Increase part of a recent trend of greater optimism among producers.

May 3, 2017

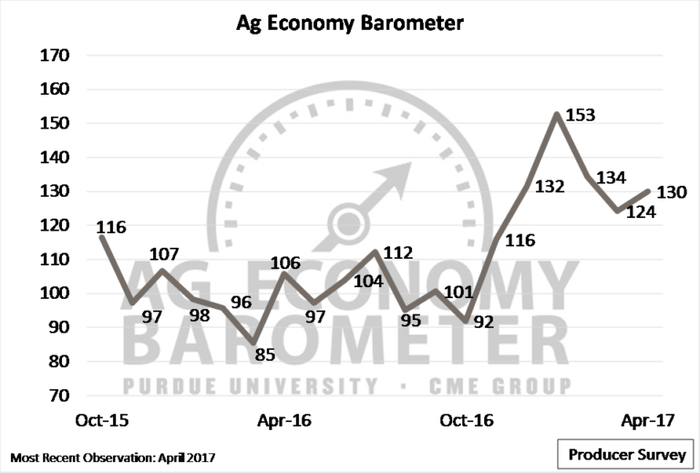

Producer sentiment toward the agricultural economy inched up six points in April, according to the Purdue University/CME Group Ag Economy Barometer.

The barometer increased from 124 in March to 130 in April. The higher reading comes on the heels of two months of declines following the all-time high of 153 in January 2017.

April's 130-point reading represents a vast improvement in producer sentiment since the barometer launched at 106 in April 2016.

The increase is part of a recent trend of greater optimism among producers, said Jim Mintert, director of Purdue's Center for Commercial Agriculture and principal investigator for the barometer.

"Agricultural producer sentiment since December 2016 has been more positive than at any other time since data collection began, including the base period from October 2015 to March 2016," he said.

The barometer's two subindices also showed slight improvements, with the Index of Current Conditions increasing from 120 in March to 127 in April and the Index of Future Expectations improving from 126 to 132.

April's survey asked producers about their expectations for crop prices over the next year. While 54% said they expect prices to be about the same in 12 months, another 27% expect lower soybean prices. Only 17% said they expect soybean prices to be higher.

"This is quite different from a year earlier as the share of respondents expecting lower prices in the April 2017 survey was more than double the 13% of respondents expecting lower prices in the April 2016 survey," Mintert said.

While producer sentiment has improved significantly since last fall, another measure of confidence – the willingness to make large capital investments – has changed less over that same period, the report noted. Each month, the survey poses the question, “Thinking about large farm investments – like buildings and machinery – generally speaking, do you think now is a good time or bad time to buy such items?” The willingness to commit to large capital expenditures might be interpreted as a measure of producers’ long-run confidence that their business will be profitable, the authors said.

Survey results going back to October 2015 show that producer responses to this question have been remarkably constant. Over the life of the survey, the range of respondents indicating that it was a bad time for large farm investments ranged from a low of 60% (December 2015) to a high of 78% (March 2016). However, since April 2016, the results show that this figure has been in a 10-point range of 63-73%. Since November 2016, when the barometer readings started increasing, this sentiment gauge has improved from a reading of 73 in October 2016 to 65 in April 2017.

“The improvement parallels the change in the barometer but suggests that the shift in buying/investment behavior is more muted than the change in overall sentiment measured by the barometer,” the authors noted.

The latest survey results also indicated that more producers think used machinery prices are low, and fewer producers think used machinery values are high. When asked about their expectation for used farm machinery prices over the upcoming 12 months, 61% of producers expect prices to remain “about the same,” while a larger share of respondents expect higher prices (24%) than lower prices (16%) in 12 months.

Quarterly, the barometer also includes survey data from 100 industry thought leaders, such as agribusiness executives, agricultural lenders, commodity and farm organization leaders as well as agricultural economists in the academic and government sectors.

Thought leaders' expectations for the health of the farm economy increased by 12% in April compared to January, but their optimism about the farm economy didn't carry over to commodity prices, said David Widmar, senior research associate for the Center for Commercial Agriculture and leader of the barometer's research activities.

"Despite the improvement in thought-leader sentiment from January to April, the group indicated they are less optimistic about both corn and soybean prices than they were back in January," he said.

The April release marks a year since the barometer launched. A supplemental year-in-review report is also available on the website. The report looks at trends in the barometer and supporting areas, such as farmland values and commodity prices.

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)