Barge sales to Gulf export points have slowed.

Trainloads of corn were sold to the Southeast ethanol and poultry markets in late March as ethanol plants and poultry farms there need coverage for April, grain shippers said this week.

Meanwhile, barge sales to Gulf of Mexico export points have slowed as importers continue to shop in South America. Barges of corn and soybeans were loaded and shipped on the Mississippi River, but those were sold some time ago.

Corn for April shipment to the Gulf was bid 34 over the Chicago Board of Trade (CBOT) May contract this week, compared with 38 over last week. Soybeans bids at the Gulf for April slipped to 22 over from 25 over a week ago.

River navigation is open on the Mississippi River as a warm winter allowed an early resumption of barge traffic. Basis bids for corn and soybeans at Gulf export points eased in the past week due to the increased barge traffic and to the competition from South America.

A lack of farmer selling has lessened the supply of crops available for shipment. The drop in the Chicago, Ill., futures has farmers content to wait for spring or summer rallies before selling more.

Midwest farmers applied anhydrous ammonia to intended corn fields last week before weekend rain sidelined applicators. More rain is in the forecast this week for Iowa and Illinois, which grain dealers said will be welcomed. While some corn planting was under way in southern Illinois last week, the crop insurance start date is about April 5 in central Illinois and about April 11-15 in Iowa.

Shipping grain by rail to the Pacific Northwest is improving but continues to be hampered by rain and spring thaw, which has softened road beds.

“In recent weeks, BNSF, Union Pacific and Canadian Pacific have all dealt with severe winter conditions, such as snowfall, track washouts and landslides that have disrupted grain traffic, with areas in Washington, Idaho and Montana particularly affected,” according to the U.S. Department of Agriculture’s latest "Grain Transportation Report."

While such delays continue, USDA said the railroads reported improvements in operations and delivery times. Forecasts for more rain in that region could cause more delays, the agency added.

In that report, USDA said rail shipments of grain to the Pacific Northwest during the week ended March 15 slipped to 6,311 from 7,601 in the prior week. Year-to-date shipments there remain higher than a year ago.

Barge movement

Barge shipments of grain during the week ended March 18 totaled 876,544 tons, up 3% from the prior week and up 71% from a year ago, according to the "Grain Transportation Report."

Grain vessel loadings at the Gulf remained active, with USDA reporting 44 vessels loaded during the week of March 16, up 19% from a year ago. Seventy-three vessels are expected to be loaded in the next 10 days, up 52% from a year ago, the report said.

In the rail sector, grain car loadings totaled 24,248 for the week ended March 11, up 1% from the prior week and up 11% from a year ago.

For truckers, the U.S. average diesel fuel price dropped 2 cents during the week ended March 20 to $2.54/gal. That is up 42 cents from a year ago.

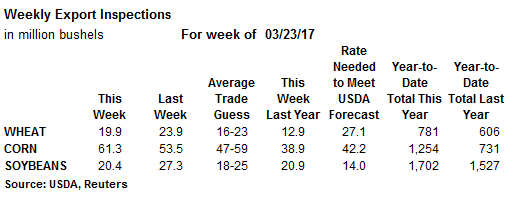

USDA’s latest weekly grain inspections are detailed in the following table and charts.

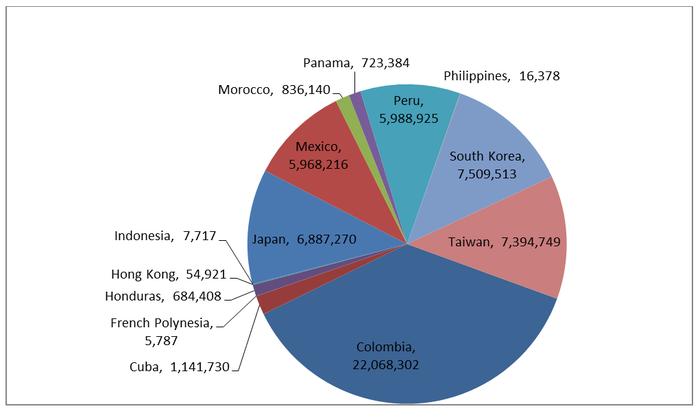

Corn export destinations, bushels – week ended March 23 – USDA

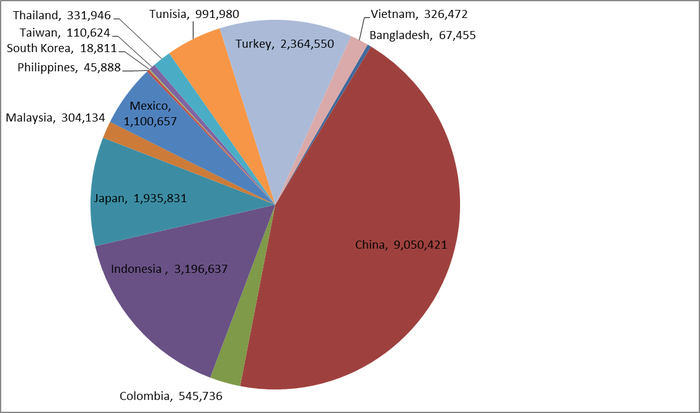

Soybean export destinations, bushels – week ended March 23 –USDA

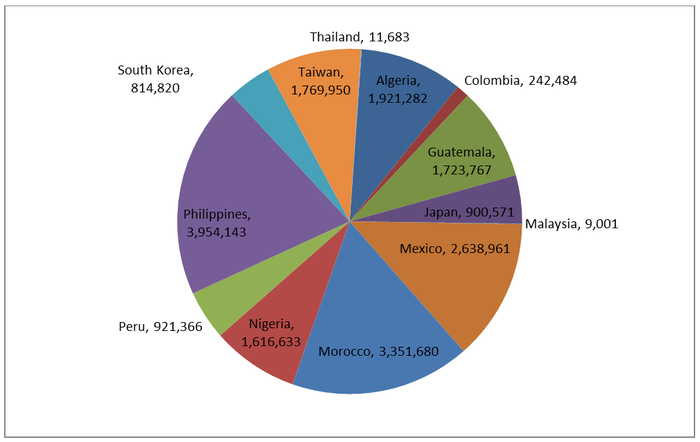

Wheat export destinations, bushels – week ended March 23 – USDA

About the Author(s)

You May Also Like