Coronavirus impact will come later as unemployment is projected to climb to 14.5% in second and third quarters.

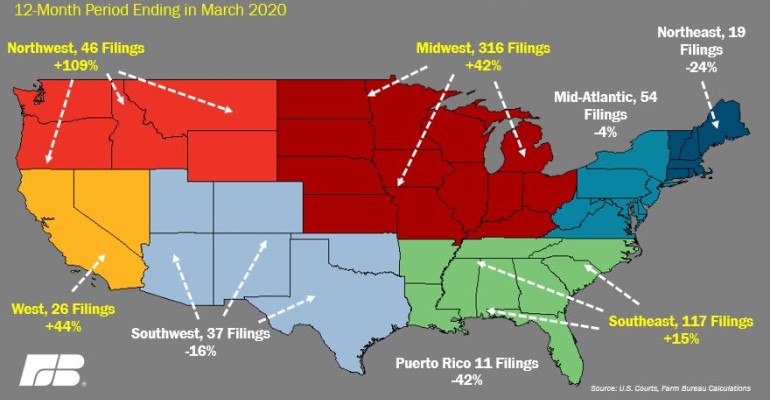

Year-over-year farm bankruptcies increased 23%, according to recently released data from U.S. courts. An American Farm Bureau Federation "Market Intel" report shows a total of 627 bankruptcy filings during the 12-month period ending March 2020, marking five consecutive years of Chapter 12 bankruptcy increases, including an accelerated rate since January.

The continued increase in Chapter 12 filings coincides with recent changes to the bankruptcy rules in the 2019 Family Farmer Relief Act, which raised the debt ceiling to $10 million.

“Each bankruptcy represents a farm in America struggling to survive or going under, which is both heartbreaking and alarming,” Farm Bureau president Zippy Duvall said. “Even more concerning, the difficulty staying afloat is made worse by the [COVID-19] pandemic and related shutdowns as farmers are left with fewer markets for their products and lower prices for the products they do sell.”

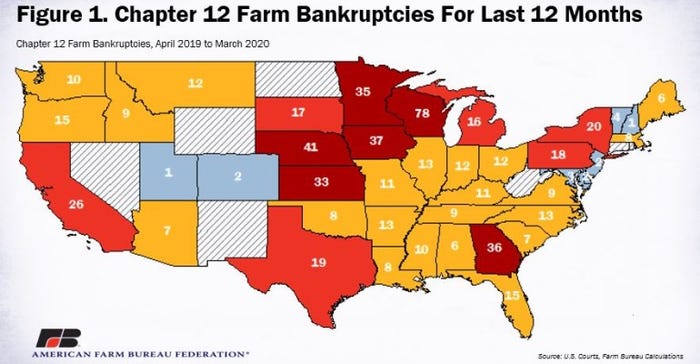

Wisconsin was the hardest-hit state, with 78 filings in the 12-month period, followed by Nebraska with 41 Chapter 12 filings and Iowa with 37. More than 50% of the Chapter 12 filings were in the 13-state Midwest region, followed by 19% in the Southeast.

Farm Bureau chief economist John Newton said the filings are concentrated in the Midwest likely due to several years of low crop and milk prices. “The incidence of bankruptcies does remain low – approximately three per 10,000 farms – but the trend is concerning, given where we’ve been and the COVID-19-related economic struggles that are certain to follow,” Newton said.

The immediate challenges to the agriculture sector with respect to COVID-19 are well documented, Newton said, while a lesser-discussed concern is the impact of high unemployment on off-farm income and, ultimately, debt repayment capacity.

“The last considerable increase in loan delinquencies coincided with the Great Recession,” Newton noted. During that time, unemployment reached nearly 10%, and off-farm income fell by as much as $10,000 per household, resulting in farm loan delinquencies that exceeded 3% in 2010. “This increase in delinquencies is likely a major factor in farm bankruptcies rising to their highest levels of the decade in 2010,” he added.

U.S. unemployment is projected to reach 14.5% in the second and third quarters, which will cause a decline in off-farm income. This could affect the ability of farmers, notably small- to medium-sized farms, to service a record $425 billion in debt, because many farmers rely on off-farm income as a stabilizing force.

“Low interest rates certainly help, but farmers and ranchers need an immediate injection of working capital. The Coronavirus Food Assistance Program will help, but early estimates of the damage to the farm economy suggest more is needed,” Newton said.

Duvall added, “Congress and the Administration made an initial investment in America’s farmers and ranchers with the $19 billion Coronavirus Food Assistance Program, but more must be done to ensure farms survive to continue providing food for America’s families during the pandemic and beyond.”

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)