Farmers hold tightly to what few soybeans they have left.

Strong cash bids to move soybeans downriver to fill ocean vessels supported prices inland in hopes of getting farmers to turn loose any remaining old-crop supplies. However, farmers largely held tight to what few soybeans they still had, grain dealers said this week.

A slowdown in soybean sales in Brazil has shifted buyers to the U.S., which helped raised cash basis bids at the Gulf of Mexico. Corn bids also improved following a slowdown in farmer sales. Farmer selling of both crops slowed following weakness in the Chicago, Ill., futures in late July.

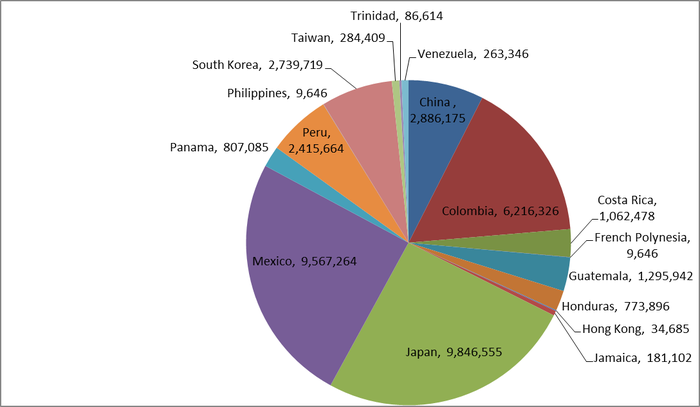

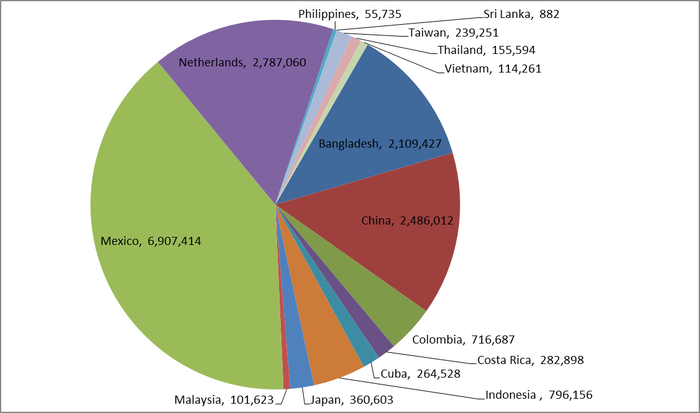

In the latest week, Mexico displaced China as the leading destination for soybean shipments, with China coming in third behind the Netherlands.

Talk continued in the cash markets that the slow farmer sales in Brazil will shift export business to the U.S. The value of Brazil’s real increased about 6% in July against the dollar following the dollar’s drop to a one-year low. The real currently is valued about 3.11 to the dollar versus 3.3 early in July. Since soybeans are sold in dollars, that hurt income for Brazilian farmers and caused a slowdown in sales.

Barge loadings have resumed on the Mississippi River near the Quad Cities after being suspended for a few days early last week because of high water.

At the Gulf this week, soybeans were bid 51 over August for August shipment versus 48 over a week ago and 42 over November for September versus 38 over. The latest Gulf bids for corn were about 21 over September for August shipment versus 18 over a week ago and bid 24 over September for September shipment versus 22 a week ago, according to wire reports.

Crop development

Crops in western Iowa and central Illinois have received beneficial rain since late last week, dealers said. Most of the corn and soybeans in Iowa and Illinois were in good shape, with rain needed in the aforementioned areas.

Weather maps show rain in parts of the Dakotas and the Midwest in the next three days, but no severe storms are indicated. The latest 6- to 10-day outlook (Aug. 6-10) is cool and wet for the Midwest and central Plains and cool and dry for the northern Plains.

Gulf barge loadings

Barge grain loadings during the week ended July 22 totaled 1,230,416 tons, up 34% from the prior week and up 30% from a year ago, according to the U.S. Department of Agriculture’s "Grain Transportation Report." Much of the increase was in soybean barges, which totaled 453,000 tons, up 163% from the three-year weekly soybean average for July.

Grain vessel loadings at the Gulf totaled 32 vessels during the week of July 20, down 11% from a year ago. Forty-two vessels are expected to be loaded in the next 10 days, down 32% from a year ago, the report said.

In the rail sector, grain car loadings totaled 22,802 for the week ended July 15, up 26% from the prior week and down 11% from a year ago.

For truckers, the U.S. average diesel fuel price increased about 2 cents during the week ended July 24 to $2.51/gal. That is up 13 cents from a year ago.

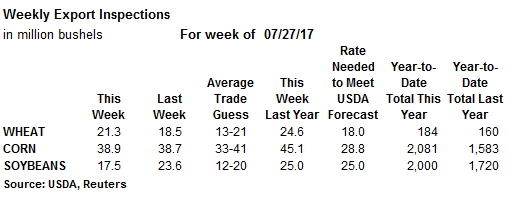

USDA’s latest weekly grain inspections are shown in the following charts.

Corn export destinations, bushels – week ended July 27 – USDA

Soybean export destinations, bushels – week ended July 27–USDA

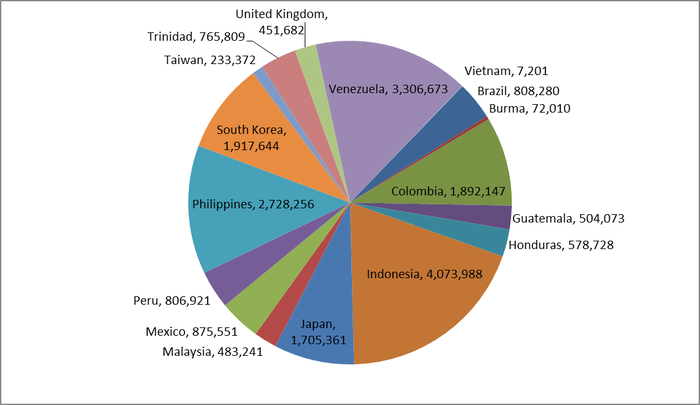

Wheat export destinations, bushels – week ended July 27 – USDA

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)