Milk production of top five exporting countries expected to rise.

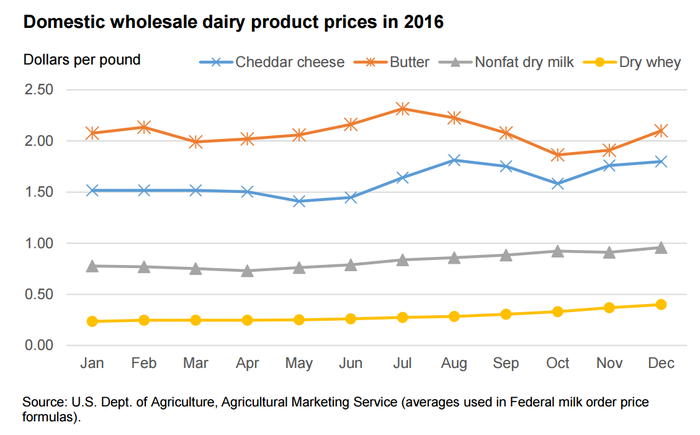

Wholesale domestic prices for all major dairy products increased from November to December, according to the U.S. Department of Agriculture’s January “Livestock, Dairy & Poultry Outlook.” While the butter price typically declines from November to December, the monthly average butter price rose the most, from $1.909 to $2.100/lb. December prices for cheese, nonfat dry milk (NDM) and dry whey were $1.799, 95.8 cents and 39.9 cents/lb., respectively — the highest monthly prices of the year.

Robust domestic demand likely contributed to the uptick in product prices, USDA said. In November, domestic commercial disappearance was substantially higher than in November 2015 for butter (3.8%), NDM (4.5%), American cheese (9.9%) and other-than-American cheese (3.5%). November year-over-year commercial disappearance for milk in all products increased by 5.1% on a milk-fat milk-equivalent basis and by 3.8% on a skim-solids milk-equivalent basis.

USDA reported that U.S. milk production continued to increase, totaling 17.1 billion lb. in November, up 2.4% from November 2015. Milk per cow averaged 1,829 lb. per head, 39 lb. above November 2015. Milk cows totaled 9.339 million head, 17,000 more than in November 2015 and 4,000 more than in October 2016.

November exports on a milk-fat basis were 870 million lb., an increase of 64 million lb. from October. USDA noted that, since Aug. 1, 2016, Canada has allowed temporary supplementary imports of butterfat products and cream — in addition to imports usually allowed under tariff-rate quotas — in order to alleviate shortages.

U.S. exports of cream with more than 10% milk fat rose from 1.2 million gal. in October to 2.0 million gal. in November, with about 90% of the exports going to Canada. Exports of butter in November were relatively strong at 5.1 million lb., with exports to Canada comprising 60% of the total. Exports on a skim-solids basis were 3.460 billion lb. in November, a decline of 107 million lb. from October but 674 million higher than November 2015.

According to USDA, robust domestic use and relatively strong exports caused stock levels to fall significantly from October to November.

Butter ending stocks decreased by 67 million lb., representing the largest one-month drop since September 1993 — a time when most butter stocks were owned by the U.S. government. November ending stocks of dairy products on a milk-fat basis were 13.7 billion lb., a decline of 1.8 billion from October but 900 million lb. higher than November 2015. November stocks on a skim-solids basis were 14.3 billion lb., 600 million less than October but 600 million lb. above November 2015.

International outlook

USDA is forecasting that the combined milk production of the top five major exporting countries -- Argentina, Australia, the European Union, New Zealand and the U.S. -- will grow at a modest rate of 1% in 2017. While U.S. milk production is expected to grow about 2% in 2017, growth rates of 0% and 1% are expected for the EU and New Zealand, respectively.

USDA said the U.S. is expected to face strong competition from the EU for cheese exports in 2017.

“After a setback in 2014 and 2015 due to a Russian trade ban, EU cheese exports are expected to total 1.808 billion lb. in 2016 and are forecasted to reach a record 1.819 billion lb. in 2017. A key issue facing the United States' export competitiveness with the EU is the strong dollar compared to the euro,” USDA reported.

Dairy forecasts for 2017

USDA's feed price outlook was changed little from last month's forecast. For 2016-17, the corn price forecast is $3.10-3.70/bu. -- an increase of 5 cents on both ends of the range -- and the soybean meal price forecast is unchanged at $305-345 per ton. The alfalfa hay price fell from $135 per ton in October to $130 in November.

USDA raised the forecast for milk cows for 2017 by 5,000 head to 9.365 million as higher milk prices and relatively low feed costs are expected to encourage greater expansion of the herd. Similarly, the forecast for milk per cow was raised to 23,185 lb. per head, an increase of 15 lb. These changes result in a milk production forecast of 217.1 billion lb. for the year, 300 million lb. more than last month's forecast.

On both a milk-fat and skim-solids basis, USDA left 2017 forecasts for imports unchanged from last month, at 7.0 billion and 6.2 billion lb., respectively. For exports, only small changes were made: 8.3 billion lb. on a milk-fat basis (down 100 million) and 40.2 billion lb. on a skim-solids basis (up 100 million).

Based on recent commercial disappearance data and a strengthening economy, the 2017 domestic use forecast was raised from last month's forecast to 215.0 billion lb. on a milk-fat basis (up 200 million) and to 183.5 billion lb. on a skim-solids basis (up 1.0 billion).

USDA lowered ending stock forecasts for 2017 to 13.2 billion lb. on a milk-fat basis (down 500 million) and 12.9 billion lb. on a skim-solids basis (down 300 million).

With higher demand expected, USDA raised its product price forecasts for butter, cheese, NDM and dry whey to $2.095-2.205, $1.675-1.755, $0.99-1.05 and 41.5-44.5 cents/lb., respectively.

Lower expected beginning stocks on a milk-fat basis will also support higher butter prices, USDA added. With higher dairy product prices, the agency raised the Class III and IV price forecasts to $16.35-17.15 and $15.25-16.15/cwt., respectively. The all-milk price forecast was raised to $17.60-18.40/cwt., compared to the forecast of $16.85-17.65 last month.

About the Author(s)

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)