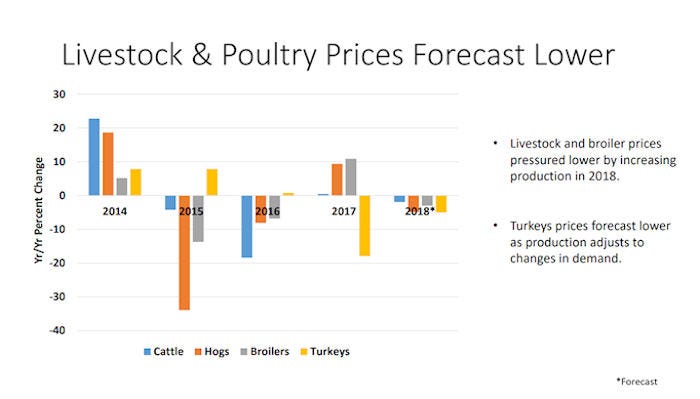

USDA says prices projected to be slightly lower as increased production is not fully offset by projected increase in exports.

Strong domestic demand for broiler meat supported higher prices in 2017 and is expected to carry into 2018, although with lower price expectations as production growth pressures prices, according to the latest outlook released by the Economic Research Service during the U.S. Department of Agriculture’s Agricultural Outlook Forum.

USDA projects that total meat and poultry production will hit nearly 104 billion lb. in 2018 as production of beef, pork and broilers all increase.

Broiler production is forecasted to increase 2.3% to 42.6 billion lb. in 2018. Based on recent hatchery data, the U.S. layer flock increased in 2017, while eggs per layer remained below year-earlier levels. Seanicaa Herron, agricultural economist at the World Agricultural Outlook Board, reported that more layers have been required to offset the reduction in the rates of eggs per layer and chick placements for incubation.

In addition to an increasing layer flock, steady growth in bird weights through the second half of 2017 and into early 2018 is helping to support higher broiler meat production forecasts this year. After declining in 2016 as the industry was affected by “woody breast,” the proportion of heavier-weight birds produced increased in 2017, supporting higher average bird weights. Bird weights are expected to trend higher in 2018, Herron noted.

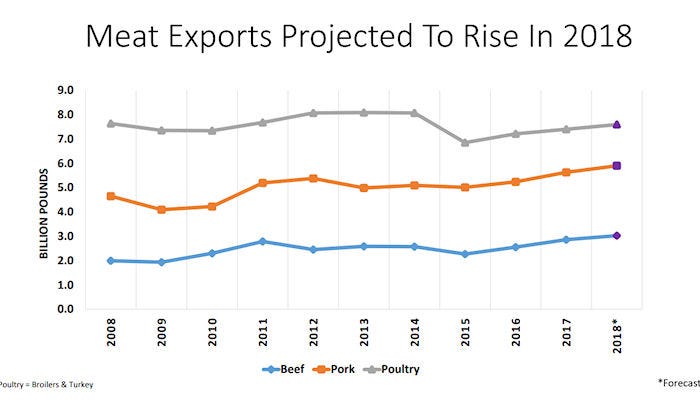

USDA chief economist Robert Johansson said foreign markets have become increasingly important and projected poultry exports to be up 14% for the year.

Specifically, broiler meat exports are projected to increase 2.5% to nearly 7 billion lb. in 2018. In 2017, exports increased 2% thanks to continued progress toward recovery from disruptions due to the 2015 outbreak of highly pathogenic avian influenza.

On Feb. 27, China announced, in compliance with a World Trade Organization ruling, that it will be dropping anti-dumping and anti-subsidy duties on U.S. broilers. However, China continues to keep its borders closed following due to avian influenza concerns.

South Korea did reopen its borders in late 2017, though, and USDA projects expected export gains to build. “Also, larger exportable supplies and improved shipments to developing markets in sub-Saharan Africa, the Caribbean and Central America will support further expansion in broiler meat exports,” Herron stated.

The 12-city broiler price is forecasted to average 88-94 cents/lb. in 2018, compared with an average of 93.5 cents/lb. in 2017.

Egg outlook

USDA projects total U.S. egg production for 2018 to be 8.9 billion doz., up 2.1% from 2017. Hatching egg production declined nearly 0.6% last year but is expected to increase 1.5% in 2018 as both broiler and egg flocks are expected to be larger. Table egg production rose 2.7% in 2017 and is expected to increase another 2.2% in 2018.

“Favorable margins, due to high prices in 2017 and into 2018, will support producer intentions to expand egg production in 2018,” Herron said.

As of Jan. 1, there were 17.4% more layer-type eggs in incubators than the previous year, setting the stage for continued expansion in 2018.

Egg exports for 2018 are forecasted to reach 320 million doz., down fractionally from 2017 based on slower grow in several key destinations, USDA explained.

For 2017, New York wholesale egg price were estimated at 100.9 cents/doz., with prices surging in the third and fourth quarters of the year. For 2018, the New York egg price forecast is expected to increase 16%, averaging 114-121 cents/doz.

Turkey market correction

USDA forecasts lower turkey prices as production adjusts to changes in demand. Turkey production in 2018 is projected to reach nearly 6 billion lb., down fractionally from 2017. Producer margins began to decline in late 2016 and continued to do so through 2017 as production outpaced domestic demand for turkey products. Margins deteriorated as the higher wholesale prices in 2016 plummeted in 2017.

Recent hatchery data indicate lower production levels in the months ahead as placements and eggs hatched have declined significantly, along with eggs placed in incubators. “Turkey production is forecasted to decline below year-ago levels in the first and second quarters of 2018; however, production growth should begin to slowly recover in the last half of the year as supplies and demand move into balance and prices improve seasonally,” Herron said.

Exports appear to be the “silver lining” for the turkey sector in 2018, Herron added. In 2017, exports were estimated to be 9% higher year over year, and for 2018, turkey exports are projected to rise 3.9% to nearly 645 million lb. Exports to Mexico, the largest market for U.S. turkey, are expected to remain firm.

The national whole-hen frozen turkey price remains below both the 2017 level and the five-year average. “Domestic demand for turkey appears weaker relative to previous years,” Herron noted. “In the face of strong competition from competing meats, turkey prices will remain under pressure.”

The turkey price forecast for 2018 averages 88-94 cents/lb. for the year, 5% below prices in 2017.

About the Author(s)

You May Also Like