Afternoon report: Soymeal dips below the $400/ton benchmark as cash markets rule the corn and soy complexes.

First Feedback from the Field update for the season! Farm Futures’ Feedback from the Field series is back for another year to help farmers across the country share their views on the 2023 growing season! My first update was posted on our website yesterday, so check out FarmFutures.com for those insights.

Many of our farmer respondents are busy with applications, having just recently finished planting activities. More rain is headed for the drought-stressed Plains, but dry skies in the Upper Midwest and Eastern Corn Belt could impede crop development over the next couple weeks. Farmers share their concerns in my latest update!

Want to share your planting/spraying/application insights? Just click this link to take the survey and share updates about your farm’s spring progress. I review and upload results daily to the FFTF Google MyMap, so farmers can see others’ responses from across the country – or even across the county!

Corn

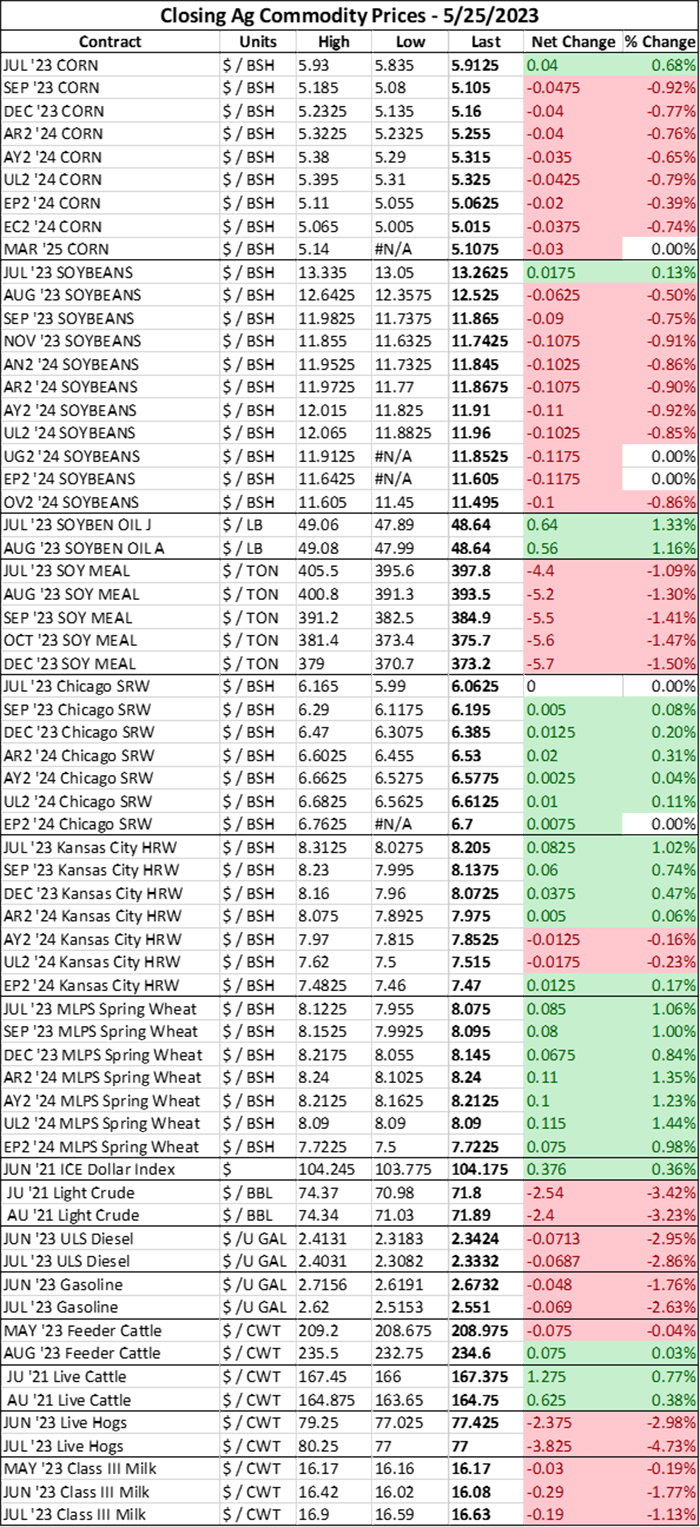

Corn prices fell $0.02-$0.05/bushel today, though nearby July 2023 futures contracts rose $0.04/bushel to $5.9125/bushel at last glance as strong cash demand continues to keep a floor under nearby prices.

A strong dollar, weakening export demand, and prospects for a large U.S. crop following beneficial rains in the Plains this week all contributed to bearish price activity in the corn complex today. Losses were limited by growing concerns about dry weather in the Eastern Corn Belt, which could thwart forecasts for a record-setting U.S. corn crop to be harvested later this fall.

Soybeans

Soybean futures prices fell $0.06-$0.12/bushel during today’s trading session amid lackluster export demand prospects. A surging dollar and rapid planting progress in the U.S. also contributed to today’s losses in the soy complex.

The nearby July 2023 soybean contract edged nearly $0.02/bushel higher, reflecting strong cash market conditions as basis offerings at crush facilities around the Heartland maintain a $0.05-$0.70/bushel premium over the nearby contract, with the most significant price movements of the trading session occurring at crush plants in the Central Plains.

The rising cash prices are increasingly tightening soy crush margins. But overall, crush margins remain profitable which will likely sustain the favorable cash offerings for another week or so. Poultry and livestock producers have been slow to book fresh soymeal sales in recent weeks, which triggered nearby soybean meal prices to fall below the $400/ton benchmark for the first time since last November.

Livestock producers have been waiting for soymeal to notch a fresh price low, and this could be the sign we are there. My brother (on the family dairy farm in Illinois) is considering locking in pricing on some soybean meal right now and I’m encouraging him to do so (in case you needed a sign as well!)

Weekly soybean export sales volumes reported through the week ending May 18 came in below market expectations in this morning’s Export Sales report from USDA. While the sentiment did contribute somewhat to bearish prices today, it should not have come as a surprise – China’s import volumes are down, Brazil is wrapping up harvest on a record-setting crop amid falling cash prices, and quite frankly, this time of year isn’t peak movement season for U.S. soy shipments.

Export sales volumes for soymeal shipments rose 68% from last week’s four-week average, but a strong dollar continues to limit the attractiveness of U.S. soymeal on the global stage.

Wheat

Chicago wheat prices wobbled between gains and losses in today’s trading session as a stronger dollar weakened prospects for U.S. wheat in the global market, especially in the wake of what looks to be a record-setting season for soft red winter wheat production.

But showers in the Northern Plains that delayed spring wheat planting and ongoing drought worries for the hard red winter wheat crop in the Southern Plains kept Minneapolis and Kansas City futures trading $0.04-$0.09/bushel higher today.

Hard red winter wheat may be struggling in Kansas, but soft red winter wheat fields in the Midwest are flourishing amid more favorable weather. Tarso Veloso Ribeiro and Michael Hirtzer, who were on the Kansas Wheat Tour with me last week, from Bloomberg published this stellar article today about superb wheat conditions in the Midwest following a crop tour through Illinois this week.

“The tour showed that we will have one of the best wheat crops we ever produced in the state,” Mark Krausz, president of the Illinois Wheat Association, who farms around 1,800 acres just east of St. Louis, told Bloomberg. “And we have lots of acres.”

While the soft red winter wheat varieties grown in the Midwest won’t be able to fill the gaps over the next year for bread producers who require hard red winter wheat, the abundant soft red crop will likely give livestock producers more affordable feed options – especially if recently dry conditions in the Eastern Corn Belt inflict harm on the young corn crop.

“Bigger wheat harvests in Illinois, Indiana and Ohio also mean the grain can serve as an alternative to corn for hog producers, who have been battling high feed costs that have made some operations unprofitable,” Veloso and Hirtzer conclude.

Inputs & Dryer Fuel

The Wall Street Journal published a brilliant article yesterday about the recent energy market price drop and how it has changed the landscape for the natural gas market in the year since Russia’s unprovoked invasion of Ukraine triggered what the WSJ dubs “the worst energy crisis since the 1970s.”

Natural gas prices are tumbling lower as Russia attempts to offload surplus natural gas supplies on the global market at steep discounts, after the European Union was able to procure necessary supplies from the U.S. after Russia turned off its natural gas pipeline into the E.U. last year.

And while the lower natural gas prices have helped ease inflationary pressures that have dogged the global economy over the past year, the falling costs also come with a risk – lower revenues for final products are keeping production margins tight.

“The price of products such as copper and ammonia is falling in line with that of natural gas as demand for goods weakens globally,” Joe Wallace and Kim Mackrael write for the WSJ. “Factories in Europe, which still face higher energy prices than competitors elsewhere, are the first to feel pressure to slow.”

European fertilizer companies are bearing the brunt of this burden, with one international fertilizer company, OCI, nothing that the potential price volatility in the natural gas market is enough to prevent OCI from restarting ammonia production after idling it in 2021 due to high natural gas costs.

“We don’t want to restart it, then have to shut back down again,” OCI’s Chief Executive Ahmed El-Hoshy told the WSJ, noting that the company is increasingly reliant on ammonia imports from countries where it can be more cheaply produced.

Meanwhile, International fertilizer behemoth Yara is ramping its ammonia production back up after slowing down last year due to high costs, but it continues to run its European plants at only half of normal production capacity.

“It’s a different reality at the moment, with much lower energy prices but also much lower fertilizer prices and food prices as well,” said Chief Executive Svein Tore Holsether.

For U.S. farmers, there are a few key points to take away here. First – the lower natural gas prices now may provide for a great opportunity to line up and pre-price fall dryer fuel supplies. Second – the reduced production capacity of European fertilizer output means that competition on the global nitrogen market may be strong in the coming months, which could translate into higher fertilizer prices for the fall application season.

Weather

Heat will continue to dominate the Heartland forecast through the rest of the week, according to NOAA's short-range forecasts, with temperatures moderating slightly by tomorrow. Rain and thunderstorm systems are likely to linger in the Southern and Western Plains through the end of the week. It will remain dry in the Eastern Corn Belt into the weekend, with even fewer chances for rain expected next week.

NOAA’s 6-10-day outlook is showing an above average chance for temperatures in the Upper Plains, Eastern Corn Belt, and Upper Midwest through the end of the month. An above average chance for rainfall will cover most of the West as well as the Plains, while moisture outlooks for the Eastern Corn Belt are trending below average during that time.

That’s good news for drought-stressed growers on the Plains, but the dry outlooks further east could present some development challenges for young crops, especially as more distant forecasts continue to show much of the same weather patterns.

The 8-14-day forecast is trending very similarly to its 6-10-day counterpart through the beginning of June, though the heat will likely begin to recede across the Heartland during that time. Chances for showers continue to be forecast above average through the Western and Southern Plains during that time, which should be a welcome soil moisture recharge for drought-stressed areas in that region, while dryness will persist in the Upper Midwest and Eastern Corn Belt.

If young crops begin to show signs of dry stress, then I expect that futures markets will stage a rally over the next week, even though a rapid planting season is about to quickly end. As El Niño weather patterns begin to take hold across the world, the Eastern Corn Belt is at increasing risk of dry weather this growing season.

Financials

The U.S. economy is continuing to run hot, even as the economy continues to process Federal Reserve rate hikes. But Wall Street shrugged off any of those worries – as well as concerns about the debt ceiling negotiations �– and staged a rally during today’s trading session. S&P 500 futures rose 1.10% to $4,160.56 on optimism surrounding the economic growth prospects as well as strength signals from the tech sector.

Here’s what else I’m reading this morning on FarmFutures.com:

Naomi Blohm is keeping a close eye on beef demand as summer heats up.

My latest E-corn-omics column summarizes my harrowing findings from last week’s Winter Wheat Tour in Kansas.

Bryce Knorr digs into mathematical equations to help farmers compare future yields to U.S. averages in an effort to provide marketing perspectives.

Mike Downey asks – who should own Iowa farmland?

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)