Sub-indices of current conditions and future expectations shift in opposite directions.

October 3, 2017

Producers' optimism about the future of the agricultural economy fell in September, according to the Index of Future Expectations, a sub-index of the Purdue University/CME Group Ag Economy Barometer.

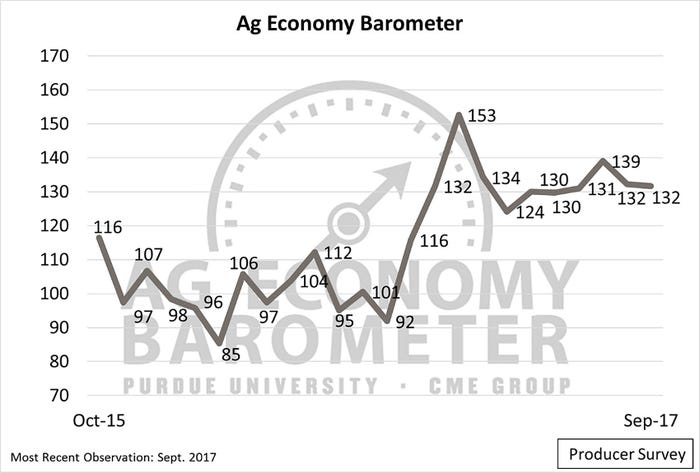

The overall Ag Economy Barometer held steady from August to September with a reading of 132 as its two sub-indices — the Index of Future Expectations and the Index of Current Conditions — shifted in opposite directions. The Index of Future Expectations fell seven points to 130 in September, while the Index of Current Conditions climbed from 122 in August to 135 in September, reaching its second-highest level since data collection began in October 2015.

The measure of agricultural producer sentiment — which is based on a monthly survey of 400 U.S. producers of corn, soybeans, wheat, cotton, beef cattle, dairy cattle and hogs — has ranged between 130 and 139 over the last six months and remains well below its peak level of 153 established in January 2017 (Figure).

"Although the decline in the Index of Future Expectations was modest, it could be an indication that some of the optimism that surfaced among producers in late 2016 and early 2017 is eroding," said Jim Mintert, director of Purdue's Center for Commercial Agriculture and principal investigator for the barometer. "One of the drivers of the jump in producer sentiment after the 2016 U.S. presidential election was a sharp increase in expectations about the U.S. economy, but the last two times the barometer survey has posed questions about the overall economy, respondents were noticeably less optimistic."

For example, in October 2016, a larger share of producers (23%) expected the U.S. economy to contract over the upcoming 12 months than expected the economy to expand (13%). By December, however, this had changed markedly, as half of survey respondents expected the U.S. economy to expand during the upcoming year. This improved again in March, with nearly 60% expecting economic expansion to take place.

However, in June and again in September, respondents' optimism about the U.S. economy had waned. In the September survey, just 40% of respondents said the economy is likely to expand — a decline of nearly one-third since March. Although most of the decline was attributable to producers' responses shifting from “expand” to “remain about the same,” the share of producers expecting the economy to contract increased to 13% in September, compared to 9% in both March and June.

The Purdue/CME Group Ag Economy Barometer held steady in September as producers' expectations for the future fell and sentiment toward current conditions increased.

Uncertainty about NAFTA impact

Another topic on the September survey was trade agreements and negotiations, specifically the North American Free Trade Agreement (NAFTA). The survey asked respondents whether NAFTA has been good or bad for the U.S. economy and, separately, for U.S. farmers and ranchers. Overall, 52% of producers said they believe NAFTA has been good for the U.S. economy, while 59% reported that the agreement has been good for U.S. farmers and ranchers.

In contrast, in February, 93% of respondents said trade was important to the U.S. agricultural economy, and 80% of producers said trade was important to their farms. The differences among the responses to the more general trade questions and those that focused specifically on NAFTA suggest that there is some uncertainty among producers about the impact of NAFTA, Mintert said.

Moreover, Mintert noted, just looking at the percentage of favorable responses regarding the impact of NAFTA might not tell the whole story.

"An unusually large percentage of survey participants — 24% in the case of the U.S. economy and 20% in the case of farmers and ranchers — opted not to answer these two questions," he said. "Although we can't say for sure why producers opted not to respond to these two questions, it might also reflect a relatively high degree of uncertainty regarding NAFTA's impact."

In conclusion, one source of optimism among U.S. producers following the fall 2016 elections was an expectation that the U.S. economy would strengthen in the year ahead. However, recent surveys suggest that confidence among agricultural producers that the U.S. economy will continue to expand in the year ahead appears to be waning, which might be contributing to weakness in the Index of Future Expectations.

Additionally, uncertainty regarding the future of agricultural trade, which an overwhelming majority of producers regard as important, could also be a concern for farmers when they consider future prospects for their farming operation and the U.S. agricultural economy.

The full September report includes more information about producers' sentiment toward NAFTA, their expectations for the stock market in 12 months and what they think might happen with the U.S. economy in the next year.

The Purdue University Center for Commercial Agriculture was founded in 2011 to provide professional development and educational programs for farmers. Housed within the department of agricultural economics, the center's faculty and staff develop and execute research and educational programs that address different needs for managing in today's business environment.

CME Group is the world's leading and most diverse derivatives marketplace.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)