Afternoon report: Wheat prices also made modest inroads in Monday’s session.

Last week was a painful one for the grain markets as corn, soybeans and wheat all suffered technical setbacks that pushed some contracts significantly lower. Corn prices, in particular, had fallen to the lowest levels since October 2021. But today, bargain buyers finally entered the fray, handing out double-digit gains for both corn and soybeans. Wheat prices also trended higher but were much more modest, in contrast.

Most of the eastern Corn Belt will remain completely dry between Tuesday and Friday, while the Plains could catch some additional rainfall during this time, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts more seasonally wet weather for the Plains between May 29 and June 4, and most of the central U.S. could face seasonally warm weather next week.

On Wall St., the Dow slid 74 points lower in afternoon trading to 33,351 as politicians plan to meet later this afternoon for a fresh round of debt ceiling negotiations. There is less than two weeks to hammer something out before the U.S. finds itself in default. Energy futures found variable gains, with crude oil up 0.5% this afternoon to $71 per barrel. Diesel shifted slightly higher, while gasoline jumped 2.5% higher. The U.S. Dollar firmed fractionally.

On Friday, commodity funds were net sellers of corn (-500), soybeans (-8,000), soymeal (-2,500) and CBOT wheat (-3,000) contracts, and were roughly even trading soyoil contracts.

Corn

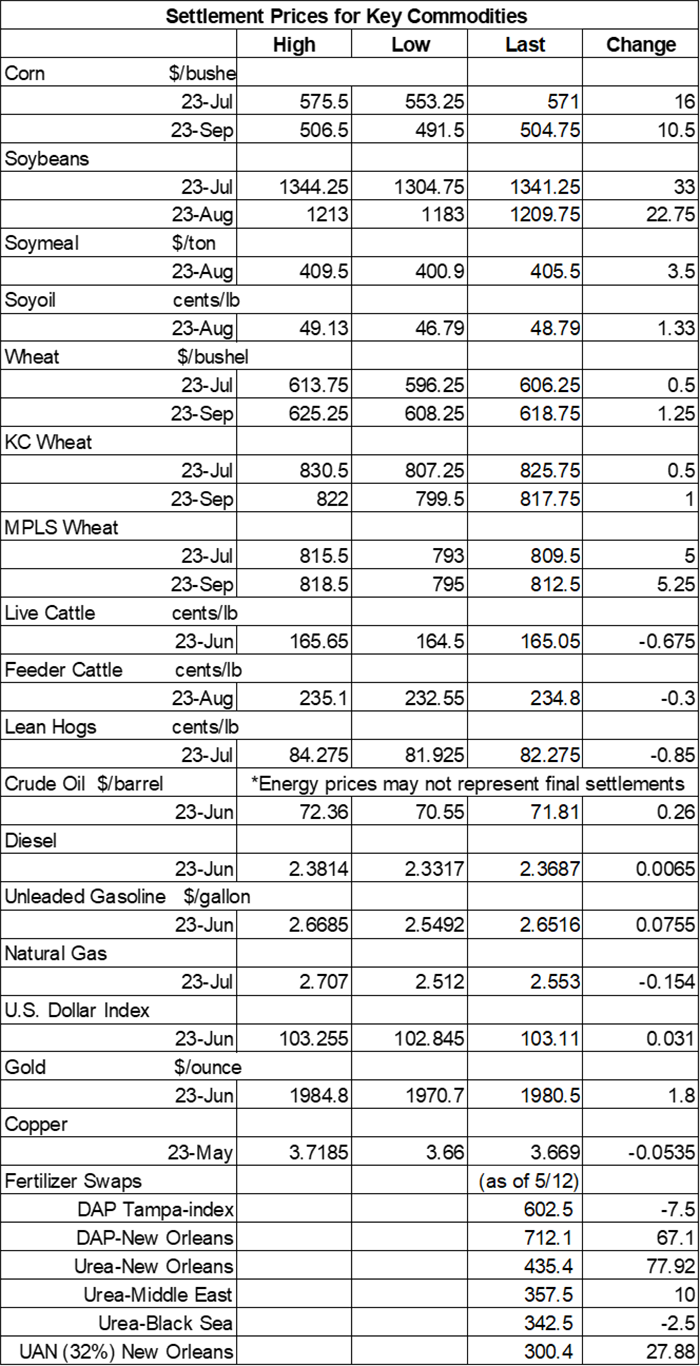

Corn prices climbed higher throughout Monday’s session amid a round of technical buying that led to gains of more than 2% by the close. July futures rose 16 cents to $5.7050, with September futures up 10.5 cents to $5.05.

Corn basis bids were steady to mixed, with one anomalous change of note at an Iowa processor, where they jumped 50 cents higher on Monday.

Corn export inspections reached 52.1 million bushels last week. That was on the high end of trade estimates, which ranged between 27.6 million and 56.1 million bushels. Japan was the No. 1 destination, with 19.9 million bushels. Cumulative totals for the 2022/23 marketing year are still well below last year’s pace, however, after reaching 1.078 billion bushels.

Ahead of this afternoon’s crop progress report from USDA, analysts think the agency will show corn plantings move from 65% a week ago up to 82% through May 21. Individual trade guesses ranged between 79% and 85%.

Taiwan issued an international tender to purchase 2.6 million bushels of animal feed corn to be sourced from the United States, South America or South Africa that closes on Wednesday. Additional details regarding shipment were not immediately available.

“If your farm has experienced growth in recent years – whether that’s additional employees, additional family members on the farm, more acres, added crops or new side businesses – then you as a leader might start to feel “stretched” at times,” according to Darren Frye, CEO of Water Street Solutions. Implementing a series of written processes can help, and Frye serves up some ideas around this topic in his latest blog – click here to learn more.

Preliminary volume estimates were for 284,857 contracts, trending around 31% below Friday’s final count of 414,397.

Soybeans

Soybean prices found significant gains after a round of technical buying led to double-digit gains on Monday. July futures rose 33 cents to $13.4025, with August futures up 26 cents to $12.74. The rest of the soy complex was also in the green today. Soymeal futures rose more than 0.75%, while soyoil futures jumped nearly 3% higher.

Soybean basis bids held steady across the central U.S. on Monday.

Private exporters announced to USDA the sale of 225,000 metric tons of soymeal for delivery to the Philippines during the 2022/23 marketing year, which began September 1.

Soybean export inspections were relatively disappointing last week after only reaching 5.7 million bushels. That was on the low end of trade estimates, which ranged between 3.7 million and 18.4 million bushels. Japan was the No. 1 destination, with 2.1 million bushels. Cumulative totals for the 2022/23 marketing year are trending modestly below last year’s pace so far, with 1.771 billion bushels.

Prior to the next crop progress report from USDA, analysts expect to see soybean plantings move from 49% a week ago up to 66% through May 21. Individual trade guesses ranged between 61% and 69%.

You may not be reading this hoping for a math lesson, but grain market analyst Bryce Knorr says there are some valuable lessons to be learned for those who crack the books. In particular, Knorr calls correlations and linear analysis the “bread and butter” for those who use supply and demand data to forecast prices. Click here to read his latest thoughts in today’s Ag Marketing IQ blog.

Preliminary volume estimates were for 240,016 contracts, sliding slightly below Friday’s final tally of 247,452.

Wheat

Wheat prices made modest inroads on some technical buying that was largely spurred by spillover strength from corn and soybeans. September Chicago SRW futures added 1.25 cents to $6.1825, September Kansas City HRW futures picked up a penny to reach $8.1650, and September MGEX spring wheat futures gained 5.25 cents to $8.1225.

Wheat export inspections improved to 15.0 million bushels last week. That was better than the entire range of trade guesses, which came in between 3.7 million and 12.9 million bushels. Mexico was the No. 1 destination, with 3.2 million bushels. Cumulative totals for the 2022/23 marketing year are trending slightly below last year’s pace, with 703.4 million bushels.

Ahead of this afternoon’s USDA crop progress report, analysts expect to see winter wheat quality ratings firm slightly, with 30% of the crop in good-to-excellent condition through May 21. Individual analyst estimates ranged between 28% and 32%. For spring wheat, analysts expect to see planting progress move from 40% a week ago up to 60% through Sunday.

Russian consultancy Sovecon is still estimating that the country’s wheat exports will reach 139.6 million bushels in May. That would be a monthly decline of 11.6%, if realized. Russia is the world’s No. 1 wheat exporter.

Taiwan issued an international tender to purchase 2.1 million bushels of grade 1 milling wheat from the United States, which closes on May 26. The grain is for shipment in July.

South Korea issued a tender to purchase 5.0 million bushels of milling wheat, which can be sourced from the United States, Canada or Australia. Offers can be submitted through Tuesday. The grain is for shipment starting in August.

Preliminary volume estimates were for 99,718 CBOT contracts, moving slightly ahead of Friday’s final count of 96,014.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)