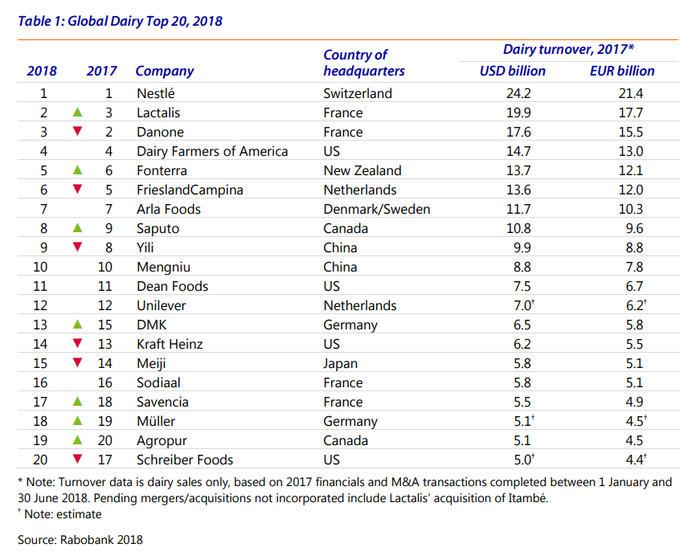

World's largest food and beverage company Nestlé continues to hold top spot.

August 6, 2018

Dairy price recovery in 2017 positively affected the combined turnover of the top 20 companies, which, in 2017, was up 7.2% on the year in U.S. dollar terms and 5.1% in euro terms, according to Rabobank’s latest “Global Dairy Top 20 – A Shuffling of the Deck Chairs” report.

“For the second consecutive year, there were no new entrants to the Dairy Top 20 list, with the $5 billion threshold difficult to achieve due to a scarcity of large acquisitions or mergers,” said Peter Paul Coppes, senior analyst of Dairy at Rabobank. “However, while the names have remained the same, the order shifted in 2017.”

The world's largest food & beverage company, Switzerland's Nestlé, reigns supreme on the list, but the gap between number one and number two has narrowed. French Lactalis swapped places with compatriot Danone and moved into second place, boosted by its acquisitions of U.S. yogurt businesses Stonyfield and Siggi’s. Danone slipped to the third spot, after divesting Stonyfield following the acquisition of WhiteWave, reducing its stake in Yakult, and selling its holdings in the Al Safi Danone joint venture in Saudi Arabia.

The report noted that merger-and-acquisition (M&A) activity in the dairy sector grew in 2017, fueled – as in other sectors – by the availability of cheap capital. However, unlike other food & agribusiness sectors, the megadeals which did occur – Danone/WhiteWave and Saputo/Murray Goulburn – had limited impact on rankings within the Global Dairy Top 20.

There were 127 deals in the dairy complex during 2017, compared to 81 in 2016. In 2018, there has already been 62 deals, Rabobank said, adding that nearly half of those have been in Europe. Rabobank expects that over the next few decades, the dairy market will grow by at least 30% in volume and value, the result of population growth, urbanization and income growth.

Cooperatives still dominate but are also challenged by the economic environment, Rabobank also relayed. In fact, the fourth through seventh top spots are held by large cooperatives, accounting for 54 billion in turnover in 2017, more than double the turnover of Nestlé.

Despite their presence, Rabobank said dairy farmers struggle with creating “farmholder” vs. “shareholder” value, which requires them to determine whether to invest in their own operations or in a cooperative.

Rabobank said Chinese companies need to address the integration of non-Chinese management as they consider growth opportunities around the globe. Increased collaboration between Chinese and non-Chinese companies in China has the potential to create a pipeline of global management talent, the report noted.

The report also noted that historically, the dairy industry has been very local, with milk production, processing, and consumption all occurring locally. This was particularly true in markets dominated by fluid milk consumption, the report said. However, economies of scale in milk production and the conversion of milk into longer shelf-life products like butter, cheese, and dry dairy ingredients has required many dairy companies to now be more globally-oriented.

Overall, Rabobank sees an increased amount of ‘disruption’-based M&A deals, either defensive or opportunistic. These disruptions could include things like increasing investment in plant-based alternatives or using biotechnology as a tool to help the bottom line.

“By nature these deals are often small and involve start-ups, but they are growing in volume.”

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)