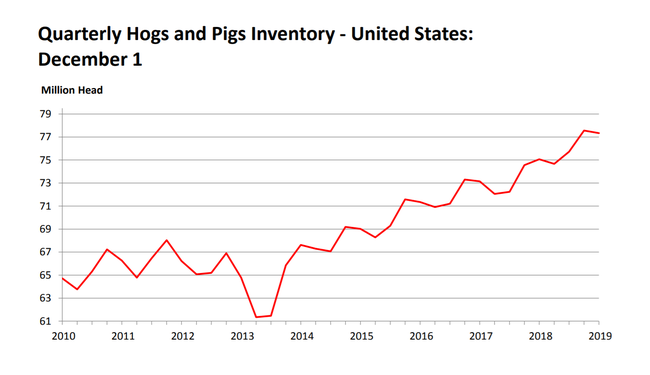

‘Hogs & Pigs’ report shows producers started expanding as soon as ASF news broke in August 2018.

Growing inventories and larger slaughter numbers reveal that hog producers are positioning themselves to capitalize on the global animal protein deficit resulting from the African swine fever (ASF) outbreak overseas.

The U.S. Department of Agriculture released its latest “Hogs & Pigs” report this week, which showed that the U.S. inventory of all hogs and pigs on Dec. 1, 2019, was 77.3 million head, a record for the quarter and up 3% from Dec. 1, 2018. The number was down slightly from Sept. 1 but was in line with the average pre-report estimate.

Breeding inventory, at 6.46 million head, was up 2% from last year and up slightly from the previous quarter. Analysts had expected a 1.6% increase.

During a post-report call hosted by the National Pork Board, Altin Kalo, senior analyst with Steiner Consulting Group, said the increase in the breeding herd “certainly will underpin supply growth for the second half of next year and will set us up for another record year in 2020.”

Market hog inventory, at 70.9 million head, was up 3% from last year but down slightly from last quarter. The number was in line with pre-report estimates.

The September-to-November 2019 pig crop, at 35.1 million head, was up 2% from 2018. Sows farrowing during this period totaled 3.17 million head, down 1% from 2018. Sows farrowed during this quarter represented 49% of the breeding herd. Average pigs saved per litter were at a record high of 11.09 pigs for the September-to-November period, compared to 10.76 last year.

According to the report, U.S. hog producers intend to have 3.13 million sows farrow during the December 2019 to February 2020 quarter, up 1% from actual farrowings during the same period one year earlier and up 5% from the same period two years earlier. Intended farrowings for March to May 2020, at 3.15 million sows, are up slightly from the same period one year earlier and up 3% from the same period two years earlier. The total number of hogs under contract owned by operations with more than 5,000 head but raised by contractees accounted for 48% of the total U.S. hog inventory, unchanged from the previous year.

China developments dominate

The latest data show that U.S. producers started expanding in August 2018 as soon as news of ASF broke, Bob Brown, president of Bob Brown Consulting, noted on the call.

"Just looking at the last 28 weeks of hog slaughter, starting in June of this year through last week, FI [federally inspected] hog slaughter totaled 70.7 million head. That was up about 3.7 million, or 5.5%, over the same period in the prior year, which says to me that USA pork producers started expanding in August of 2018 with the first time they heard news of ASF in China," Brown said. "It looks to me like that they started holding more gilts, and you can't increase hog slaughter by 5.5% over a six-month period unless you had started the previous summer in this particular respect."

The question is: What will U.S. expansion look like?

“This report just shows one view of it. Some of us think that maybe it’s even a little short,” Brown said, adding that USDA has revised the pig crops supplying recent hog slaughter higher since they were first estimated.

USDA raised the December 2018 to February 2019 pig crop from 3.8% to 5.3%. The March-to-May pig crop, which was slaughtered in September, October and November, now has been revised higher to more than 5.8%.

“The USDA continues, it appears to me, to be undercounting farrowings and the pig crop by a bit,” Brown said.

While record production would typically cause some angst for the industry, Brown said the industry is likely shipping record amounts overseas. Still, U.S. producers haven’t really been able to benefit from it yet, he added.

Combined, however, pork exports from the European Union, the U.S., Canada and Brazil to China “blew the doors off of every other month in history,” Brown said, and while some have suggested that the buying may be done, “I’m just thinking they may be getting started.”

In October — the last month for which actual data were available — pork exports exceeded 275,000 metric tons, a new record high and up 126% from the same month a year ago.

Still, China�’s deficit remains a mystery. “We still don’t know if the deficit is 30%, 50% or 75%,” Brown said.

Nonetheless, he pointed out that U.S. pork is a very good alternative right now in the global marketplace.

“Pork prices in the EU are record high right now; pork prices in Brazil are record high right now. Those prices have already rallied sharply where ours is hanging around the five-average. We’re really a great alternative if we can get China to turn our way,” Brown noted.

Price forecasts

Using the CME lean hog index as a basis, Kalo forecasts prices at $70/cwt. during the first quarter of 2020, $86/cwt. during the second quarter, $83/cwt. during the third quarter and 71/cwt. during the fourth quarter. Brown’s forecasts are higher, at $75/cwt. for the first quarter, $92/cwt. for the second and third quarters and $75/cwt. for the fourth quarter.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)