – have seen reasonable performance, which has kept rents up as well.

Sherrick said farmland remains an attractive asset, and he’s seeing strong signals for that to continue ahead.

Takach added that loan performance has probably outperformed where he would have expected the market to be six months ago. More than 60% of farmer loans have been for refinancing to take advantage of the low interest rates. There was a lot of activity in the second quarter, and he expects that more of that will occur in the third and fourth quarters.

Farmers will continue to tap into real estate equity to shore up their liquidity, as this is a liquidity crisis, not a solvency crisis like in past agricultural credit cycles, Jackson said.

“As long as we don’t enter a long-term massive recession, it looks at least positive for agriculture,” Kauffman concluded.

About the Author(s)

You May Also Like