Trade baked in large China sales, but grain prices still moved higher following today’s USDA report.

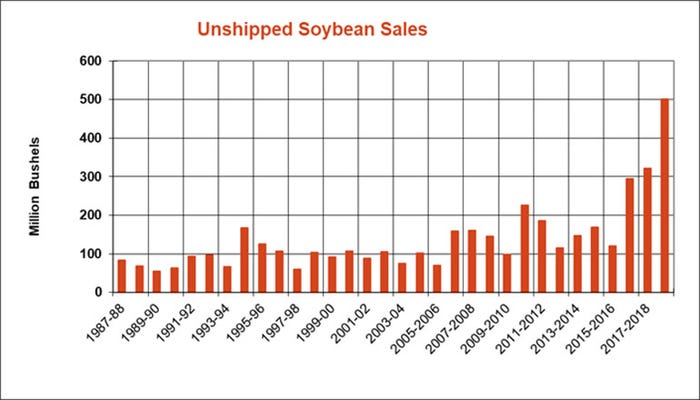

With the announcement of a 60-million-bushel soybean sale to China last week, analysts were already anticipating a big number to be revealed for total soybean exports in the latest USDA report, out Thursday morning. Still, questions surrounding the rest of the 2018/19 marketing year that wraps at the end of August still linger, according to Farm Futures senior grain market analyst Bryce Knorr.

“Total soybean commitments reached 1.603 million bushels this week, in sight of USDA’s current forecast of 1.875 billion for the 2018 marketing year,” he says. “It’s possible more buying from China could push sales to USDA’s goal, but some of the purchases usually are rolled to new crop. The big question is what would happen to all the soybeans coming out of South America, where prices are running neck-and-neck with those delivered out of the Gulf.”

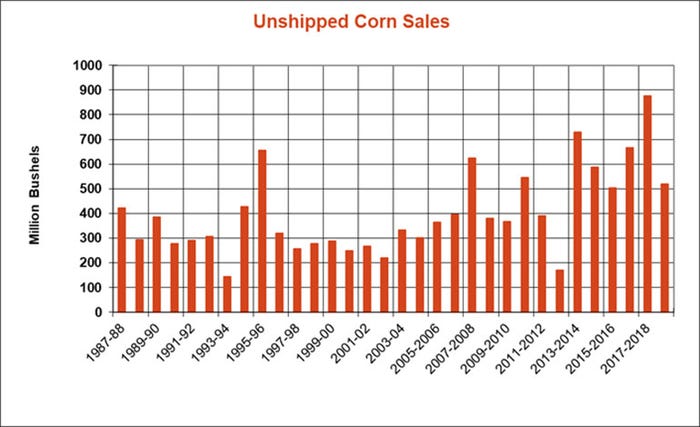

A record book of unshipped soybean sales should compete with corn for available shipping capacity, but it will take time for the river system to return to normal, keeping freight rates high and weighing on basis, Knorr adds.

“Corn sales tapered off recently, so there aren’t a lot of shipped sales ready to go compared to soybeans,” he says.

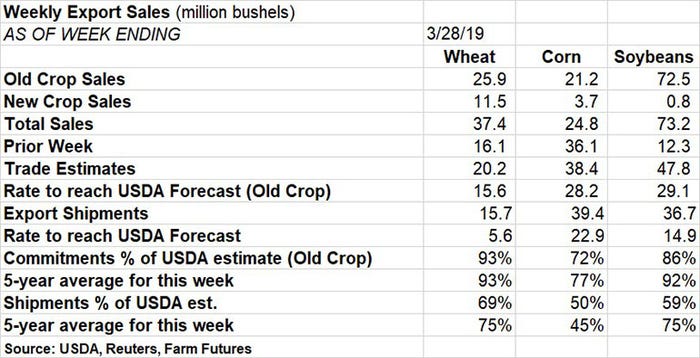

For the week ending March 28, soybean exports found 72.5 million bushels in old crop sales and another 800,000 bushels in new crop sales for a total of 73.2 million bushels. That far exceeded the prior week’s tally of 12.3 million bushels and bested the average trade guess of 47.8 million bushels. The weekly rate needed to match USDA forecasts is now at 29.1 million bushels.

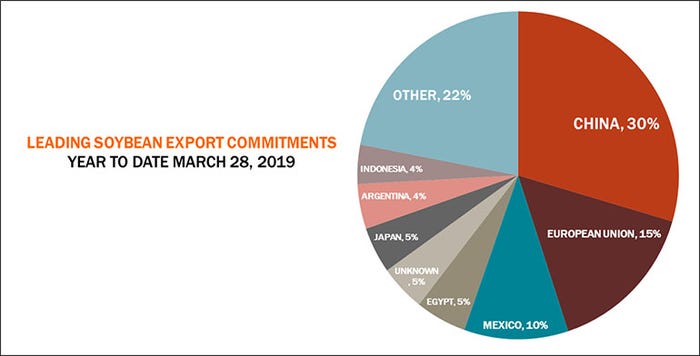

Soybean export shipments were for a more modest 36.7 million bushels but also stayed ahead of the weekly rate needed to match USDA forecasts, now at 14.9 million bushels. China remains the No. 1 destination for marketing year-to-date soybean export commitments, accounting for 30% of the total. Other top destinations include the European Union (15%), Mexico (10%), Egypt (5%), unknown destinations (5%) and Japan (5%).

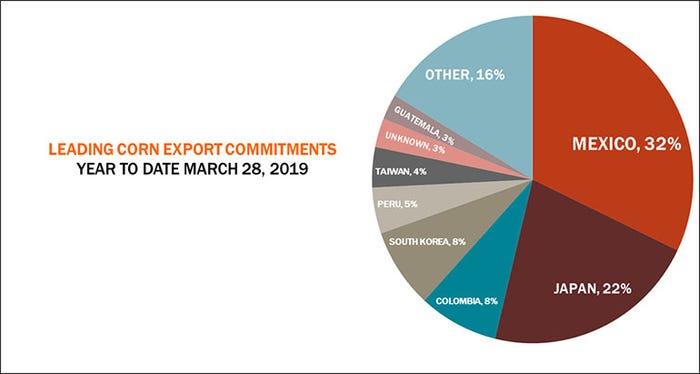

Corn exports saw 21.2 million bushels in old crop sales last week, plus another 3.7 million bushels in new crop sales, for a total of 24.8 million bushels. Totals slid below both the prior week’s tally of 36.1 million bushels and trade estimates of 36.1 million bushels. The weekly rate needed to match USDA forecasts is still a manageable 28.2 million bushels.

Corn export shipments reached 39.4 million bushels last week, staying ahead of the weekly rate needed to match USDA forecasts, now at 22.9 million bushels. As for total corn export commitments this marketing year, Mexico leads all destinations with 32% of the total. Other top destinations include Japan (22%), Colombia (8%), South Korea (8%) and Peru (8%).

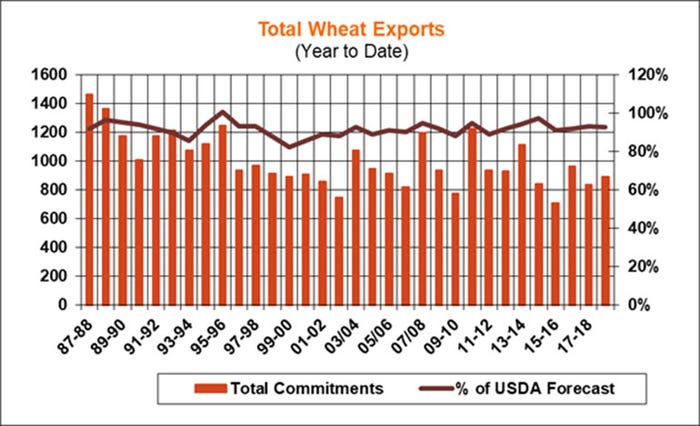

Wheat export sales posted healthy totals last week, notching 25.9 million bushels in old crop sales plus another 11.5 million bushels in new crop sales for a total of 37.4 million bushels. That more than doubled the prior week’s tally of 16.1 million bushels and surpassed trade estimates of 20.2 million bushels. The weekly rate needed to match USDA forecasts is now at 15.6 million bushels.

“Wheat sales were good this week, with buyers finally starting to book some new crop, too,” Knorr says. “Still, it could be hard for total exports of old crop to reach USDA’s forecast with just two months to go in the marketing year.”

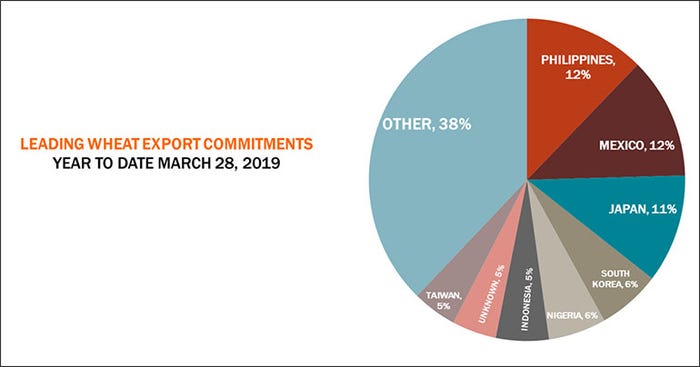

Wheat export shipments reached 15.7 million bushels last week, pushing the weekly total needed to keep pace with USDA forecasts down to 5.6 million bushels. For the 2018/19 marketing year, three countries are vying for the No. 1 destination, including the Philippines (12% of the total), Mexico (12%) and Japan (11%). Other top destinations include South Korea (6%) and Nigeria (6%).

Click on the download button below for more charts and information.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)