Price trends deliver competitive boost and optimism for 2017.

March 22, 2017

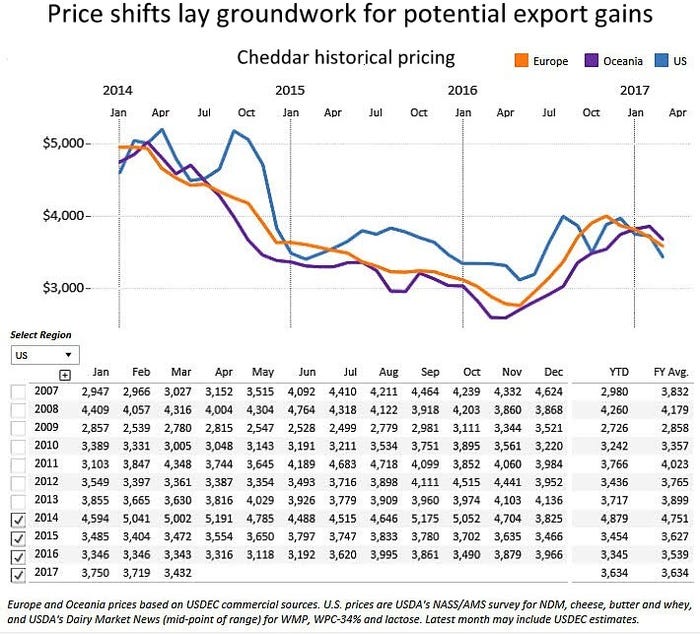

Cheese price trends have been working in favor of U.S. suppliers for nearly two quarters, and markets suggest more of the same in the months ahead, according to the U.S. Dairy Export Council (USDEC). While recent price shifts support U.S. competitiveness, USDEC said time will tell whether that edge helps deliver export gains.

“From a price standpoint, the previous two-plus years have been difficult on U.S. cheese suppliers. From August 2014 through September 2016, except for a handful of months, U.S. cheddar ran at a significant premium to (European Union) and Oceania cheese,” USDEC noted.

On average, over that period, a survey by the U.S. Department of Agriculture’s Agricultural Marketing Service showed that the U.S. cheddar price was $366 per ton higher than indicative EU cheddar prices and $575 per ton more than indicative Oceania cheddar prices. It dipped below EU prices for a three-month span in 2015 but never dropped under the Oceania price.

Since October 2016, USDEC said pricing has been more inconsistent but, on the whole, is moving in the U.S.'s favor. From October through early March 2017, EU cheddar averaged $106 per ton more than U.S. cheese. Since the start of 2017, Oceania cheddar has grown more expensive than U.S. cheese by the month, with the gap rising from $69 per ton in January to $243 per ton through mid-March.

“It’s too early to speculate whether the price shifts will help deliver sustainable growth for U.S. cheese exports, and many additional factors influence cheese sales, but these are positive signs,” USDEC said.

Since prices began to tighten late last summer, U.S. cheese appears to have found more solid global footing, according to USDEC. For the last quarter of 2016, U.S. cheese exports rose 14% compared to the previous year. In January, despite double-digit year-over-year declines to Mexico and Japan (the numbers one and three U.S. cheese markets, respectively), overall U.S. cheese volume rose 3%. Broad demand for U.S. product in South Korea, Canada, Central America, Oceania, Southeast Asia and elsewhere — indicative of steadily rising global cheese consumption — helped deliver the gain, USDEC explained.

In its latest “World Agricultural Supply & Demand Estimates” report, USDA reduced its U.S. cheese price forecast for 2017, citing high U.S. stocks. While that does not guarantee that the U.S. will maintain a pricing advantage, USDEC said it does suggest that U.S. suppliers are likely to remain more price competitive in the months ahead than they have been over the past couple of years.

“Should the United States hold the price edge, recent history provides some cause for export optimism: The last two times U.S. cheese prices ran less than EU and Oceania prices for the calendar year were 2010 and 2013. Those two years also marked the two largest annual single-year volume gains for U.S. cheese exports,” USDEC noted.

You May Also Like