New-crop soybean sales still lag, but old-crop business takes marketing year down to wire.

When it comes to soybeans, traders watch what China is doing as closely as they follow growing season weather in the U.S. The world's largest importer of soy remained in the headlines this week as questions persist about China's overall appetite for protein.

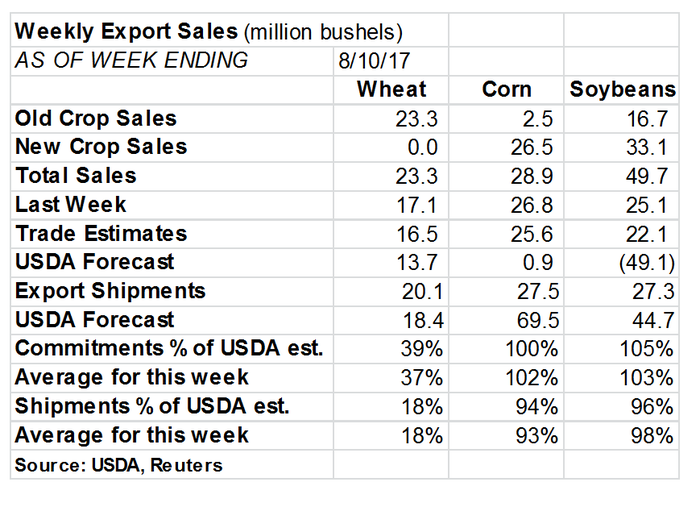

The U.S. Department of Agriculture's export sales report released Thursday raised eyebrows because China purchased a net 16.7 million bu. of old-crop soybeans last week, just three weeks before the Aug. 31 official end of the 2016-17 crop marketing year. While it's not unusual for buyers to snap up deals as old-crop supplies are flushed into the market, the pace of China's purchases flew in the face of recent news reports.

Chinese processors are reported to be awash in soybeans, facing weak profit margins that caused some to resell shipments. Still, other buyers are taking delivery, with beans from the U.S. working into the pipeline at a time of year when South American supplies usually dominate. Faced with low prices for their crop, some Brazilian growers are refusing to sell, which is opening the door for some late-season sales out of the U.S.

These last-minute purchases may not whittle down old-crop supplies much, although it appears that USDA is still too low on its forecast for sales, despite raising its projection by 40 million bu. on Aug. 10. Total sales and shipments of old-crop soybeans exceed USDA's forecast by nearly 50 million bu., but the pace of shipments also is running a little slower than average. Some of those purchases may wind up being shifted to the new crop, at least officially.

That could eventually help bump up sales of 2017-18 soybeans, which are running at an eight-year low. More new deals were put on the books last week, totally 33.1 million bu., with China and “unknown” destinations taking the lion's share.

Soybean demand got more good news that helped turn the market around on Wednesday. A Chinese trade delegation signed deals to buy 140 million bu. of U.S. soybeans. As expected, some of those ceremonial purchases are beginning to turn into a reality: USDA also announced on Thursday that China purchased 6 million bu. of new-crop soybeans under its daily reporting system for large purchases. However, the deal was listed as optional origin — a bearish twist that could disappoint traders.

Corn and wheat exports were also better than expected. Total sales of corn came in at 28.9 million bu., all but 2.5 million bu. of it for new-crop corn. Sales of 2016-17 corn still look on track to beat USDA's annual forecast, although that bump could be offset by weaker ethanol demand.

Pre-harvest corn sales normally take a back seat to soybeans. This year's total is well below the strong pace of a year ago, when a smaller crop in Brazil helped kick off the 2016 selling season, which boosted corn exports to one of the best totals ever.

Wheat sales of 23.3 million bu. are keeping the early pace of business on track to top USDA's forecast for the 2017 crop, despite huge supplies flooding the world market from Russia. Most of the buyers are regular customers in Asia, the Americas and Africa.

About the Author(s)

You May Also Like