Profit margins weakened significantly during third quarter.

The outlook for the farm economy has continued to worsen through 2016, despite some occasional rebounds in income and profit margins, according to Nathan Kauffman, an economist who also serves as assistant vice president and Omaha, Neb., branch executive with the Federal Reserve Bank of Kansas City.

“Following a brief rebound in crop prices in the second quarter, profit margins for crop producers deteriorated in August and September. Profit margins also remained poor in the cattle and dairy sectors,” he said in a new report.

According to the report, agricultural credit conditions have weakened further as loan repayment problems have picked up steadily, and bankers have expressed increasing concerns about the softening farm economy spilling over to Main Street business activity in rural areas.

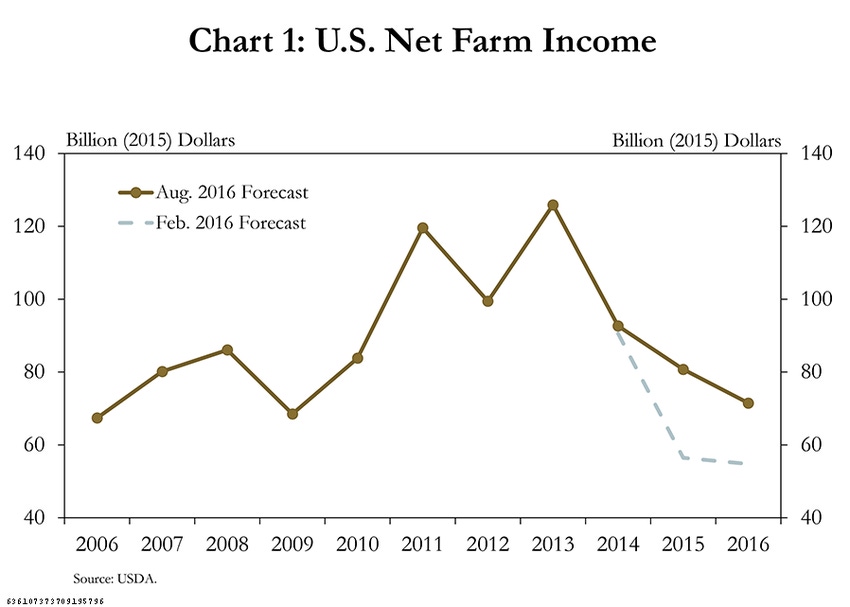

In August, the U.S. Department of Agriculture’s expectations for 2016 farm income were revised up modestly from the February forecast, but income was still expected to decline notably from a year ago.

Kauffman said USDA's August revision can be interpreted as both positive and negative for the farm sector. On the positive side, farm income expectations for 2015 and 2016 were revised upward by 43% and 31%, respectively (Chart 1). On the negative side, however, the expected decline in farm income from 2015 to 2016 widened from 3% earlier in the year to 11% in the most recent report.

“The improvement in farm income expectations was largely due to downward revisions in production costs for the farm sector as revenue expectations continued to weaken,” he explained.

In addition, while U.S. farm income expectations were revised upward in August, Kauffman noted that profit margins for many producers of major U.S. agricultural commodities weakened significantly in the third quarter.

As such, the downturn in the agricultural economy has continued to affect credit conditions in the sector. From 2010 to 2014, borrowers had few problems repaying loans. Since 2014, however, bankers in the 10th Federal Reserve District have consistently reported an increase in the severity of loan repayment problems.

As of the second quarter of this year, 10th District bankers indicated that more than 7% of their agricultural loans were experiencing either “major” or “severe” repayment problems, an increase from just 4% in 2015.

Bankers in the Kansas City Fed District also continued to point to spillover effects from the softening farm economy to Main Street business activity, Kauffman noted.

“As 2016 winds down, there will be increasing focus on the outlook for 2017 and likely more questions about the ability of some producers to continue to operate after experiencing losses for multiple consecutive years,” he said.

Many producers have relied more heavily on short-term financing and restructured debt to get through 2016, but if the outlook for cash flow remains poor during the next loan renewal season, Kauffman said some producers may need to consider more aggressive alternatives to shore up depleted working capital.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)