Food sector retail sales maintain steady growth.

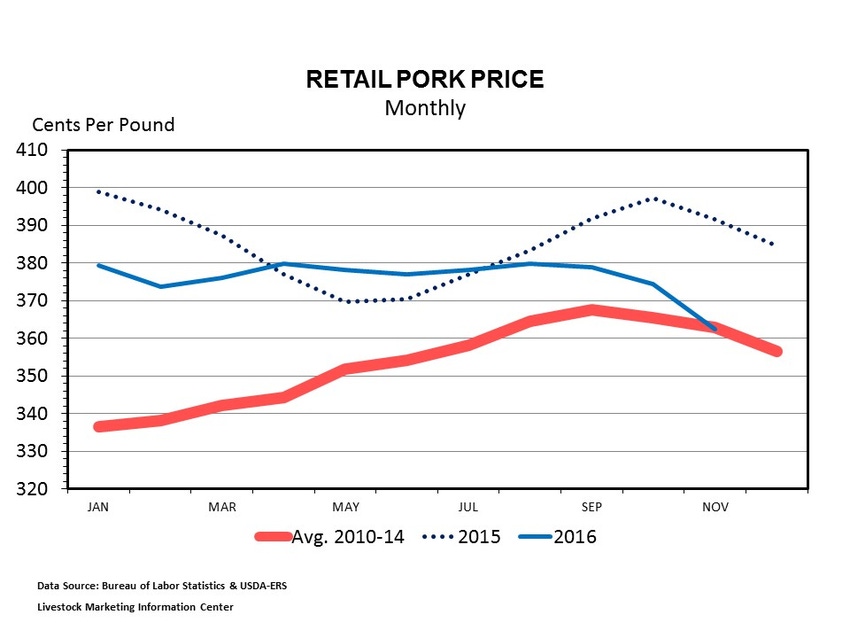

According to the U.S. Department of Agriculture's Economic Research Service (ERS), retail pork prices in November registered the biggest month-to-month decline of the year, dropping 12 cents from October to $3.63/lb. This was the biggest month-to-month drop since December 2010. The November retail pork price was 7.5% below the same time last year.

According to the Livestock Marketing Information Center (LMIC), the pork cutout value in November was also 1% lower than a year earlier.

“Normally, grocery store pork prices decline from November to December, but the steady price performance at the wholesale level (which the cutout value is derived from) may limit additional declines in retail pork prices during December,” LMIC noted.

ERS also calculates a monthly fresh beef price in grocery stores (i.e., the retail price), and November's price was significantly lower than the prior month. The price declined 10 cents/lb. from October to November after an 11-cent monthly decline from September to October. Compared to a year ago, LMIC said November's fresh beef price fell 7.5%.

In contrast, the average retail price for Choice beef — which excludes ground product — moved up from October to November, the first increase since June, according to the ERS calculations.

At the wholesale level during November, the Choice cutout value increased 2% from October, the first month-to-month increase since June. This was still 12% below year-ago levels, according to LMIC.

The grocery store chicken price for November was unchanged from October. LMIC said reported ERS retail chicken prices this year have been very stable, ranging from a low of $1.87/lb. in February to a high of $1.93 in January. Prices have been about 3% less than in 2015.

Food sector retail sales maintain steady growth

Retail sales in the food sector during November were 4.1% higher than last year, according to LMIC, which added, “The gain in retail sales was notably more upbeat than for most of the months earlier this year.”

Within this, foodservice and drinking place sales were up 5.0% — a rebound from the 3.3% year-over-year gain in October, which was the smallest increase for 2016.

Grocery store sales were up 3.3% in November compared to last year. Grocery store sales were up 1.7% during the summer quarter after posting a 1.9% gain in the spring quarter. The November year-over-year grocery store increase was the biggest since June. For the U.S. economy as a whole, LMIC said total retail sales during November rose 5.3% year over year, the second-biggest gain for 2016.

LMIC suggested, “Overall retail sales trends may be following along in the wake of disposable personal income (DPI) advances in recent months (or maybe it was just a relief to be past the November election).”

October DPI was up 4.1% from a year earlier, the first year-over-year increase to exceed 4.0% since January. August and September registered DPI gains of 3.6% and 3.8%, respectively, with the year-over-year August increase being the smallest for 2016.

October wages and salaries, which account for slightly less than 60% of DPI, were up 4.3% from a year ago but down from a 4.6% gain in the prior month. Interest income, which has been static due to low interest rates in recent years, posted an impressive gain, as did Social Security income, which was driven by a cost-of-living adjustment, LMIC noted.

Add to Anti-Banner

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)