Net farm income expected to be 3% lower, with all animal and crop receipts projected to be lower.

February 11, 2016

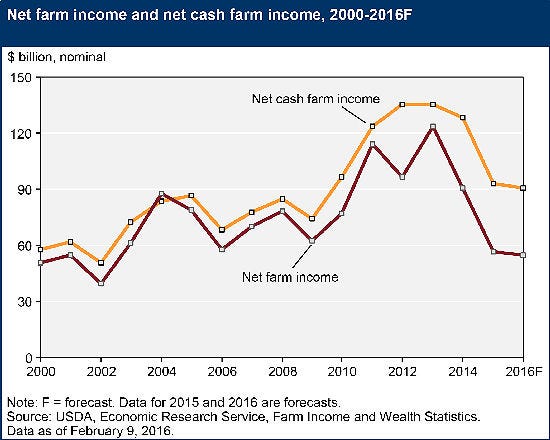

Farm sector profitability is projected to decline for the third straight year, according to the latest farm income forecast released by the U.S. Department of Agriculture’s Economic Research Service (ERS).

Net cash farm income is forecasted at $90.9 billion, down about 2.5% from the 2015 estimated levels, while net farm income is forecasted to be $54.8 billion in 2016, down 3%. If realized, 2016 net farm income would be the lowest since 2002 (in both real and nominal terms) and would represent a drop of 56% from its recent high of $123.3 billion in 2013. These declines are moderate compared to the 27% and 38% reductions in net cash income and net farm income, respectively, that occurred in 2015, ERS said.

Cash receipts are forecasted to fall $9.6 billion (2.5%) in 2016, led by a $7.9 billion (4.3%) drop in animal/animal product receipts and a $1.6 billion (0.9%) decline in crop receipts. Nearly all major animal specialties — including dairy, meat animals and poultry/eggs — are expected to have lower receipts, as are vegetables/melons and feed crops.

Animal/animal product cash receipts increased by 43.8% in real terms from 2005 to 2014 but are estimated to have declined by 12.5% in 2015 and are expected to fall an additional 4.3% in 2016 (to $181.4 billion) in nominal terms.

After reaching a record high of $49.3 billion in 2014 and falling 28.2% in 2015, milk receipts are expected to drop another 6.4% in 2016 as declining prices continue to outweigh an expected increase in milk production. Cash receipts from cattle production are also expected to decline for a second consecutive year in 2016, falling 3.9% as cattle/calf prices are expected to decline further. Hog production is expected to continue rising in 2016 as the industry recovers from porcine epidemic diarrhea virus (PEDV) in 2014. However, hog prices are expected to drop again in 2016 following a sharp decline in 2015, leading to a 5.1-percent drop in 2016 hog cash receipts.

Poultry and egg cash receipts are expected to fall 4.1% in 2016 due primarily to a decline in egg receipts. Poultry and egg receipts were broadly affected by highly pathogenic avian influenza (HPAI) in 2015, although the impacts on individual commodities have been mixed. Since being detected in December 2014, HPAI has claimed 49.7 million birds, with turkeys and egg-laying chickens suffering the largest loss in numbers. Turkey and chicken egg quantities are both expected to have declined in 2015, placing upward pressure on prices and leading to higher cash receipts for both commodities.

Following the sharp rise in 2015, egg prices are expected to decline in 2016, outweighing an expected rebound in production and leading cash receipts to fall by $2.0 billion. In contrast, higher turkey production is expected to lead turkey cash receipts 5.3% ($300 million) higher, despite a small projected drop in turkey prices. U.S. broiler production is expected to increase in both 2015 and 2016. The increase in broiler production — coupled with HPAI-related import bans on U.S. poultry by some nations — increased the U.S. supply and led broiler prices sharply lower in 2015. Broiler prices are expected to continue declining in 2016 as production increases, leading to a modest decline in broiler cash receipts.

Since hitting a record high in 2012, corn receipts are forecasted to fall 36% through 2016, primarily due to lower prices. While production is expected to increase slightly in 2016, continued weakening in corn prices is expected to more than offset production gains, leading to a decline of $800 million in corn cash receipts in 2016. In contrast, increases in soybean production are expected to outweigh small price declines, leading to an increase of 1.5% in soybean cash receipts in 2016.

While overall cash receipts are declining, receipts for several commodities are expected to increase by at least 1% relative to 2015 forecast levels. Direct government farm program payments are projected to rise $3.3 billion (31.4%) to $13.9 billion in 2016 in response to the expected price environment.

Expenses lower

Multiyear reductions in farm production expenses are infrequent; it happened last over 1984-86. The $3.8 billion (1%) decline projected for 2016 follows an estimated $10.1 billion decline in 2015. Before then, production expenses increased, on average, 9% annually (in nominal terms) from 2010 to 2014. The decline projected in expenses for 2016 is driven primarily by lower spending on feed, fuel and fertilizer, which will outweigh expected increases in spending on hired labor, interest and property taxes/fees.

Farm asset values are forecast to decline by 1.6% in 2016, and farm debt is forecasted to increase by 2.3%. Farm sector equity, the net measure of assets and debt, is forecasted to decrease $55 billion (2.2%) in 2016. The decline in assets reflects a drop in the value of farm real estate, as well as declines in crop inventories and financial assets. The increase in farm debt is driven by increases in both real estate debt (up 1.1%) and non-real estate debt (up 3.8%).

Interest payments for non-real estate debt are also expected to increase by 10.6% based on continued demand for operating and other types of non-real estate loans. This follows an estimated 20% increase in non-real estate interest expense in 2015.

Household income

The median income of farm households increased steadily over 2010-14, peaking at an estimated $80,620 in 2014. After a slight dip in 2015, median household income is forecasted to rebound in 2016 to an expected $81,666. Median farm income earned by farm households is forecasted to decline $1,473 in 2016.

Most farm households earn all of their income from off-farm sources. Median off-farm income is projected to increase 4.1% to $75,354 in 2016. (Because farm and off-farm income are not distributed identically for every farm, median total income will generally not equal the sum of median off-farm and median farm income.)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)