Earnings increase in second quarter on improved conditions across CHS wholesale and retail agricultural-related businesses.

April 7, 2017

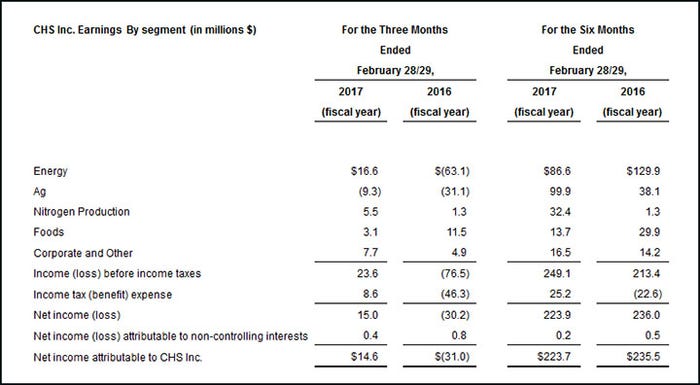

CHS Inc., the nation's leading farmer-owned cooperative and a global energy, grain and food company, reported net income of $14.6 million for the second quarter of its 2017 fiscal year (ended Feb. 28, 2017), compared to a net loss of $31 million for the second quarter of fiscal 2016.

Operating earnings for the second quarter were $10.5 million, up from a loss of $91.8 million from the same quarter of 2016. Revenues were $7.3 billion, up 11% from $6.6 billion in the 2016 second quarter.

Earnings for the first six months of fiscal 2017 were $223.7 million, compared to $235.5 million for the first six months of fiscal 2016. CHS said this 5% decrease was a result of increased loan loss reserves, higher income taxes and continued challenges in the energy operating environment, which were partially offset by improved conditions across CHS wholesale and retail agricultural related businesses.

Revenues for the first six months of 2017 were $15.4 billion, an increase of 7% from $14.4 billion for the first six months of 2016.

"As our operating environment remains challenging, we continue to act prudently, taking appropriate and measured actions regarding costs and investments (and) positioning ourselves to take advantage of opportunities as they arise while focusing on return on our invested capital," CHS president and chief executive officer Carl Casale said. "We are on a journey and are starting to see the benefits of our focus."

The CHS Energy segment generated a pretax income of $16.6 million for the 2017 second quarter, compared to a loss of $63.1 million for the same period in 2016, representing an increase of $79.7 million. Results were primarily due to increased refining margins and a $46.1 million non-cash charge to reduce inventory to market value in the second quarter of 2016 that did not recur in the current year.

The company's propane and lubricants businesses saw an increase in earnings that was partially offset by a decrease in the transportation business compared to the same period of the prior year.

For the first six months of 2017, the Energy segment generated pretax earnings of $86.6 million, compared to $129.9 million for the same period last year.

The CHS Ag segment, which includes the domestic and global grain marketing and crop nutrients businesses, renewable fuels, local retail operations and processing and food ingredients, lost $9.3 million in the 2017 second quarter, compared to a loss of $31.1 million for the year-ago period.

Each of the primary business units in the Ag segment realized increased earnings during the second quarter of 2017 versus 2016, with the exception of country operations. Grain marketing increased earnings due primarily to improved grain margins. Wholesale crop nutrients income increased for the quarter due to higher volumes. Processing and food ingredients earnings increased due to an impairment charge for assets held for sale in the prior fiscal year. Earnings from renewable fuels marketing and production operations also increased, primarily due to higher margins.

These increases were partially offset by increased loan loss reserves related to the CHS country operations retail business. Absent these reserve increases, the country operations business experienced strong second-quarter operating performance versus the prior-year period.

These earnings were part of the $99.9 million total for the Ag segment for the first six months of fiscal 2017, compared to $38.1 million for the first six months of 2016.

The Nitrogen Production segment generated income of $5.5 million during the second quarter, compared to income of $1.3 million in the previous-year period, and $32.4 million for first six months of 2017, compared to $1.3 million for the first half of fiscal 2016. The increase is primarily due to six months of activity in the current fiscal year versus only one month of activity in the first half of the prior fiscal year, given that the CHS investment in CF Nitrogen occurred in February 2016.

The company's Foods segment, previously reported as a component of Corporate & Other, generated pretax earnings of $3.1 million during the second quarter, down $8.4 million versus $11.5 million for the same year-ago period; earnings were $13.7 million during the first six months, compared to $29.9 million for the first half of fiscal 2016. The decreases were primarily due to reduced margins at Ventura Foods LLC, the CHS equity method investment that makes up the Foods segment.

Corporate & Other generated second-quarter pretax income of $7.7 million, compared to $4.9 million during the year-ago period -- an increase of $2.8 million, or 57%; for the six-month period, income was $16.5 million, compared to $14.2 million during the first six months of 2016. Earnings in this category are derived from the company's equity investment in the Ardent Mills LLC wheat milling joint venture and CHS Business Solutions operations.

CHS is a leading global agribusiness owned by farmers, ranchers and cooperatives across the U.S. CHS supplies energy, crop nutrients, grain marketing services, animal feed, food and food ingredients, along with business solutions such as insurance, financial and risk management services.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)