Boost in cash receipts from commodity sales unable to overcome dramatic drop in income from direct government payments.

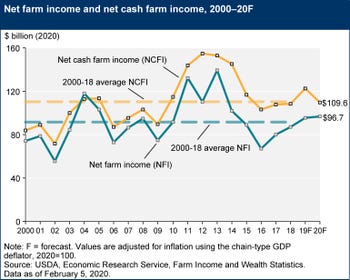

Net farm income, a broad measure of profits, is projected to increase $3.1 billion, or 3.3%, to $96.7 billion in 2020, while net cash farm income is set to decline $10.9 billion, or 9%, to $109.6 billion, according to the latest "Farm Income & Financial Forecasts" released by the U.S. Department of Agriculture's Economic Research Service (ERS) on Feb. 5.

During a webinar, ERS economist Carrie Litkowski said the main driver in this year’s lower income forecast relates to a partial Market Facilitation Program (MFP) payment that boosted direct government payments by 73% in 2019, and without a new MFP program in 2020, the direct government support payments are forecasted to decrease by 37% in 2020.

“The increase in cash receipts is relatively modest when we look at net income and income for farm businesses,” Litkowski said. “That increase in cash receipts is eclipsed by a drop in government payments of almost $9 billion less.”

“The increase in cash receipts is relatively modest when we look at net income and income for farm businesses,” Litkowski said. “That increase in cash receipts is eclipsed by a drop in government payments of almost $9 billion less.”

The Dairy Margin Coverage program, which replaced the Dairy Margin Protection program in the 2018 farm bill, is projected to make net payments of $600 million to dairy operators in 2020. Payments in calendar year 2020 under the Agriculture Risk Coverage (ARC) program are expected to decline $700 million from 2019 levels, while Price Loss Coverage (PLC) payments in 2020 are expected to increase $1.5 billion from 2019 levels. Under the 2018 farm bill, producers may change their program election (ARC or PLC) for their farms for crop year 2019 compared with the prior election for the farm under the 2014 farm bill.

“Many farmers are expected to switch their enrollment from ARC to PLC because declines in market prices are expected to trigger PLC payments for some crops but not trigger ARC payments, which are based on historic revenue,” ERS said.

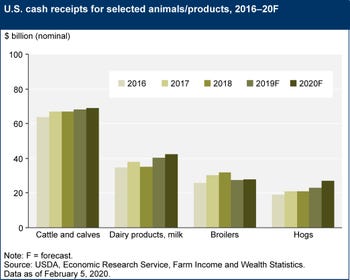

Cash receipts for all commodities in 2020 are projected to increase $10.1 billion (2.7%) to $384.4 billion (in nominal terms). Total animal/animal product receipts are expected to increase $8.2 billion (4.6%) following growth in receipts for hogs, milk, cattle/calves and poultry/eggs.

Total crop receipts are expected to be largely unchanged, increasing $1.9 billion, or 1%, from 2019 levels in nominal terms but declining 0.9% when adjusted for inflation.

Total production expenses (including operator dwelling expenses) are forecasted to increase $10.4 billion (3%) to $354.7 billion (in nominal terms) in 2020. Spending on most categories of expenses, especially feed and hired labor, is expected to increase, but interest expenses are expected to decline, ERS said.

Farm business average net cash farm income is projected to decrease $8,100 (8.7%) to $85,200 per farm in 2020. Every resource region is expected to see farm business average net cash farm income decrease by 4.4% or more. All categories of farm businesses except hogs and dairy farms are expected to see average net cash farm income fall in 2020.

Litkowski noted that farm sales are expected to decline in 2020, as many inventories were sold in 2019, so there likely will be fewer or almost no held inventories sold. Lower prices are expected to temper increases in corn cash receipts, while soybean cash receipts are expected to fall due to lower quantities and should outweigh higher prices.

Overall, increases in both prices and quantities are projected to positively affect cash receipts in 2020, but higher quantities are expected to have the larger effect of the two. Cash receipts are expected to increase $10.1 billion in 2020, with highe

Milk receipts are expected to increase $2.1 billion (5.2%) in nominal terms in 2020, reflecting both higher prices and quantities sold. Cash receipts from cattle and calves are expected to increase $1.1 billion (1.6%), also because of slightly higher price and quantity forecasts in 2020. Hog cash receipts are expected to increase $4.2 billion (18.4%), reflecting a rise in both the price and quantities of hogs sold.

Broiler receipts are expected to increase $300 million (1.0%) in 2020, owing to higher quantities sold. Cash receipts for chicken eggs are expected to grow $200 million (2.7%), reflecting growth in prices and quantities sold. Turkey receipts are expected to increase $200 million (4.5%), also because of price and quantity growth.

Farm sector production expenses (including expenses associated with operator dwellings) are projected to increase by $10.4 billion (3%) in nominal terms in 2020. Feed purchases, the largest single expense category, are expected to increase 5.8% (to $59.6 billion).

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)