Reports details global veterinary services market growth.

April 27, 2018

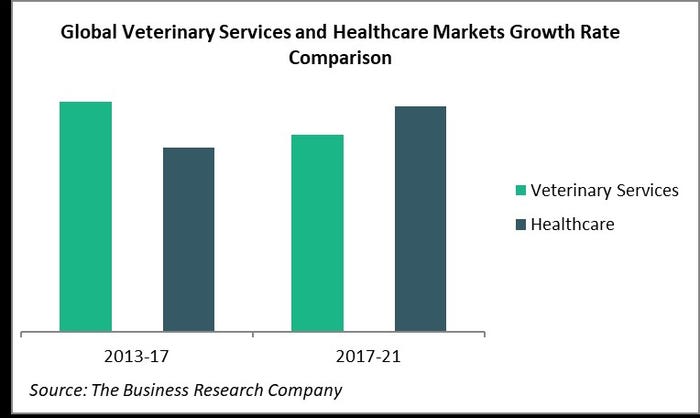

The global veterinary services market is growing at 6.2% annually, slightly slower than the overall health care market, which, at a global level, is growing at 7.1% a year, according to a report by Business Research Co. titled “Veterinary Services Global Market 2018.”

The veterinary services market includes health care for pets, farm animals and animals kept in zoos and wildlife parks required in cases of disease or injury and for health maintenance and management. The industry comprises licensed veterinary practitioners who practice veterinary medicine, dentistry or surgery for animals.

The health care market covers pharmaceutical drugs, biologics and medical equipment for both humans and animals (Figure 1).

Figure 1. Global veterinary services and healthcare markets growth rate comparison

Growth in the pet population, increasing penetration of pet insurance, pet humanization within the growing global urban populations and increased awareness of animal welfare needs due to social media are helping the veterinary services market maintain growth, according to the Business Research Co. report.

However, growth is being held back below the 7.2% the market was achieving until recently due to high costs for equipment, licenses and trained personnel. These high costs, which, in turn, affect prices, make veterinary services less affordable.

In developed countries like the U.S., one key indicator –- the number of visits to veterinary clinics by pet and livestock owners -– has fallen recently. This probably results from a combination of decreasing affordability and the availability of information online. According to the American Pet Products Assn., 43% of U.S. dog owners and 41% of cat owners rely on online information.

Market segmentation

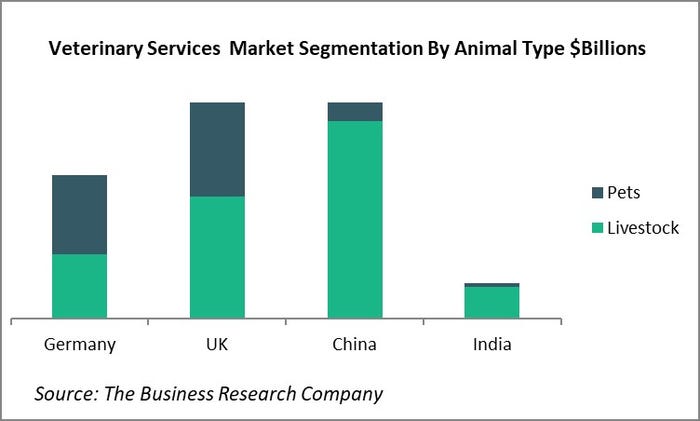

The veterinary services market can be split by animal type: pet care and livestock services. Fifty-four percent of the German market for veterinary services is in the pet care segment, making Germany the only country where that segment is bigger than the livestock segment. Next highest is the U.K., where the pet care segment accounts for 42% of the total.

In contrast, less than 8% of all expenditures on veterinary services are for pet care in China and only a little over 5% in India.

In terms of value, the U.S. is by far the world's largest pet care veterinary services market, worth $13.5 billion in 2017 -- well ahead of the U.K.'s $2.6 billion. The largest single segment by animal type is the U.S. livestock veterinary services market, which is worth $27.5 billion -- again, far ahead of the next largest, which is China's livestock segment, worth $5.5 billion in 2017. China's livestock segment outstrips that of a country like the U.K., where spend per animal is much higher, because of its large livestock and poultry animal population, Business Research Co. (Figure 2) reported.

.

Figure 1. Global veterinary services and healthcare markets growth rate comparison

Market geographies

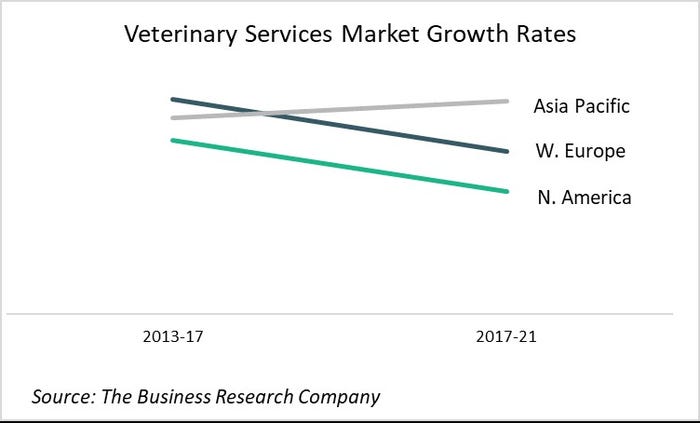

North America is by far the largest region for the veterinary services market. Western Europe and Asia Pacific are second and third, both worth about half that of America. Growth, however, has been, and will continue to be, slower in North America than in the other two, while Asia Pacific’s growth -- previously a little lower than Western Europe’s -- has now overtaken it (Figure 3).

Figure 3. Veterinary services market growth rates

North America’s dominance in the veterinary services market is largely generated in the U.S. As a percentage of gross domestic product (GDP), however, both the U.K. and Australia spend a little more than the U.S., the Business Research Co. report said.

Per capita spending is highest in the U.S., followed by Australia and the U.K. In contrast, China, which by far has the largest animal population in the world, at 6.35 billion animals, spends less than 1% of GDP on veterinary services, equating to $4.34 per capita of the human population, against $127.10 in the U.S.

Factors influencing the size and growth of the veterinary services market by region and country include the animal disease burden, GDP and its distribution, consumption patterns (which influence the extent of livestock farming -- thus, China’s animal population vastly outstrips India’s), government regulations relating to animal health safeguarding and meat and dairy production and, on the supply side, the size of the veterinary workforce, government support for animal welfare practices and investment by the industry, Business Research Co. said in its report.

Levels of pet ownership, 'humanization" of pets, as in Japan, preventive measures against outbreaks of disease that can be transferred from animals to humans, are other factors that influence the size of particular markets. For example, China has seen a significant increase in pet ownership among its urban population and with it an increase in demand for veterinary services for companion animals.

According to research conducted by Daxue Consulting, 8% of families in China’s tier-1 and tier-2 cities now own pets. Pet owners in China spend $50 a year, on average, on medical treatments for their pets.

China's population is urbanizing at the rate of over 30 million a year, according to the CIA World Factbook; many of the newly urbanized population in China miss the presence of animals that they knew in their former rural homes and acquire companion animals instead.

A further factor is government livestock regulations, according to Business Research Co. Regulations surrounding the maintenance of cattle and livestock are increasing the demand for veterinary services. For instance, in March 2016, the U.S. Food & Drug Administration announced an amendment in its humanly medically important antibiotics regulations. With effect from 2017, food animal producers need to administer the Veterinary Feed Directive drugs under the supervision of licensed veterinarians. Thus, increasingly stringent rules and regulations surrounding the production and export of farm animals and meat products are expected to drive the veterinary services market higher through 2021.

For more information on the report, click here Veterinary Services Global Market 2018.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)