Work throughout region helping end-users determine how to incorporate DDGS into rations.

January 20, 2018

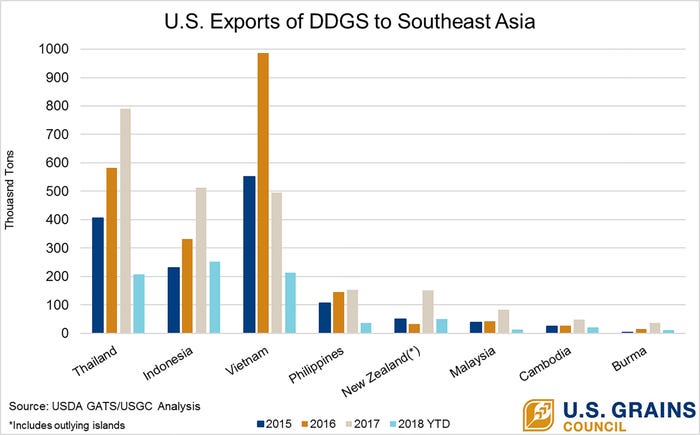

Considerable concern surrounded the export potential for U.S. distiller’s dried grains with solubles (DDGS) following an adverse trade policy decision by Vietnam, a historic top buyer, in December 2016. Instead, however, the U.S. Grains Council (USGC) reports that other countries in the region increased DDGS purchasing, the Vietnamese market re-opened and the region set a new record at 2.3 million metric tons in DDGS imports in 2016/2017.

“Offsetting the decline in sales to Vietnam, the market for U.S. DDGS in Southeast Asia diversified significantly,” said Manuel Sanchez, USGC regional director for Southeast Asia. “We lost the largest DDGS market in the region for eight months and still reached a record import volume overall.”

Following the detection of quarantine pests, the Vietnamese Plant Protection Department (PPD) issued a decision in October 2016 to temporarily suspend DDGS importation. As a result, Vietnam purchased 50% less U.S. DDGS in 2016/2017 at nearly 495,000 tons, compared to almost 986,000 tons the year prior.

The Vietnamese government lifted its suspension of U.S. DDGS imports in September 2017, following an intense effort by the Council, the U.S. Department of Agriculture’s Animal and Plant Health Inspection Service (APHIS) and the Office of the U.S. Trade Representative (USTR). Thus far in the 2017/2018 marketing year (September-November 2017), USGC said Vietnam has purchased more than 213,000 tons of U.S. DDGS, a steady uptick in the market.

Elsewhere in the region, the Council continued to expand DDGS sales by providing technical expertise and support as well as connecting grain buyers and end-users with U.S. suppliers. Programs in Vietnam are targeting aquaculture and swine programs whereas activities in Indonesia and Malaysia focus on boiler and layer sectors. In the Philippines, the Council is providing information on storing and handling.

This work throughout the region is helping end-users determine how best to incorporate U.S. DDGS into their rations, USGC said. Combined with one of the lowest per unit of protein cost compared to other feed ingredients in the market, the Council saw notable increases in demand for U.S. DDGS from buyers in Southeast Asia in 2016/2017.

“We saw notable year-over-year growth in both Thailand and Indonesia,” said Sanchez. “New buyers like New Zealand, Cambodia and Myanmar also made a big splash this past marketing year.”

Thailand was the fourth largest buyer of U.S. DDGS in 2016/2017, purchasing 791,000 tons. Already in the new marketing year, Thailand has purchased more than 206,000 tons, bolstered by the Council’s trade servicing and technical assistance to the country’s feed manufacturers for swine, broilers and layers sectors, among the largest in the world.

“Thailand’s growth can be directly attributed to the Council’s programs in country,” Sanchez said. Indonesia has also steadily increased imports of U.S. DDGS over the three marketing years, importing about 512,000 tons in 2016/2017. Indonesia has already purchased more than 251,000 tons of U.S. DDGS in 2017/2018.

Smaller buyers are also substantially increasing their purchases of U.S. DDGS, USGC reported. New Zealand more than quadrupled purchases of U.S. DDGS with 151,000 tons in 2016/2017, compared to 32,600 tons the previous marketing year. New Zealand has already purchased 50,000 tons of U.S. DDGS in 2017/2018.

“Market potential for DDGS exports to the region remains optimistic in 2017/2018,” Sanchez said. “We expect demand for U.S. DDGS strengthen as industries in these countries continue to grow and incorporate more co-products into their rations.”

You May Also Like

.png?width=300&auto=webp&quality=80&disable=upscale)