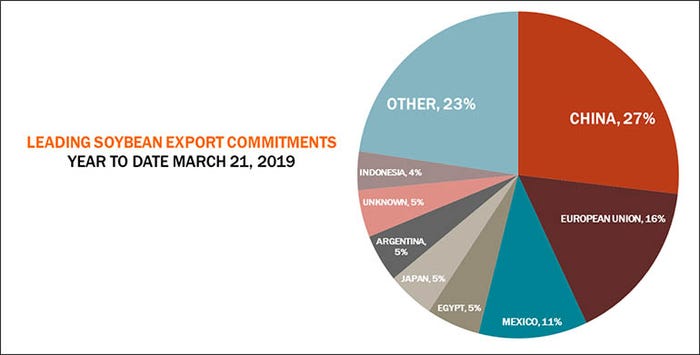

China waits for trade deal to buying.

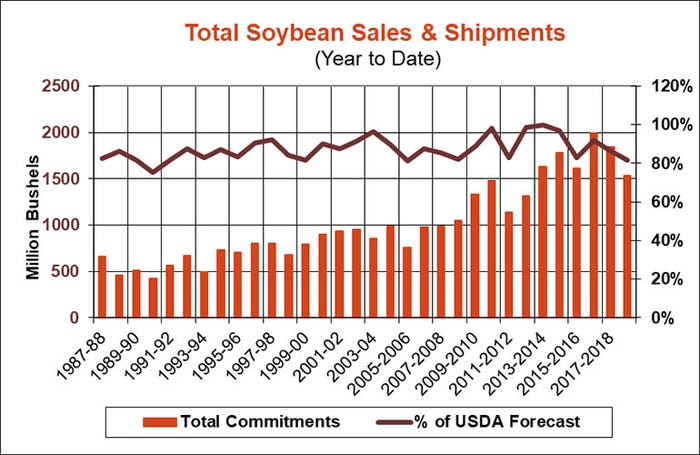

U.S. soybean growers are once again caught in the crossfire of the trade war with China, even as truce talks are underway again. Resumption of the negotiations in December brought an initial burst of buying with promises for more. But with officials from the two sides meeting in Beijing, with another round likely in Washington soon, China’s buying has mysteriously dried up.

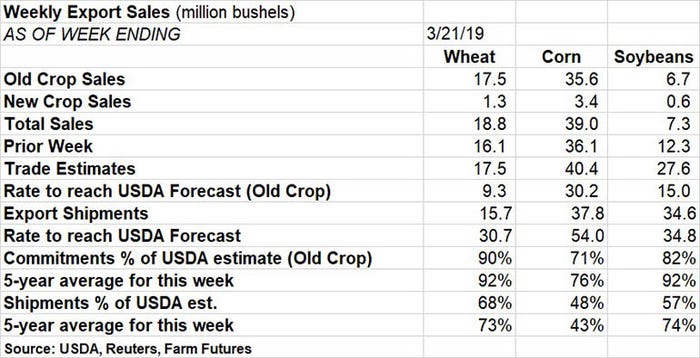

China made only a smattering of new purchases last week totaling 156,000 bushels, according to the weekly summary put out this morning by USDA. That wasn’t even enough to show up among the leading buyers on the agency’s “highlights” report. While other countries were more active, most of those deals were just switched by grain companies from deals earlier listed as sold to “unknown destinations.” As a result the total amount of new purchases came to just 6.7 million bushels, with another 600,000 bushels of new crop booked as well.

The total fell far short of trade expectations and the 15 million bushels of new bookings needed every week through August to reach USDA’s forecast for the 2018 crop.

Any deal with China is expected to include provisions for aggressive sales of soybeans and other ag products to China, including pork, sorghum, DDGSs, ethanol and corn. But tariffs could remain as a wedge the U.S. uses to enforce compliance of the agreement. China did indeed book 11.8 million bushels of corn that showed up in this week’s report, but made no new purchases of sorghum and cancelled some pork.

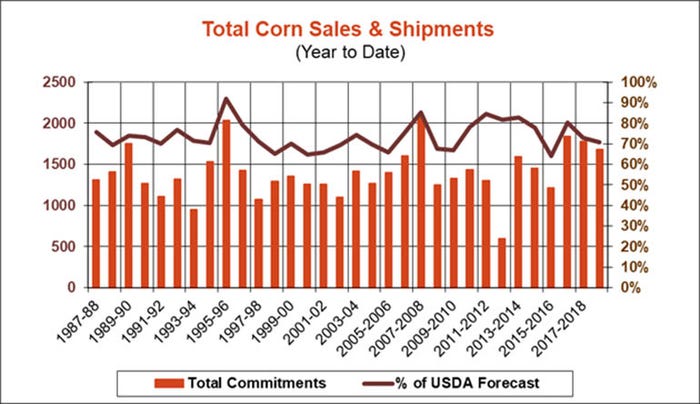

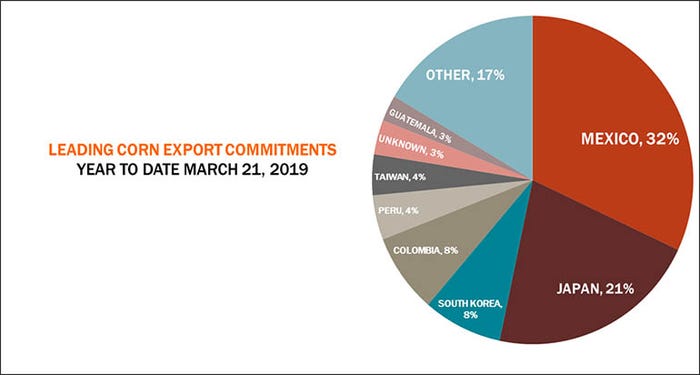

The corn purchases were part of 35.6 million bushels of net old crop sales put on the books last week with the overall total including new crop coming close to trade guesses. Perhaps more importantly, the old crop total beat the weekly rate forecast for the rest of the marketing year by USDA, amid fears the U.S. faces tough competition this summer from South American suppliers. Shipments also ran close to the rate needed to keep pace with USDA’s last estimate March 8.

Mexico remains the top buyer of U.S. corn this year, accounting for nearly one in three sales and shipments, with Japan in second place capturing a 21% share.

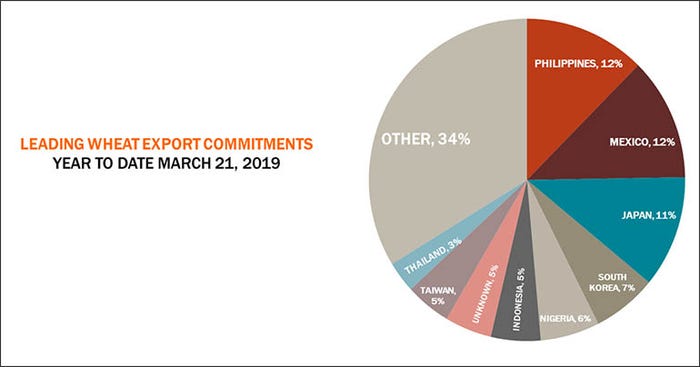

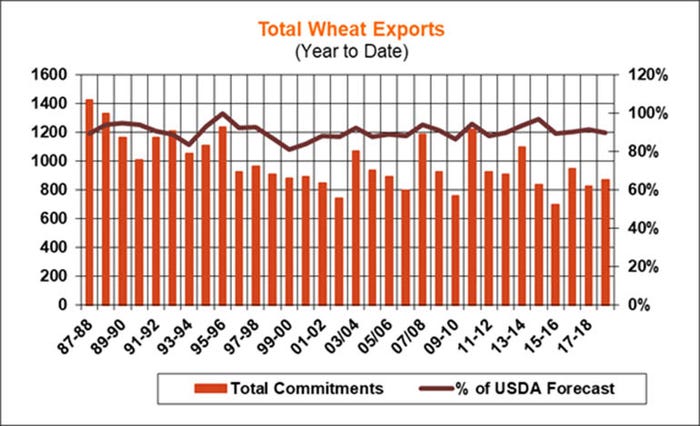

Wheat exports continue to pick up as the marketing year winds down, with buyers more than willing to step in at lower prices. Net old crop purchases came in at 17.5 million bushels, above the rate needed to reach USDA’s forecast for the marketing year ending May 31, though shipments are a little slower.

The government separately announced the sale of nearly 10 million bushels more under its daily reporting system for large purchases. In addition to confirming yesterday’s sale of 4.4 million bushels of SRW to Egypt, USDA said Iraq purchased 1.8 million bushels of old crop HRW and another 3.7 million bushels for delivery in the 2019 marketing year. The deals didn’t impress the market much on the morning open, however, with futures slipping to new session lows.

Click the download button below for more charts and information.

About the Author(s)

You May Also Like