Afternoon report: Corn, soybeans and wheat all trend higher in Tuesday’s session.

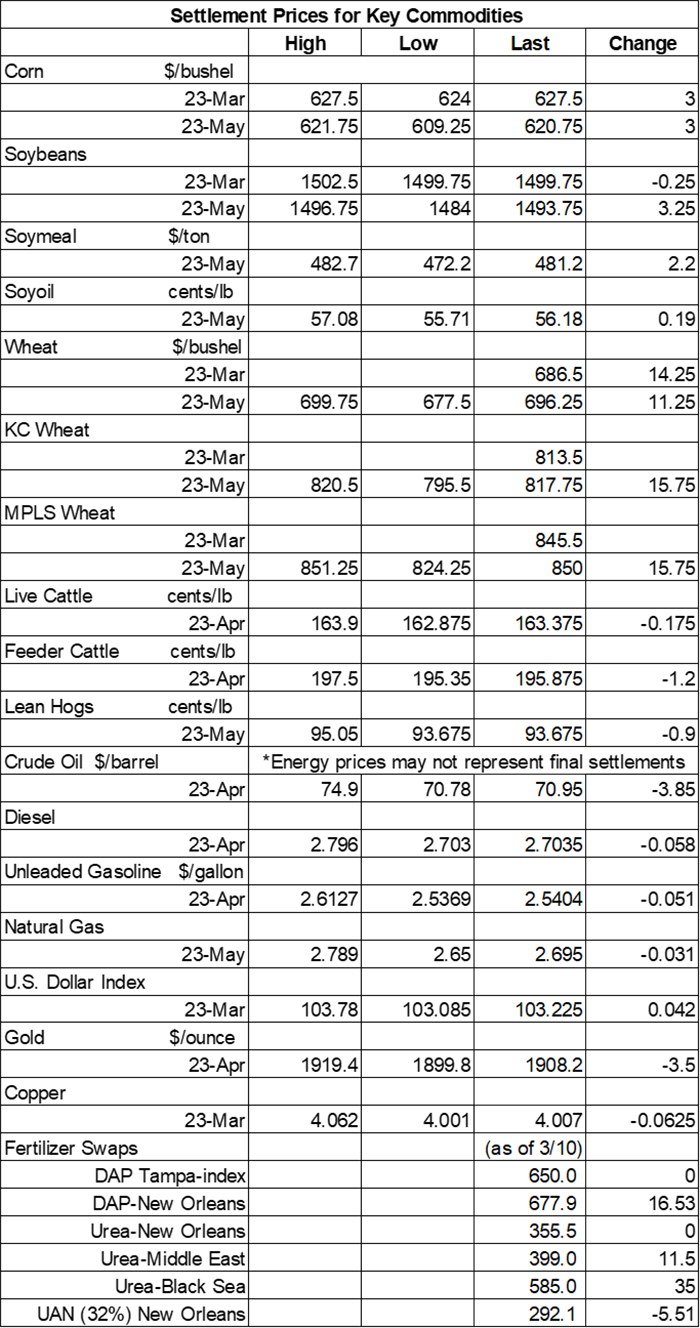

Grain prices were mixed but mostly higher on Tuesday. Corn and wheat saw the biggest improvements as they continue to recover from multi-month lows seen in recent sessions. Wheat contracts found gains that mostly ranged between 1.5% and 2%, while corn improved more than 1%. Nearby soybean contracts were down fractionally today, meantime, while May contracts shifted around 0.25% higher.

Abundant wet weather is on its way to the Mid-South and Great Lakes region later this week, with some areas set to receive another 1.5” or more between Wednesday and Saturday, per the latest 72-hour cumulative precipitation map from NOAA. The agency’s new 8-to-14-day outlook predicts seasonally wet weather for most of the Corn Belt between March 21 and March 27, with colder-than-normal conditions likely for the western half of the country next week.

On Wall St., the Dow rose 164 points in afternoon trading after regional banks rebounded from an absolute slaughter on Monday. Investors had been worried that the lightning quick closure of Silicon Valley Bank would potentially cause similar bank runs for other lending institutions. Energy futures slumped lower. Crude oil crumbled more than 4.25% to $71 per barrel (a nine-week low) on rising domestic stocks and lingering inflation concerns. Diesel and gasoline each faded around 1.25% lower. The U.S. Dollar firmed fractionally.

On Monday, commodity funds were net buyers of CBOT wheat (+1,500) contracts but were net sellers of corn (-3,500), soybeans (-8,000), soymeal (-3,000) and soyoil (-3,500).

Corn

Corn prices moved moderately higher on Tuesday, thanks in part to a flash sale to China announced this morning. Spillover strength from wheat lent some additional support as well. March futures added 3 cents to $6.2750, with May futures up 7.5 cents to $6.21.

Corn basis bids were steady to slightly firm across the central U.S. on Tuesday after trending 1 to 2 cents higher at three Midwestern locations today.

Private exporters announced the sale of 24.1 million bushels of corn for delivery to China during the 2022/23 marketing year, which began September 1.

A Reuters poll of 12 analysts shows an expectation that Brazil’s 2022/23 corn production will reach 4.985 billion bushels. That would be a year-over-year increase of nearly 12%, if realized. These estimates took into consideration a 4.4% increase in planted acres and the likelihood of improved per-acre yields this season.

Per the latest data from the European Commission, EU corn imports during the 2022/23 marketing year 747.6 million bushels through March 12. That’s substantially higher than last year’s pace of 466.1 million bushels.

A South Korean feedmill group purchased 5.3 million bushels of animal feed corn from optional origins in an international tender that closed earlier today. The grain is for arrival in August. And another South Korean buyer purchased an additional 2.7 million bushels of animal feed corn, likely soured from South America or South Africa, in a private deal that closed earlier today.

Algeria issued an international tender to purchase 1.4 million bushels of animal feed corn to be sourced from Argentina. The deadline for offers is on Wednesday, and the grain is for shipment during the first half of April.

Preliminary volume estimates were for 290,608 contracts, which was moderately higher than Monday’s final count of 267,377.

Soybeans

Soybean prices were narrowly mixed as traders are still looking at a “tale of two crops” in South America – where Argentina’s production keeps fading while Brazil should hold on for a record-breaking effort this season. March futures eased 0.25 cents to $14.9975, while May futures added 3.25 cents to $14.9450.

The rest of the soy complex made modest inroads, with soymeal and soyoil futures both up around 0.4% today.

Soybean basis bids held steady across the central U.S. on Tuesday.

European Union soybean imports during the 2022/23 marketing year are trending moderately below last year’s pace after reaching 283.3 million bushels through March 12. EU soymeal imports are also down year-over-year, with 10.88 million metric tons during the same period.

Brazilian consultancy Pátria Agronegócios was the latest group to serve up an estimate for the country’s 2022/23 soybean production, offering a projection of 5.475 billion bushels. Most current estimates are trending somewhere between 5.4 billion and 5.6 billion bushels.

What does “work life balance” mean to you? Is it truly attainable, or should you be seeking something else entirely? “Instead of looking for the elusive balance between work and family, look for boundaries,” suggests Tim Schaefer, founder of Encore Wealth Advisors. “Creating and keeping boundaries in a family business is hard, but worthwhile. Embracing boundaries allows all family members to grow at work, and at home.” Schaefer expands on this concept and offers additional advice in his latest column – click here to learn more.

Preliminary volume estimates were for 163,207 contracts, fading moderately below Monday’s final count of 212,433.

Wheat

Wheat prices grabbed double-digit gains as traders remain focused on a critical Black Sea shipping deal that is up for extension on Friday (more on this below). May Chicago SRW futures gained 11.25 cents to $6.9575, May Kansas City HRW futures rose 15.75 cents to $8.1625, and May MGEX spring wheat futures rose 15.75 cents to $8.4825.

Negotiations continued today in an attempt to extend a critical Black Sea deal that allows for safe passage of shipping vessels amid Russia’s ongoing invasion of Ukraine. Russia is pushing for a 60-day extension, while Ukraine wants a 120-day extension. The deal will be renewed on March 18 if no formal objections are lodged prior to then.

European Union soft wheat exports during the 2022/23 marketing year have reached 791.5 million bushels through March 12, which is moderately above last year’s pace so far. EU barley exports are trending moderately below last year’s pace, in contrast, with 196.6 million bushels during the same period.

Tunisia received multiple offers in its international tender to purchase up to 8.6 million bushels of soft wheat from optional origins but has announced no purchases at this time. The grain is comprised of eight consignments that are for shipment between late March and late May.

Japan issued a regular tender to purchase 2.7 million bushels of food-quality wheat from the United States, Canada and Australia that closes on Thursday. Of the total, 29% is expected to be sourced from the U.S. The grain is for shipment starting in late April.

Jordan purchased 2.2 million bushels of hard milling wheat from optional origins in an international tender that closed earlier today. The grain is for shipment during the first half of August.

Preliminary volume estimates were for 92,232 CBOT contracts, sliding 21% below Monday’s final count of 116,052.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)