December 2022 corn futures are very profitable even with high fertilizer prices and other input prices.

December 21, 2021

During the first two weeks of December, we conducted a five-day seminar series starting in Lafayette, Indiana; then on to Bloomington, Illinois; Ames, Iowa; Kearney, Nebraska and Sioux Falls, South Dakota. Attendance was very strong, and we learned a lot.

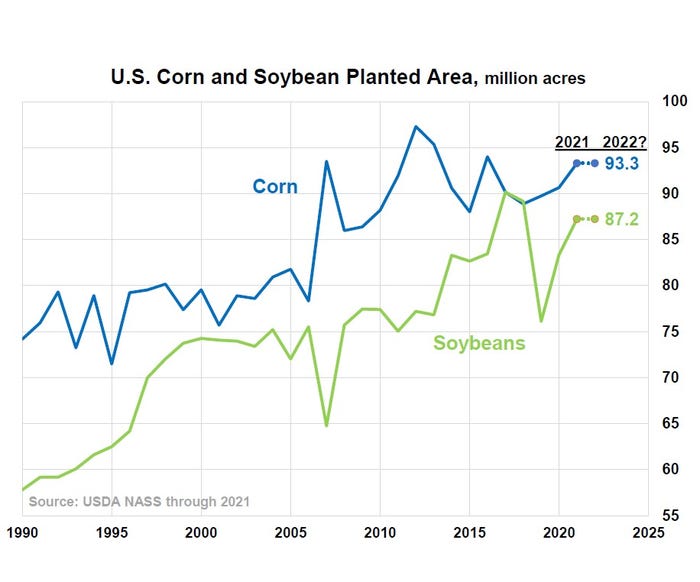

The primary takeaway from these meetings was that the large majority of farmers will be sticking with a normal corn/soybean acreage rotation. Very few producers indicated that they would plant fewer corn acres this year than last year. At each meeting, however, approximately the same number of producers indicated they would increase corn acres.

Some of the variables involved:

Almost everyone at each meeting already had fertilizer purchased and for the most, part laid in storage.

The vast majority has already applied anhydrous ammonia—that means corn acres. The only state that didn’t was Nebraska where much of the fertilizer is applied through irrigation systems.

The most important variable between now and the end of February will be the average price of corn for the month of February which determines the minimum floor for crop revenue insurance. If corn prices stay where they are now, it all but guarantees more corn acres this coming year. December 2022 corn futures are very profitable even with high fertilizer prices and other input prices.

Chemical shortages

There was actually more concern among producers for getting the herbicides and insecticides that will be needed this coming growing season than fertilizer. There are some shortages of all chemicals and appears as though there will be some logistical issues for some producers getting the exact chemicals they want. Most people thought ahead on fertilizer and purchased anhydrous ammonia for $700 per ton, less than half of the current price.

Also impacting the crop mix will be lower natural gas prices, the key input for making anhydrous ammonia and other nitrogen fertilizers. Natural gas prices in the U.S. have dropped roughly 40% over the past three months, but they remain near record highs in Europe.

Commodity prices are cyclical

Let’s not ever forget that. The cure for low prices is low prices and the cure for high prices is high prices. Some recent examples are quite visible in the sharp rise in lumber prices followed by the sharp drop. Steel prices had been on a sharp rise ever since Covid started, but in the last few weeks, that trend has reversed. Soybean oil led the bull market in the soy complex and now it is leading the market down making new six-month lows in December. Soybean meal was caught in between, but with the action in soybeans and soybean oil, we do not feel buyers need to be too concerned.

People will believe what they want to believe in the short-term. Attitudes in the grain industry at this point in time are similar to what we witnessed in 2012/13. The last surge up was helped by concerns of inflation. As this is written, it does not appear as though President Biden’s $1.75 trillion “Build Back Better” plan is going to happen. That could be the one fundamental change that will reverse sharply rising prices in almost all sectors of our economy. Attitudes are everything and attitudes are now starting to change.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)