U.S. competitiveness hindered by trade war, weakening global economy, more export competition from South America and rising U.S. dollar.

October 15, 2019

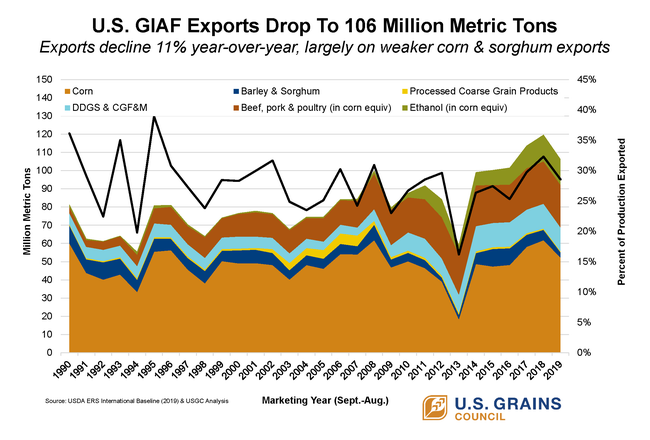

The final numbers for the 2018-19 marketing year are in and show that overall exports of U.S. grains in all forms (GIAF) rank as the third-best export year of all time, despite declining 11% from last year’s all-time high to 106 million metric tons, equivalent to 4.17 billion bu., according to data from the U.S. Department of Agriculture and analysis by the U.S. Grains Council (USGC).

“Unfortunately, the weakness we first observed in February -- particularly for corn -- accelerated sharply in the final three months,” USGC president and chief executive officer Ryan LeGrand said. “The increasingly disruptive trade dispute with China, weakening global economic growth, stronger export competition from South America and a U.S. dollar, which continues to rise in value, all hurt U.S. competitiveness.”

Decreased exports were particularly pronounced for U.S. corn and sorghum. Together, the declines for these two commodities represented 92% of the overall 13.3 million-ton reduction in GIAF exports in 2018-19. While export declines were fairly widespread over all 10 product sectors USGC tracks, other categories did not suffer as much as corn and sorghum. The best performance was in pork, beef and poultry exports, which collectively showed a slight gain, reaching 23 million tons (905 million bu.) in corn equivalent, and together represented 21% of the GIAF total.

One bright spot was GIAF exports to Mexico, which increased 2% to eke out a new record high of 25.6 million tons (1 billion bu.). This success, however, was overshadowed by the dramatic 81% decline in exports to China since 2015-16, with shipments totaling just 2.7 million tons (106 million bu.) in the 2018-19 marketing year.

Strong South American competition

U.S. corn exports totaled 52.3 million tons (2.06 billion bu.), down 15% from the previous year, as strong competition from plentiful South American supplies took a toll, especially in the final three months of the marketing year. Despite this decline, several markets in the Western Hemisphere did show year-over-year increases.

“The overall bad news for 2018-19 U.S. corn exports was not equally shared across all country regions,” LeGrand said. “In an interesting development, all but one of the 10 markets showing the greatest positive unit growth this year were in the Western Hemisphere.”

Top buyer Mexico set a new record high at 16.1 million tons (633 million bu.), up 407,000 tons (16 million bu.) year over year. Canada saw the largest increase, at 700,000 tons (27.6 million bu.), for a total of 2.42 million tons (95.3 million bu.) and ranking as the fifth-largest buyer. Guatemala, El Salvador, Nicaragua, Costa Rica, Haiti, the Dominican Republic and Ecuador all realized gains, in addition to New Zealand. These gains were offset by losses to South Korea, the European Union, Vietnam, Peru, Egypt, Saudi Arabia, Morocco, Israel, Taiwan and Colombia.

China limits sorghum trade

As recently as 2015-16, U.S. sorghum exports to China totaled 7.1 million tons (280 million bu.), but exports to China in 2018-19 collapsed to just 628,000 tons (24.7 million bu.), largely due to prohibitive import tariffs in China. Overall, U.S. sorghum exports took a sharp downturn, decreasing 54% year over year to just 2.3 million tons (90.5 million bu.).

“The story behind decreased U.S. sorghum exports is simpler. The decline is the result of a sharp contraction in exports to China,” LeGrand said. “Between recent trade remedy actions by China and new punitive duties in China on sorghum, U.S. sorghum exports have declined significantly.”

Sorghum prices did stimulate exports elsewhere, but these increases were not enough to offset the loss of the Chinese market. The second-largest buyer -- the EU, led by Spain -- jumped to 610,000 tons (24 million bu.), and Mexico, ranked as the third-largest buyer, purchased more sorghum, at 489,000 tons (19.3 million bu.).

Ethanol exports ease

Even U.S. ethanol, which has been the fastest-growing U.S. agricultural export over the past 10 years, saw a small drop in 2018-19 to 1.55 million gal. (almost 14 million tons, or 551 million bu. in corn equivalent).

“While ethanol only represents 5% of the overall GIAF decline in 2018-19, this year’s performance was a noticeable pause after five years of uninterrupted double-digit increases and new record highs,” LeGrand said. “Lower exports to China and Brazil accounted for 182 million gal. of loss -- a casualty of reduced market access -- but otherwise, exports were largely up to the other top ethanol markets."

Had those two markets remained even with last year’s shipments, LeGrand said U.S. ethanol exports likely would have set another new record high.

China increased tariff rates and punitive duties on U.S. ethanol in the past year, resulting in a drastic decline in U.S. exports from 108 million gal. (38.3 million bu. in corn equivalent) in 2017-18 to virtually none in 2018-19. A Brazilian tariff rate quota on ethanol, combined with plentiful domestic supplies, also negatively affected U.S. ethanol exports, which declined 72 million gal. (25.5 million bu. in corn equivalent).

Elsewhere, U.S. ethanol export markets showed healthy increases, including to India, which set a new record as the third-largest buyer, at 200 million gal. (70.9 million bu. in corn equivalent), and to South Korea, which increased 20% to a record of 92 million gal. (32.6 million bu. in corn equivalent). Notably, both of these markets currently import ethanol for industrial uses rather than for fuel ethanol.

The EU, the Philippines, Colombia and Peru all also showed increases on the year. Second-largest buyer Canada remained essentially unchanged at 331 million gal. (117 million bu. in corn equivalent) while the mature but stable market awaits the implementation of higher new blending rates to drive the next wave of growth.

U.S. DDGS diversification continues

U.S. dried distillers grains with solubles (DDGS) exports remained relatively flat in 2018-19, at 11.2 million tons, down 3.5% year over year. The largest drop was to Turkey, which realized a substantial decline to 468,000 tons primarily due to a currency devaluation that sharply increased dollar imports in local currency and made letters of credit difficult to obtain. Without this export contraction to Turkey, overall U.S. DDGS exports likely would have increased year over year.

Mexico continues to represent the largest buyer of U.S. DDGS, at 2 million tons, down slightly from the previous year. DDGS exports to Mexico have stayed relatively steady over the past three years, following significant growth between 2012-13 and 2016-17.

However, other regions continue to exhibit growth, particularly in Southeast Asia, where USGC has stepped up market development efforts in recent years, which have proved successful.

Southeast Asia now accounts for 30% of all U.S. DDGS exports, reaching a record 3.4 million tons in 2018-19, up 10% from the year before and up 233% since 2012-13. Four of the 10 largest U.S. DDGS export markets are now in Southeast Asia: Vietnam (1.3 million tons), Indonesia (973,000 tons), Thailand (725,000 tons) and the Philippines (247,000 tons).

As the 2019-20 marketing year is now in full swing, USGC will continue working in these markets and more around the world to promote the quality, reliability and value of U.S. coarse grains, co-products and ethanol.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)