FSA announces debt relief for socially disadvantaged farmers forgiving 120% of debt from guaranteed loans.

The $4 billion in debt relief authorized to Black farmers and other socially disadvantaged farmers will begin in June, according to a notice of funding availability announcing the loan payments offering aid approved under the COVID-relief inspired American Rescue Plan earlier this year. It is estimated 16,000 farmers could be eligible for the assistance.

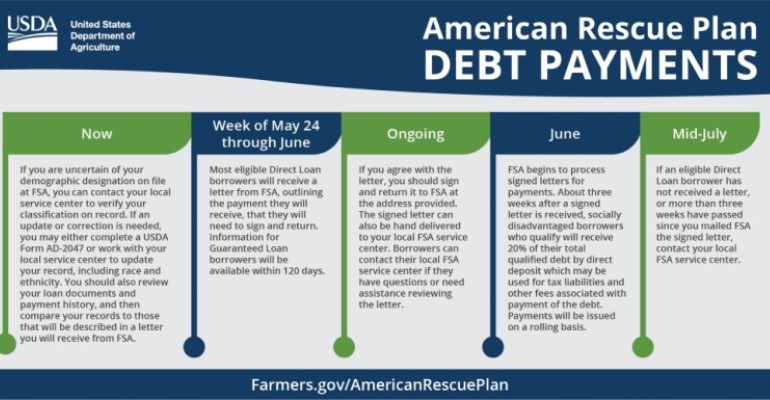

USDA expects payments to begin in early June and continue on a rolling basis. Eligible direct loan borrowers will begin receiving debt relief letters from FSA in the mail on a rolling basis, beginning the week of May 24. After reviewing closely, eligible borrowers should sign the letter when they receive it and return to FSA. (View a more detailed timeline here.)

A subsequent notice addressing guaranteed loan balances and direct loans that no longer have collateral and have been previously referred to the Department of Treasury for debt collection for offset, will be published within 120 days.

“The American Rescue Plan has made it possible for USDA to deliver historic debt relief to socially disadvantaged farmers and ranchers beginning in June,” says Agriculture Secretary Tom Vilsack. “USDA is recommitting itself to gaining the trust and confidence of America’s farmers and ranchers using a new set of tools provided in the American Rescue Plan to increase opportunity, advance equity and address systemic discrimination in USDA programs.”

Section 1005 of the ARPA provides funding and authorization for USDA FSA to pay up to 120% of direct and guaranteed loan outstanding balances as of January 1, 2021, for socially disadvantaged farmers and ranchers. The 120% payment represents the full cost of the loan to include 100% toward loan balances as of January 1, 2021, and the 20% reimbursement is available for tax liabilities and other fees associated with payment of the debt. Any payments by borrowers made since January 1 will be reimbursed in full.

Related: Black farmer loan forgiveness challenged

For much of the history of the USDA, socially disadvantaged farmers and ranchers have faced discrimination—sometimes overt and sometimes through deeply embedded rules and policies—that have prevented them from achieving as much as their counterparts who do not face these documented acts of discrimination, the USDA explains.

Over the past 30 years, several major civil rights lawsuits have compensated farmers for specific acts of discrimination—including Pigford I and Pigford II, Keepseagle and the Garcia cases. “However, those settlements and other related actions did not address the systemic and cumulative impacts of discrimination over a number of decades that the American Rescue Plan now begins to address,” USDA adds.

Members of socially disadvantaged groups include but are not limited to American Indians or Alaskan Natives; Asians; Blacks or African Americans; Native Hawaiians or other Pacific Islanders; and Hispanics or Latinos. The secretary of agriculture will determine on a case-by-case basis whether additional groups qualify under this definition in response to a written request with supporting explanation.

Qualifying loans as part of the announcement are certain direct loans under the Farm Loan Programs and Farm Storage Facility Loan Program.

All eligible direct loan borrowers are included in this initial announcement except those who no longer have collateral or an active farming operation. “These borrowers often have more complicated cases and may not have the same opportunities to invest in their farming operation to manage tax liabilities,” the note expects. “FSA expects these cases to account for approximately 5% of eligible direct loan borrowers.”

Sections 1005 and 1006 of ARPA provide USDA with new tools to address what they term “longstanding inequities for socially disadvantaged borrowers.”

The American Rescue Plan apportioned over $1 billion for a variety of purposes, including guidance on heirs property, credit management, and for the creation of an Equity Commission which will identify and offer solutions for addressing and removing longstanding discrimination and barriers facing USDA staff, customers, programs and services. Senior leadership in USDA has spent these first 100 days consulting with stakeholders and community groups and crafting a charter since this Commission must adhere to the rules set out in the Federal Advisory Committee Act.

Heirs’ property concerns

Heirs’ property – land jointly owned by descendants of someone who did not leave a legal will, thereby leaving them without a clear title to the land – is the leading cause of involuntary land loss among Black landowners. Land that is passed down without a will is delegated to surviving family members by way of fractional ownership, meaning any heir can divide or sell the land.

In 2020, John Deere, the National Black Growers Council, and the Thurgood Marshall College Fund announced the establishment of LEAP (Legislation, Education, Advocacy and Production Systems) coalition. The coalition launched a new website – Deere.com/LEAP - to serve as a comprehensive resource that explains why LEAP is important to farmers.

The coalition is working with organizations like the Federation of Southern Cooperatives and others to provide awareness, expertise and legal resources to help Black and other traditionally under-represented farmers gain clear title to their land. LEAP is dedicated to ensuring the long-term sustainability of over 60 million acres of land currently owned or farmed by Black farmers.

Tharlyn Fox, a John Deere employee and manager of LEAP, notes, “If you combine that history with the leadership and expertise we have in agriculture, John Deere is uniquely positioned to help address issues such as Heirs’ Property and to further unlock the economic potential of all farmers.”

About the Author(s)

You May Also Like