Index reflects more optimism toward future U.S. meat exports than current situation.

To address a need for additional meat export-focused information, Kansas State University (KSU), in collaboration with the North American Meat Institute (NAMI), initiated a new project in January 2020 focused on the sentiment of U.S. meat exporters.

Results from the first "U.S. Meat Export Sentiment" survey, which was conducted Jan. 14-22, were released last week. According to the organizers, a total of 18 responses were received, and 10 provided enough information for a report.

The U.S. Meat Export Overall Sentiment Index score in January was 150. A value above 100 indicates that the industry overall holds a firmly positive sentiment regarding U.S. meat exports, according to KSU economist Glynn Tonsor.

“In future offerings, it will be feasible to compare against earlier measures to assess trends and relative strength of sentiment,” Tonsor said.

The Current U.S. Meat Export Sentiment Index score was 130, while the Future U.S. Meat Export Sentiment Index score was 170. Tonsor said the strength in the U.S. Meat Export Overall Sentiment Index reflects more optimism regarding the future U.S. meat export situation than the current situation.

Respondents predominantly self-identified as either a “processor” or “packer/processor” and indicated that either pork or beef was the meat product providing the largest total value source of their export business. Survey results showed a wide range of responses reflecting a varied relative importance of exports as a share of total company business, with 60% suggesting a range of 1-10%. Looking over the next 12 months, 40% expect only a small change in their company’s total value of exports, only 10% expect a decline and the remaining 50% anticipate growth.

Respondents were asked which country they anticipate will most increase U.S. imports of the meat product they indicated was predominant in their export business. China and Japan were the predominant responses provided, at 50% and 20%, respectively.

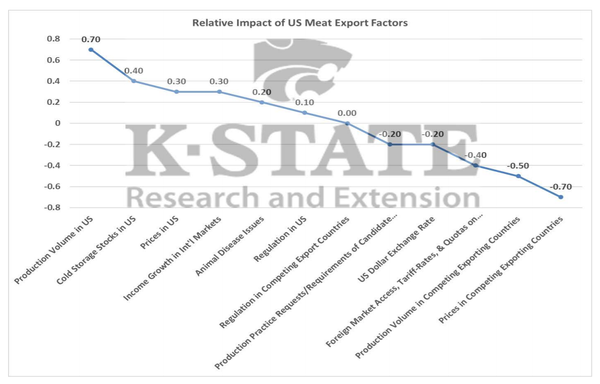

Respondents were given a list of 12 factors and asked to identify the four most supporting and the four most restricting U.S. exports currently. Results showed that U.S. production volumes, U.S. cold storage stocks, U.S. prices and income growth in international markets were the most supportive factors. Conversely, prices and production volumes in competing exporting countries, foreign market access and terms and U.S. dollar exchange rates were the most restricting factors.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)