Fewer farmers need operating loans as working capital situation improves.

Agricultural bankers in the upper Midwest reported improved lending and farm income conditions for the third quarter, according to Joe Mahon, regional outreach director for the Federal Reserve Bank of Minneapolis, Minn.

Mahon said demand for loans is down because the cash position has improved in the region, including Minnesota, North Dakota, South Dakota Montana and upper Wisconsin. Mahon said the mildly improving conditions also include steady loan repayment rates and are coming off low levels of mild improvement from a multiyear period of pretty difficult conditions in agriculture. This is due to a combination of a good growing season, recent strengthening in market prices and federal coronavirus aid acting as a “boom to farm balance sheets.”

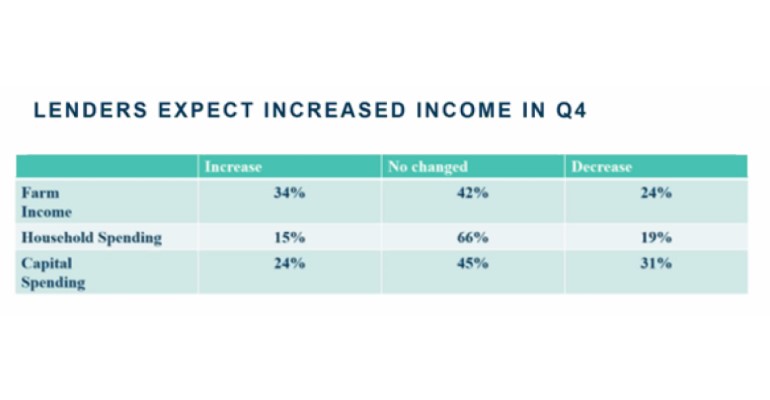

More than 50% of the agricultural bankers said farm income is expected to be flat, with capital spending down for the third quarter. However, in looking ahead to the fourth quarter, 34% of lenders expect conditions to improve, 42% expect it to be unchanged and another 24% expect farm income to decline.

With the recent increase in prices for commodities over the last couple of months, ongoing strength in export markets will also boost income outlooks.

“We did have lenders in our survey say they expected a further decrease in loan demand,” Mahon said. “That’s an indication the cash situation for some of these producers is improving and they won’t have to borrow as much.”

Demand for loans decreased slightly on balance, according to lenders. While nearly two-thirds of respondents indicated that loan demand was unchanged from a year ago, 23% noted increased loan demand. This result also pointed to some improvement in farm finances and stood in contrast to recent surveys in which larger shares of lenders were reporting increased or unchanged loan demand. Collateral requirements on loans have held steady, according to 85% of lenders surveyed, with the balance reporting increases in collateral requirements.

Fixed and variable interest rates for operating, machinery and real estate loans all decreased from the previous quarter.

Nearly a quarter of the lenders said they expect capital spending to increase for the fourth quarter, and Mahon said tax considerations might have something to do with that.

Mahon said it is unlikely that farmers are sitting on piles of cash such as circa 2012, when commodity prices were really high. During the boom years, there was a big run on equipment purchases, but equipment lasts only so long. Because the lump of capital purchases made during that period are now getting towards the end of their life cycle, farmers may be looking at this year’s improved margin environment as an opportunity to write off large purchases.

Land values also strengthened in the region, up an average of 3.1%, reversing a previous trend lower. “Values have soared in the early part of the last decade but plateaued and seen values retreat from their peaks in 2014 very slowly,” Mahon said. “This result in the third quarter is a reversal of what we’ve seen in a slowed downward movement of land prices.”

Cash rents are up slightly in most states but down 2.4% in South Dakota.

Read additional insight from Mahon here.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)