Afternoon report: Soybeans also firm on Thursday, while wheat retreats moderately lower.

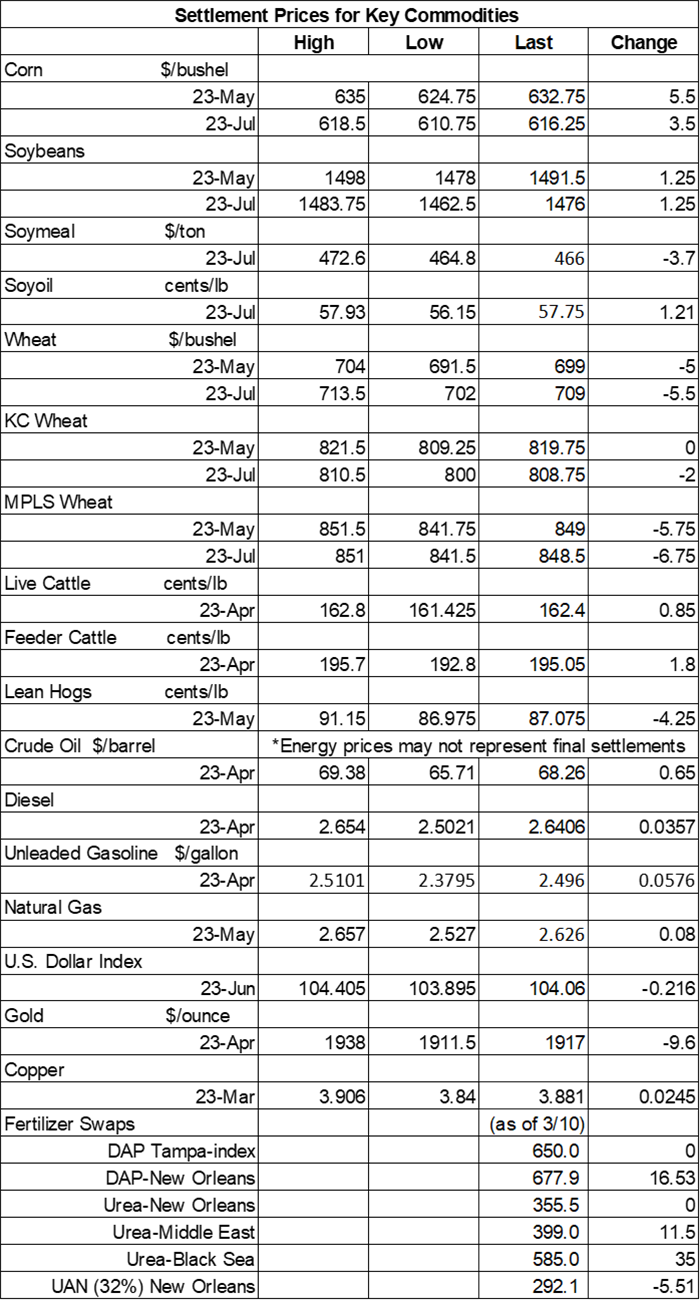

Corn futures made moderate improvements on Thursday following a solid export report from USDA and yet another flash sale announced to China this morning. Soybeans followed suit – barely – picking up small gains after some net technical buying today. Wheat failed to follow suit, with most contracts spilling around 0.75% lower on a technical setback.

NOAA’s latest 72-hour cumulative precipitation map shows a sharp contrast between the eastern half of the United States, which should receive plenty more rain and/or snow between Friday and Monday, and the western half of the country, which will remain relatively dry during this time. NOAA’s new 8-to-14-day outlook predicts seasonally wet weather for the central U.S. and near-normal temperatures for most of the Corn Belt between March 23 and March 29.

On Wall St., the Dow moved 267 points higher in afternoon trading to 32,142 as banking stocks made a comeback after taking a heavy hit in recent sessions. Energy futures also rebounded following big losses earlier this week. Crude oil improved 1% to reach $68 per barrel. Diesel moved nearly 1.5% higher, with gasoline up 2.5%. The U.S. Dollar softened slightly.

On Wednesday, commodity funds were net buyers of corn (+2,000) and CBOT wheat (+2,000) contracts but were net sellers of soybeans (-3,000), soymeal (-1,500) and soyoil (-1,000).

Corn

Corn prices continued to push higher on Thursday after another flash sale to China was announced this morning, with a healthy round of export data from USDA lending additional support. May futures added 5.5 cents to $6.32, with July futures up 3.5 cents to $6.1575.

Corn basis bids were steady to mixed across the central U.S. on Thursday after trending as much as 10 cents higher at an Ohio river terminal and as much as 7 cents lower at an Iowa processor today.

Corn exports found total old and new crop sales of 55.9 million bushels. That was down 13% week-over-week but still moderately above the prior four-week average. It was also toward the higher end of trade estimates, which ranged between 27.6 million and 66.9 million bushels. Cumulative totals for the 2022/23 marketing year are still significantly below last year’s pace, with 679.0 million bushels.

Corn export shipments notched a new marketing-year high and moved 52% above the prior four-week average, with 45.9 million bushels. Japan, Mexico, Colombia, China and Morocco were the top five destinations.

Private exporters announced the sale of 25.2 million bushels of corn for delivery to China during the 2022/23 marketing year, which began September 1.

Consultancy Strategie Grains made no changes to its estimates for 2023/24 European Union corn production, which held steady at 2.496 billion bushels. That would be a year-over-year increase of 12.2%, if realized.

Algeria passed on all offers to purchase 1.4 million bushels of corn from Argentina in a tender that closed earlier today that would have been for shipment during the first half of April. Additional details were not immediately available.

The NCAA basketball tournament kicks off today, and Luke Williams, ag risk management advisor with Advance Trading, is ready for the action to begin. “As a kid growing up, I couldn’t wait to see who was in and who was out, filling every line on my bracket just as soon as they announced the tournament teams,” he says. “Now several years later my passion for college basketball still exists, but my appreciation for the players and coaches is what has changed. Countless hours of practice, film studying, and strategy planning are spent preparing them for their time under the lights.” The same can arguably be said of farming. Williams muses on the subject in greater detail – click here to learn more.

Preliminary volume estimates were for 311,004 contracts, tracking moderately above Wednesday’s final count of 279,997.

Soybeans

Soybean prices spent part of Thursday’s session in the red but ultimately carved out modest gains after some net technical buying partly spurred by spillover strength from corn and energy prices. May and July futures each picked up 1.25 cents to reach $14.9050 and $14.7575, respectively.

The rest of the soy complex was mixed. Soymeal futures softened by more than 0.75% today, while soyoil futures raced 2.25% higher.

Soybean basis bids were steady to firm on Thursday after trending 5 to 7 cents higher at two Midwestern processors and improving 3 cents at an Ohio elevator today.

Soybean exports reached 26.9 million bushels in combined old and new crop sales last week, which was a significant improvement versus the prior four-week average. It was also on the higher end of trade estimates, which ranged between 3.7 million and 33.1 million bushels. Cumulative totals for the 2022/23 marketing year are tracking slightly above last year’s pace, with 1.574 billion bushels.

Soybean export shipments were 33% higher week-over-week but still 37% below the prior four-week average, with 28.4 million bushels. China, Mexico, Germany, the Netherlands and Japan were the top five destinations.

China’s agriculture ministry announced it will make a series of policies with the intention of stabilizing soybean production this season. That includes increased subsidies for corn and soybean farmers, as well as buying additional soybeans to bolster the country’s state reserves.

Preliminary volume estimates were for 195,421 contracts, sliding slightly below Wednesday’s final count of 206,501.

Wheat

Wheat prices faded moderately lower following a round of technical selling on Thursday as a critical Black Sea shipping deal nears its deadline to be extended. Russia is pushing for a 60-day extension, while the United Nations prefers a 120-day extension. May Chicago SRW futures dropped 5 cents to $6.9775, May Kansas City HRW futures held steady at $8.1975, and May MGEX spring wheat futures fell 5.75 cents to $8.4675.

Wheat exports found 18.1 million bushels in combined old and new crop sales last week. Old crop sales improved 23% above the prior four-week average. Total sales were also near the high end of analyst estimates, which ranged between 2.8 million and 23.9 million bushels. Cumulative totals for the 2022/23 marketing year are still slightly below last year’s pace so far, with 534.2 million bushels.

Wheat export shipments shifted 45% below the prior four-week average, with 9.2 million bushels. Mexico, the Philippines, Honduras, Japan and Malaysia were the top five destinations.

Consultancy Strategie Grains slightly lowered its estimates for 2023/24 European Union soft wheat production, which is now at 4.758 billion bushels. That would represent a year-over-year increase of 4.4%, if realized.

As expected, Japan purchased 2.7 million bushels of food-quality wheat from the United States, Canada and Australia in a regular tender that closed earlier today. Of the total, 29% was sourced from the U.S. The grain is for shipment between April 21 and May 20.

Preliminary volume estimates were for 66,488 CBOT contracts, trending moderately below Wednesday’s final count of 85,494.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)