Exports remain critical to absorbing growing pork supplies.

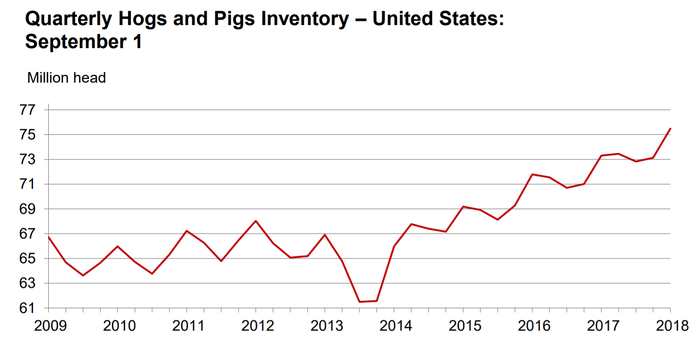

The U.S. Department of Agriculture released the “Quarterly Hogs & Pigs” report Thursday, revealing an inventory of all hogs and pigs on Sept. 1, 2018, of 75.5 million head, a 3% increase from the same period in 2017 and a 3% increase from the June 2018 report. This was in line with trade expectations.

The breeding inventory, at 6.33 million head, was 3% higher than last year and slightly higher than the previous quarter. The market hog inventory, at 69.2 million head, was up 3% from last year and up 4% from last quarter. These were both in line with pre-report trade estimates.

The June-to-August 2018 pig crop, at 34.2 million head, was up 3% from 2017. Sows farrowing during this period totaled 3.19 million head, up 3% from 2017. The sows farrowed during this quarter represented 50% of the breeding herd. The average pigs saved per litter was record high at 10.72 for the June-through-August period, compared to 10.65 last year.

The report said U.S. hog producers intend to have 3.16 million sows farrow during the September-to-November 2018 quarter, a 2% increase from actual farrowings during the same period in 2017 and a 4% increase from 2016. Intended farrowings for December through February 2019, at 3.12 million sows, are up 2% from 2018 and up 4% from 2017.

The total number of hogs under contract owned by operations with more than 5,000 head but raised by contractees accounted for 48% of the total hog inventory, up from 47% the previous year.

USDA made several downward revisions to previous report numbers, starting with a 0.4% revision to the June 2018 all hogs and pigs inventory. The net revision made to the March 2018 all hogs and pigs inventory was 0.1%. A revision of less than 0.1% was made to the December 2017 to February 2018 pig crop. The net revision made to the December 2017 all hogs and pigs inventory was 0.3%. A net revision of 0.2% was made to the September-to-November 2017 pig crop. The net revision made to September 2017 all hogs and pigs inventory was 0.3%. A net revision of less than 0.1% was made to the June-to-August 2017 pig crop.

Demand critical to moving growing supplies

During a pork checkoff conference call, analysts were all in agreement that export demand as well as domestic demand will remain critical to clearing the U.S. hog industry’s growing production.

Len Steiner, president of Steiner Consulting Group, said the USDA “Hogs & Pigs” report used to be a price-driving factor in the hog markets, but it is much less so now due to about 22.3% of all of the pork the U.S. produces going to exports this year. Next year, the U.S. is expected to export about 22.8% of total production.

“If we don’t export this, we’ll tank the market. If exports pick up, then prices can move higher,” he said.

Scott Brown, associate extension professor at the University of Missouri, emphasized that domestic demand will also be an important piece of the puzzle, especially if the U.S. economy were to “turn south.”

Steiner said he doesn’t expect per capita consumption to rise at all next year, provided that exports are strong. He believes exports will pick up next year, but much of this picture will depend on what happens in the trade wars as well as the African swine fever disease situation that's spreading from China.

“If they kill a lot of hogs in China and China decides to come to the U.S. for pork, there is a bull argument there,” he said. “If it remains the same, then that’s a little bit bearish. We’re inclined [to believe] that we’ll see more exports next year.”

If exports decrease to 18%, it would be a debacle, Steiner added.

David Miller, director of research and commodity services for the Iowa Farm Bureau, pointed out that the U.S. has been finding alternative markets to move pork product.

In terms of profitability levels, the analysts expect lower costs of production to continue, although they don’t expect them to be dramatically lower. This is due to relatively lower corn prices — which are about equal to year-ago levels — and soybean meal prices that are lower than they were last year.

Miller expects meal prices to stay lower for the next six to nine months, but this will depend upon how trade negotiations play out with China.

While there has been a lot of red ink for hog producers lately, Brown said the picture has improved.

In terms of price projections, Steiner, using the Iowa-southern Minnesota hog price, pegged the 2018 fourth-quarter price at $56.00/cwt., the first quarter of 2019 at $66.00/cwt., the second quarter of 2019 at $73.00/cwt. and the 2019 third quarter at $72.00/cwt.

Miller, using a 49-51% carcass price, projects the 2018 fourth quarter at $53-55/cwt., the 2019 first quarter at $54-57/cwt., the 2019 second quarter at $60-64/cwt, the 2019 third quarter at $60-66/cwt. and the 2019 fourth quarter at $54-60/cwt.

Brown, using the national weighted average carcass price, projects the 2018 fourth quarter at $50.00/cwt., the 2019 first quarter at $58.00/cwt., the 2019 second quarter at $61.00/cwt. and the 2019 third quarter at $58.00/cwt.

Market recap

December live cattle futures started the week lower but posted gains Tuesday and Wednesday before falling Thursday. Contracts closed Monday at $117.00/cwt. and Thursday at $118.575/cwt.

October feeder cattle futures followed the same trend. Contracts closed lower Monday at $156.30/cwt. but fell through Thursday’s lower close of $157.85/cwt.

The Choice and Select cutout closed lower Thursday at $204.71/cwt. and $192.56/cwt., respectively.

December lean hog futures were mostly lower this week. Contracts closed lower Monday at $56.975/cwt. and Thursday at $55.475/cwt.

In the pork cutout this week, the wholesale pork cutout closed lower at $80.51/cwt. Loins and hams were lower at $84.11/cwt. and $61.07/cwt., respectively. Bellies were higher, closing at $118.50/cwt.

Hogs delivered to the western Corn Belt were higher, closing Thursday at $62.17/cwt.

USDA reported the Eastern Region whole broiler/fryer weighted average price on Sept. 21 at 85.97 cents/lb.

According to USDA, egg prices were steady, with a steady to firm undertone. Supplies were mixed but usually light to moderate. Demand was mostly moderate to fair. USDA said transportation is problematic in parts of the Southeast area where flooding lingers due to the recent hurricane.

Large eggs delivered to the Northeast were slightly higher at 99 cents to $1.03/doz. Prices in the Southeast and Midwest were also slightly higher at $1.03-1.06/doz. and 90-93 cents/doz., respectively. Large eggs delivered to California were higher at $1.40/doz.

For turkeys, USDA said the market was steady to firm. Offerings have been short of needs to moderate in some instances. Frozen demand has been light to moderate, while fresh demand has been mostly moderate for November shipments. Prices for hens were higher at 78-89 cents/lb., and prices for toms were higher on the lower end of the range at 74-85 cents/lb.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)