Angus program continues to reap premiums despite challenging markets.

While the cattle market took a steep dive in falling from record highs in 2014 to last fall’s low, results from the Certified Angus Beef (CAB) 2016 “Here’s the Premium” (HTP) calf price tracking study showed prices weren't as low for producers selling Angus beef cattle.

“It pays to use Angus genetics in any market,” said Steve Suther, CAB director of industry information.

The annual project began in 1999, and the data have been analyzed by Iowa State University livestock economist Lee Schulz since 2014.

“The difference in calf prices between those two years is very wide, but the rate of decrease in the Angus premium has been less than the overall feeder cattle price decrease,” Schulz said.

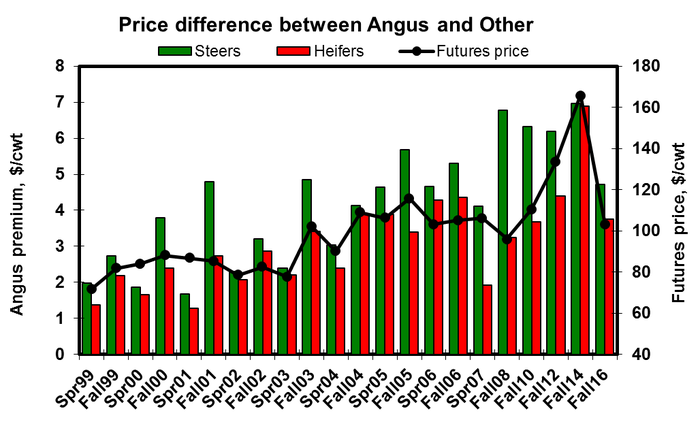

Feeder cattle futures lost nearly half of their value in that time, with a 48.3% drop, Schulz added. The lighter, five-weight calves targeted in HTP surveys fell more sharply, by nearly 56%. Angus steers held onto more value with a setback of just 32.2% in their premium over non-Angus steers in the same two years (Figure).

However, auction prices for Angus heifers did not hold up as well as bids for steers, the study showed. They still sold at a premium to non-Angus heifers, but the premium was 45.7% less than in 2014.

“Last fall’s Angus heifer premium was in the face of some very bearish prices for all heifers, as fewer producers were interested in buying replacements for breeding,” Suther said. “Also, this comes just two years after the highest Angus heifer premium ever recorded here, driven by rapid herd expansion.”

Price projections for calves are part of the math used to calculate a maximum bid price when buying replacement heifers, Schulz said, adding that the projections are lower now than they were in the fall of 2015 and definitely lower than the fall of 2014. Additionally, market psychology amid great uncertainty last fall likely affected bidders’ projections for prices down the road, he said.

“In 2014, I heard talk — and not just a little of it — of feedlots breeding heifers and selling them as replacements,” Schulz said. “Heifers at that time made up the smallest percentage of total cattle on feed we’ve seen in the history of the data going back to 1996.”

In a market with such a demand for heifers, what a buyer is compelled to pay to meet goals is sometimes more than they are “willing to pay,” Schulz added. All of that contributed to the high heifer price and record Angus premium two years ago.

According CAB, the genetics and productive potential of those heifers improved by last fall, but fed cattle hit a low mark in October, and bearish sentiments ruled. Bidders lowered their expectations to worst-case scenarios, and Angus premiums returned to earlier trend lines.

In the 2016 data, Angus heifers brought a $3.75/cwt. premium over non-Angus. Although that does not compare well with the record of $6.89, Suther noted, it is only a couple of pennies less than the average Angus heifer premium for the 2008, 2010 and 2012 studies.

Eleven auction markets across the country, from California to Kentucky and New Mexico to North Dakota, submitted data as part of the survey last fall that compared auction prices for more than 16,000 calves of known Angus versus non-Angus genetics.

Angus steers and heifers averaging 568 lb. and 557 lb., respectively, brought a combined average premium of $4.24/cwt. over their non-Angus contemporaries with similar weights and condition, compared to nearly $7/cwt. in the historically high cattle market. The analysis model adjusts for variance and the range of weights to identify Angus premiums independent of weight.

In all, CAB said 330,530 cattle in 15,346 lots have been a part of this ongoing project in 22 surveys since its inception in 1999, which has run in both spring and fall for the first eight years, with 700 lb. cattle reported in the spring. The premium since 2008 and every other fall has averaged $5.98/cwt. for Angus steer calves and $4.24/cwt. for Angus heifers.

Over the years, participating auction markets were asked to submit sale data on cattle known to be Angus versus non-Angus spanning four different sale dates. Other data included whether cattle were weaned, vaccinated or preconditioned.

Most of the markets from the original study in 1999 are still providing data for the ongoing HTP project, which has involved 15 reporting partners in all. Over the duration of the study, California and Wyoming markets have consistently had the highest Angus premiums, and Missouri was among the top three states for Angus premiums last fall.

Some auction market managers commented that it has become increasingly difficult each year to find non-Angus cattle for the data.

CAB said this comes as no surprise because the percentage of Angus cattle in the U.S. beef herd continues to rise. Some markets have stopped participating due to this lack of non-Angus comparisons, but the 2016 survey of 11 markets was the largest number of locations in a single survey year.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)

.png?width=300&auto=webp&quality=80&disable=upscale)