The answer depends on how you interpret the latest round of data

Were soybean export inspections “good” or “bad” this past week? That question typically has a subjective answer – especially in the latest round of grain export inspection data from USDA, out Monday morning.

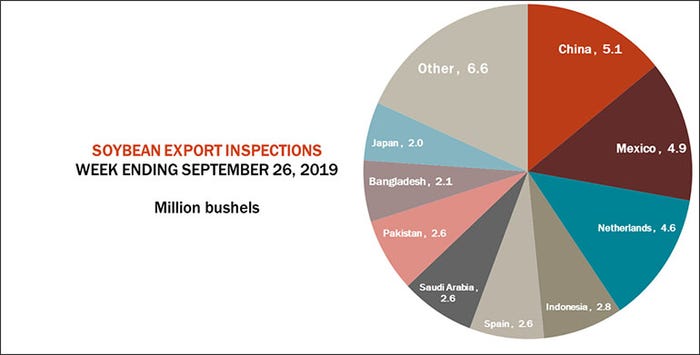

“Export inspections were good for soybeans, depending on how the data is viewed,” according to Farm Futures senior grain market analyst Bryce Knorr. “Total shipments were above the rate forecast by USDA for the 2019 marketing year with near two-dozen countries booking supplies. But China accounted for only 5.1 million bushels of that business despite increasing purchases recently as the government waived tariffs for private buyers there.”

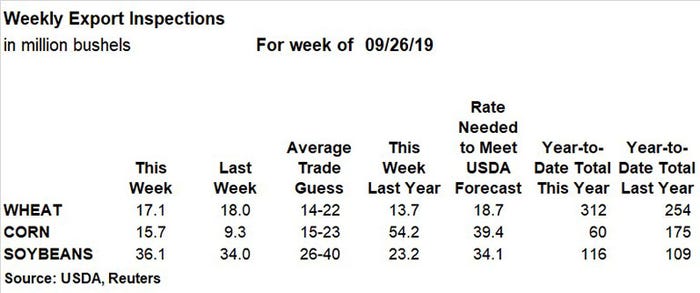

Total soybean export inspections were 36.1 million bushels for the week ending September 26. That’s slightly above the prior week’s tally of 34.0 million bushels and on the high end of trade estimates that ranged between 26 million and 40 million bushels. The weekly rate needed to match USDA forecasts also retreated slightly, to 34.1 million bushels. Year-to-date totals for 2019/20 also remain above last year’s pace, with 116 million bushels.

China led all destinations for soybean export inspections last week, with 5. 1million bushels. Other top destinations included Mexico (4.9 million), the Netherlands (4.6 million) and Indonesia (2.8 million).

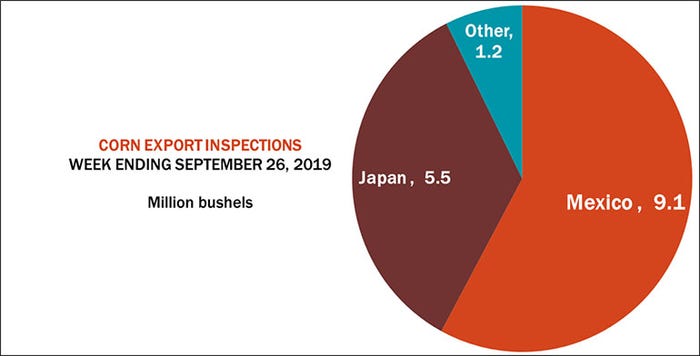

Corn export inspections improved over last week’s dismal 9.3 million bushels but were still lackluster after reaching 15.7 million bushels. That was on the low end of trade estimates that ranged between 15 million and 23 million bushels, with the weekly rate needed to match USDA forecasts moving up to 39.4 million bushels. Year-to-date totals of 60 million bushels so far for the 2019/20 marketing year are also pretty tepid, versus 175 million this time last year.

“Corn shipments improved but were again disappointing, coming it at less than half the rate needed to reach USDA’s forecast for the 2019 marketing year,” Knorr says. “Brazilian corn continues to undercut the U.S., even among domestic users here. News that Southeast livestock operations are importing corn rather that ship it from the eastern Midwest is an indication of the competition the U.S. faces.”

Mexico accounted for more than half of all U.S. corn export inspections last week, with 9.1 million bushels. Japan chipped in another 5.5 million bushels, with other countries taking on the last 1.2 million bushels.

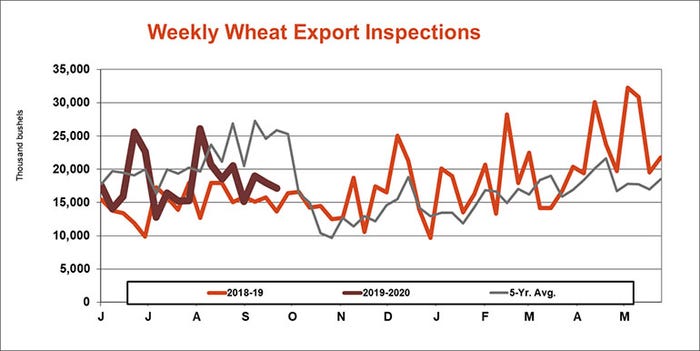

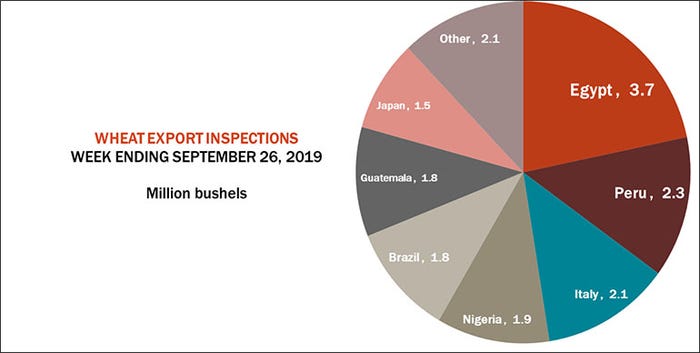

Wheat export inspections continued a mostly steady pace last week after reaching 17.1 million bushels. That was slightly behind the prior week’s tally of 18.0 million bushels but in the middle of trade estimates that ranged between 14 million and 22 million bushels. The weekly rate needed to match USDA forecasts moved slightly higher, to 18.7 million bushels, while cumulative totals for 2019/20 remain 23% above last year’s pace, with 312 million bushels.

“Wheat inspections slipped a little to 17.1 million bushels, a little below the rate forecast by USDA,” Knorr says. “Egypt was the only buyer booking more than one cargo as most customers continue to fill only short-term needs.”

Egypt’s 3.7 million bushels led all destinations for wheat export inspections last week. Other top destinations included Peru (2.3 million), Italy (2.1 million), Nigeria (1.9 million), Brazil (1.8 million) and Guatemala (1.8 million).

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)