As expected, trade aid package falls short for many commodity sectors in midst of massive drop in agricultural prices.

On Monday, the U.S. Department of Agriculture announced details for a plan to offset the short-term impact of tariffs on U.S. agricultural exports, including a 25% duty imposed by China on soybean imports and pork. As expected, soybeans and pork received the greatest amount of assistance, but this also triggered concerns from other commodity groups who say their piece of the aid pie falls short of accounting for their recent market losses.

USDA will send incremental payments to soybeans, sorghum, wheat, corn, pork, dairy and cotton producers through the Market Facilitation Program starting on Sept. 4.

Of the total of $4.7 billion in direct payment aid based on 50% of actual production or inventory, $3.6 billion will be for soybean farmers, $277 million for cotton, $290 million for pork, $127 million for dairy, $156 million for sorghum, $119 million for wheat and $96 million for corn.

Even with the aid announced, the calls for “trade, not aid,” continued. Across the board, all commodity groups continued to call for the Administration to offer a long-term solution of increasing trade through resolving the differences at the negotiating table.

Soybean farmers welcomed the deal, not surprisingly, as they are the ones who felt the most pain in recent retaliatory actions from China. American Soybean Assn. president John Heisdorffer, a soybean producer from Keota, Iowa, said, “This will provide a real shot in the arm for our growers, who have seen soybean prices fall by about $2.00/bu., or 20%, since events leading to the current tariff war with China began impacting markets in June.”

Heisdorffer explained, “This assistance will be particularly helpful to farmers who didn’t forward-contract their crop earlier this year and who need to arrange financing for planting next year’s crop.”

In the last two months, USDA has raised its estimate for soybean production in 2018 to a record 4.6 billion bu., reduced its estimate for soybean exports in the 2018-19 marketing year by 230 million bu. and projected an 82% increase in soybean carryover stocks to 785 million bu. from 430 million bu. by September 2019.

U.S. pork exports to China are down significantly for the year, with the value falling by 9% through June, according to the National Pork Producers Council. The drop has come mostly because of the 50% additional tariff China imposed in response to U.S. duties on imports of Chinese steel and aluminum and on other goods after China’s theft of intellectual property and its forced transfers of U.S. technology.

Exports to Mexico are down slightly. In June, it put a 10% tariff on U.S. pork in response to U.S. tariffs on imports of Mexican steel and aluminum; the duty increased to 20% on July 5.

Pork producers are able to receive $8 per hog based on 50% of the number of animals they owned on Aug. 1. The Market Facilitation Program payments are subject to the existing $900,000 adjusted gross income means test and a separate $125,000 per person payment limit for the eligible crops, which USDA undersecretary for farm and conservation Bill Northey said could limit some of the money funneled to pork producers.

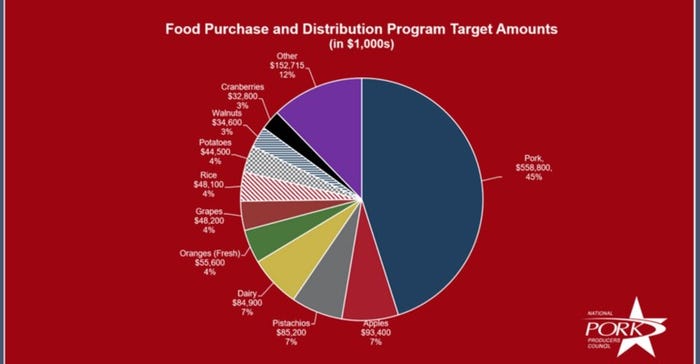

USDA’s Agricultural Marketing Service (AMS) will administer a Food Purchase & Distribution Program to purchase up to $1.2 billion in commodities unfairly targeted by unjustified retaliation.

Greg Ibach, USDA undersecretary for regulatory affairs, said pork and dairy are two sectors identified to be harmed greatly by the illegal tariffs. He said up to $84 million worth of dairy products will be distributed domestically and $585 million worth of pork products.

Too small of the piece of pie

Meanwhile, other commodity groups were unhappy with the level of assistance the Trump Administration offered their sector.

The National Milk Producers Federation (NMPF) said the tariff mitigation plan falls short of addressing the losses dairy producers are experiencing.

“The dairy-specific financial assistance package provided by USDA – centered on an estimated $127 million in direct payments – represents less than 10% of American dairy farmers’ losses caused by the retaliatory tariffs imposed by both Mexico and China,” NMPF president and chief executive officer Jim Mulhern said.

“The price drop resulting from these tariffs has not been gradual; it’s hurting U.S. dairy producers right now and will continue to do so. Since the retaliatory tariffs were announced in late May, milk futures prices have lost over $1.2 billion through December 2018. Milk prices for the balance of the year are now expected to be $1.10/cwt. lower than were estimated just prior to the imposition of the tariffs on U.S. dairy exports.”

NMPF added that a new study by Informa Economics IEG on the impact of the retaliatory dairy tariffs projects dairy farmer income will take a hit of $1.5 billion this year if the tariffs remain in place through the end of 2018. “This loss compounds to $16.6 billion if the tariffs are left in place long term over the next five years, through 2023. The impact of lost sales to China account for most of that harm, accounting for 73% of the total. That sizable decline in farmer incomes will compound the low prices and financial losses that dairies have already felt,” Mulhern added.

“Although there may be a second direct aid package at the end of the year, dairy producers are greatly disappointed that the farmer aid portion of today’s trade relief package does not adequately address the harm done to dairy,” Mulhern noted.

Corn farmers received virtually no relief from the mitigation package, at just 1 cent/bu. According to a National Corn Growers Assn. (NCGA)-commissioned analysis, which NCGA provided to USDA and the Office of Management & Budget (OMB), trade disputes are estimated to have lowered corn prices by 44 cents/bu. for crop produced in 2018. This amounts to $6.3 billion in lost value on the 81.8 million acres projected to be harvested in 2018.

“NCGA has understood from the beginning that this aid package would neither make farmers whole nor offset long-term erosion of export markets, but even with lowered expectations, it is disappointing that this plan does not consider the extent of the damage done to corn farmers,” NCGA president Kevin Skunes said.

Wheat producers also stated that the USDA aid package fails to consider all commodities. Wheat growers will receive 14 cents/bu., based on 50% of their production levels. A release from the National Association of Wheat Growers (NAWG) noted that, as a result of the tariffs, China hasn’t purchased any wheat from the U.S. since March. Further, NAWG estimates that the ongoing trade war will cause a 75 cents/bu. price decrease and a reduction in global wheat production.

“In public remarks last week, USDA Secretary Perdue stated that the federal aid package for farmers being harmed by our current trade war with China won’t seem like it’s equitable. This was made clear today when the Administration introduced a proposal which poorly reflects the reality that all farmers are being harmed by tariffs,” said NAWG president and Oklahoma wheat farmer Jimmie Musick.

“Farm income is down, and rural America is enduring a prolonged economic downturn. This relief package shows that the Administration isn’t grasping the tough conditions being faced by farmers. The long-term solution is to end the trade war,” Musick added.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)